Transurban (TCL) face the music on dividends

Transurban (TCL) -4.09%: the toll road operator out today with a trading update and cut to their dividend for the full year, announcing that a 16c payment will be made for the final dividend of FY20, nearly half that paid at the half year – not unexpected but clearly not a positive.

In terms of the trading update they said traffic volumes have been on the improve, more notably in areas that have reduced restrictions where some roads are seeing around 90% of the pre-COVID use. Across the network traffic for the week of 14 June was around 20% below last year, continuing the improvement from the circa 60% hit seen in April. Today’s announcement caused some issue for investors chasing distributions – Transurban flagged that dividends for FY21 will be paid out of free cash flow (FCF) and won’t be topped up with any capital return that has helped bolster the yield for the stock over recent years. The capital will instead be used to strengthen the balance sheet and fund further developments as they come up. Transurban looks like it will manage to sneak through the COVID-19 period without the need to raise capital given they are still compliant with debt covenants, but investors will feel it in falling distributions as a result. We like TCL though and it will continue to improve as we return to the road.

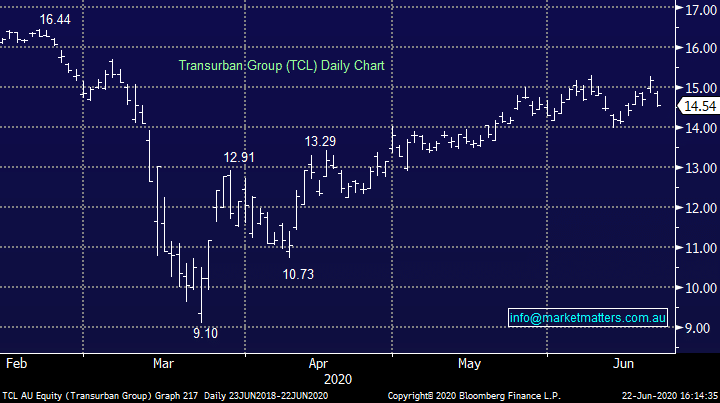

Transurban (TCL) Chart