Three key stocks to be looking at this week

**This is an extract from the Market Matters Weekend Report from 10 November. Click here to get access to the full report and more

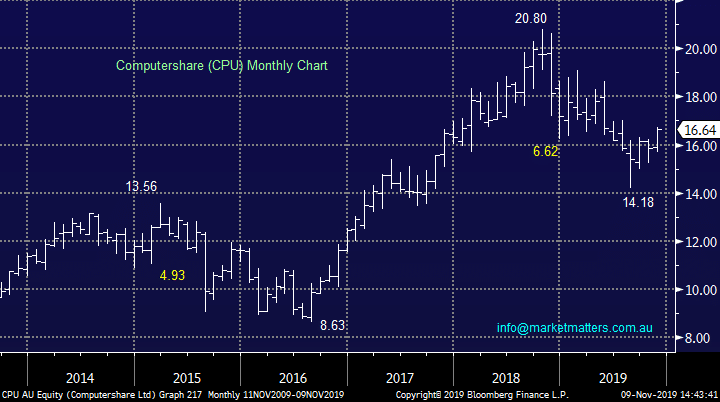

Chart of the week.

Computershare (CPU) is a stock that’s struggled over the last 12-months, investors have become concerned about the longevity of their business model as the ASX starts to embrace blockchain solutions moving forward. While we believe the threat is real the 32% correction is building in a lot of bad news, the risk / reward with buying today with stops below $16 is very attractive i.e. 4% risk compared to around 20% upside.

MM is bullish CPU with stops under $16.

NB This would be s shorter trade if we took it given the uncertainty around what blockchain technologies will ultimately mean for traditional share registries.

Computershare (CPU) Chart

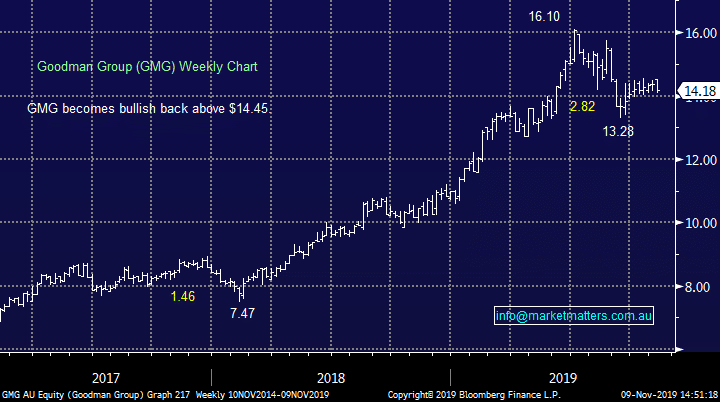

Investment of the week.

Goodman Group (GMG) is another defensive play which has become interesting following its 17% correction. We could buy GMG above $14.50 with stops below $14 i.e. 3.5% risk with a target well over 10% higher, good risk – reward.

MM likes GMG above $14.50.

Goodman Group (GMG) Chart

Investment of the week.

Goodman Group (GMG) is another defensive play which has become interesting following its 17% correction. We could buy GMG above $14.50 with stops below $14 i.e. 3.5% risk with a target well over 10% higher, good risk – reward.

MM likes GMG above $14.50.

Goodman Group (GMG) Chart

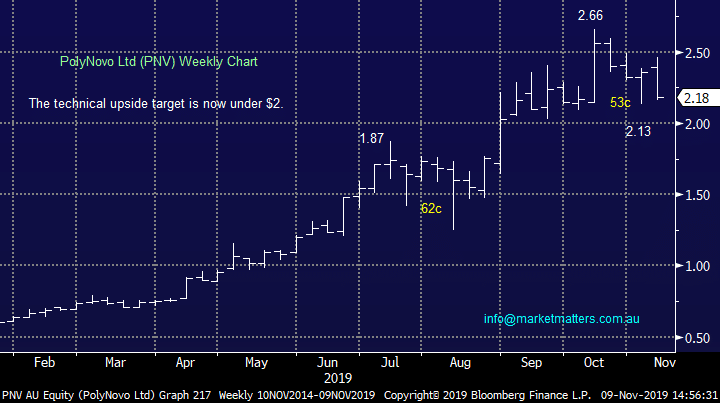

Trade of the week.

What a difference a week makes! Last week we wrote “Technically this stock looks great for new highs, with the trend, but I stress its huge valuation would have us on high alert into any sudden weakness.” Well the biotech did just that and now a dip of below $2 looks on the cards although technically this would look very interesting to MM if it happened.

MM now likes PNV around $1.95.

PolyNovo Ltd (PNV) Chart

Trade of the week.

What a difference a week makes! Last week we wrote “Technically this stock looks great for new highs, with the trend, but I stress its huge valuation would have us on high alert into any sudden weakness.” Well the biotech did just that and now a dip of below $2 looks on the cards although technically this would look very interesting to MM if it happened.

MM now likes PNV around $1.95.

PolyNovo Ltd (PNV) Chart