TPG heats up the Telcos (TPM, TLS, LLC, WTC, ALU)

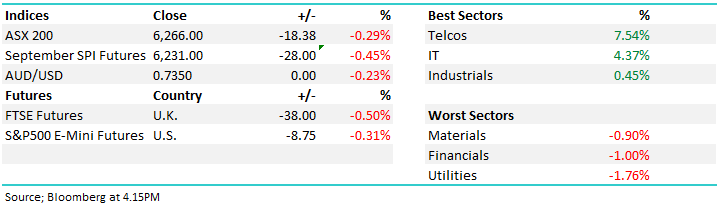

WHAT MATTERED TODAY

A day of some extreme moves from a select number of stocks / sectors while the broader market was weak overall. Telco’s the shining light following news that TPG is in talks with Vodafone Hutchinson Australia to merge the companies – clearly a move that would shake up the Telco landscape with 1. consolidation is now a strong possibility in the sector & 2. A merged Vodafone / TPG would be less aggressive on undermining current prices than a standalone TPG under David Teoh. More on that later.

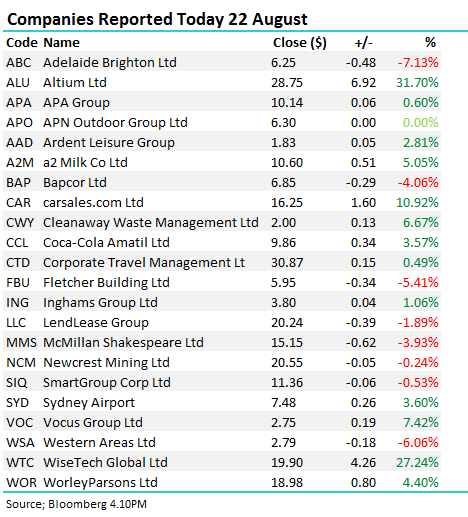

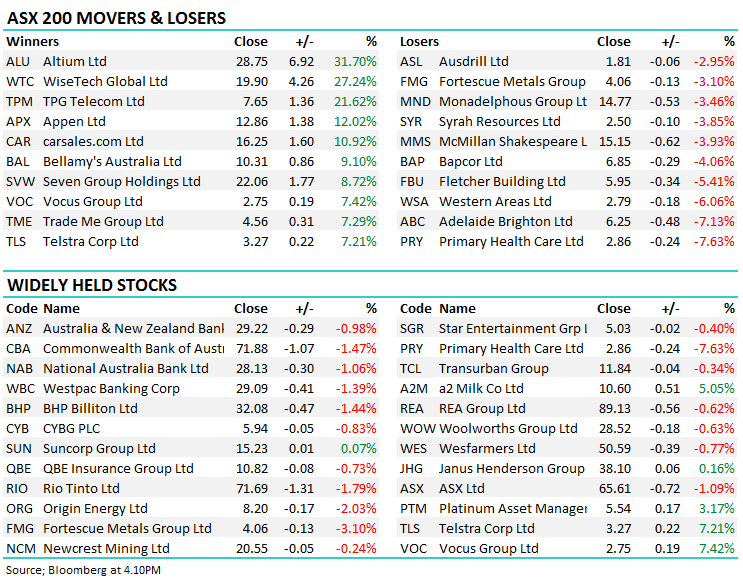

Company results today were the main driver of SP reactions, with 2 tech stocks hitting it out of the park in terms of share price performance - WTC and ALU storming higher on the back of good results and solid outlooks, however the moves looked like they were amplified by some big momentum buyers…maybe quant funds that put more weight behind the trajectory of earnings ahead of the multiple being paid – the concept of Growth At Any Price (GAAP).

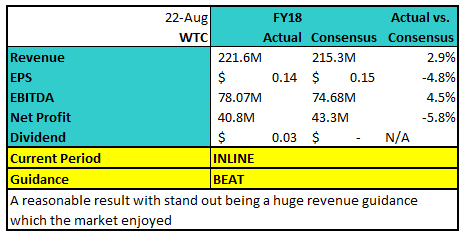

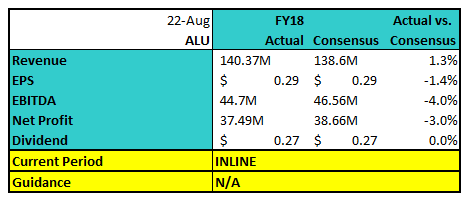

Here’s todays company results and SP reactions – we’ve tried something new today and will look to roll this out for the remainder of reporting – thanks Alex!

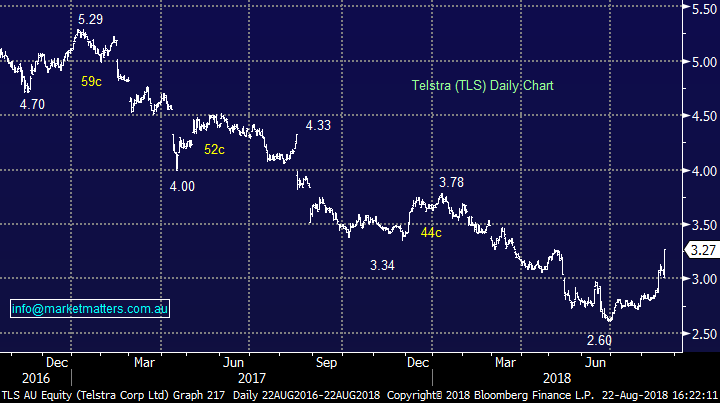

More broadly, the banks were weak today, probably because Labor is a shoe in at the next election and they’ll roll back cash rebates from franking credits – ultimately that reduces the appeal of fully franked dividends. Resource stocks were also weak with BHP trading below $32 and RIO closing at $71.44 – which is very close to our downside target. As suggested above, the telcos were the shining light and the +7% gain by Telstra (TLS) – yes, you read that right – added a massive +9% index points to the ASX 200.

Overall, the ASX200 fell -18 points today or -0.29% to close at 6266 – Dow Futures are currently trading up -74points/-0.3% at the time of writing.

Reporting hits its peak tomorrow by volume of companies by the look – including; AWC, CLY, CHC, EBO, FLT, FPH – AGM, IMF, IOF, IRE, NEC, PGH, QAN, QUB, S32, SGP, STO, VRL, WEB. For a full list of company reporting dates – click here

We hold IRESS (IRE) in the MM Growth Portfolio and for their full year, the market expects revenue of $463.5m, EBITDA of 125m dropping down to a 73m net profit. The market is expecting profit growth of 13% into FY19.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

· Asaleo Care (AHY AU): Upgraded to Neutral at Credit Suisse; PT A$0.78

· Carindale Property (CDP AU): Cut to Underweight at JPMorgan; PT A$7.80

· Citadel Group (CGL AU): Downgraded to Hold at Wilsons; PT A$7.40

· Helloworld (HLO AU): Upgraded to Add at Morgans Financial; PT A$5.75

· Monadelphous (MND AU): Downgraded to Underweight at JPMorgan; PT A$13.02

· Suncorp (SUN AU): Upgraded to Buy at Bell Potter; PT A$16.50

· Super Retail (SUL AU): Cut to Underperform at Credit Suisse; PT A$8.39

TPG (TPM) $7.65 / +21.62%; News out this morning that TPG is in talks with Vodafone Hutchinson Australia to merge the companies which has seen a fuse lit under the Telcos today. TPG has not been quite about plans to enter the Australian mobile sector with most forming the view that they would build their own network – which it had already started doing – but these merger talks take the strategy down a different route. Although in the very early stages of “exploratory non-binding discussions,” the deal makes a lot of sense. Vodafone only recently started to operate broadband services while TPG purchased its first bandwidth last year – both moving into each other’s prime markets.

The telco’s have caught a bid on the back of these development for two reasons. Firstly consolidation in the sector is now on in a big way and it is likely other companies will be running the ruler through both competitors and complimentary businesses – a positive falling competition. Secondly a merged TPG/Vodafone would be less aggressive on pricing than a standalone TPG offering – chairman David Teoh had been very vocal about his aggressive pricing plans.

TPG (TPM) Chart

Telstra (TLS) Chart

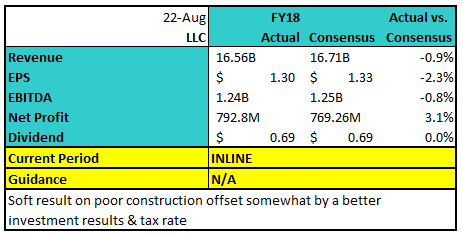

LendLease (LLC) $20.24 / -1.89%; LendLease has seen some selling today following their FY18 results which seemed reasonable at first glance however a closer look showed the decent numbers were driven by low quality additions. The property and infrastructure group saw a poor construction result offset by a lower tax rate and positives out of development and investment. Development performed well on both residential –mostly Australian units - and office sales – European focussed. Investment performed with the help of revaluations and leases in Barangaroo.

The poor quality result was taken harshly by the market and rightly so – optimism has been high in LendLease recently and the stock had risen 26.2% for the year up until yesterday’s close. No guidance was given as is standard for LendLease.

LendLease (LLC) Chart

WiseTech (WTC) $19.90 / 27.24%; A cracking SP move today from the logistics software company after they released full year numbers and announced a surprise dividend. The result on most metrics was inline / to a miss however the market is fixated on growth and WTC guided to revenue of 315-325m for FY19 versus market expectations of 287m – a clear beat even though EBITDA guidance was below market expectations….A growth stock, on a growth multiple, and a ripping share price

Wisetech (WTC) Chart

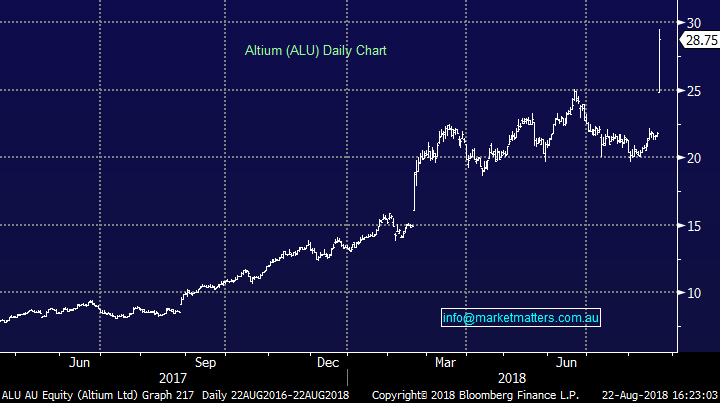

Altium (ALU) $28.75 / 31.7%; Another result that met (but didn’t beat) in terms of the current year on pretty much all metrics however they confirmed they’re confident of achieving the long held 2020 target of US$200 million revenue and EBITDA margin of 35% or better. The market was already at 204m for 2020!

Altium (ALU) Chart

OUR CALLS

We reduced QBE and added to our BBUS holding in the Growth portfolio today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here