The run of agricultural downgrades continue with Bega today (BGA, PGH, LOV, COL)

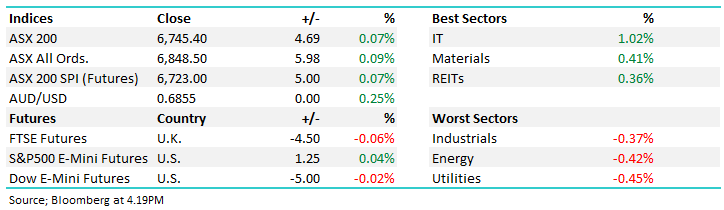

WHAT MATTERED TODAY

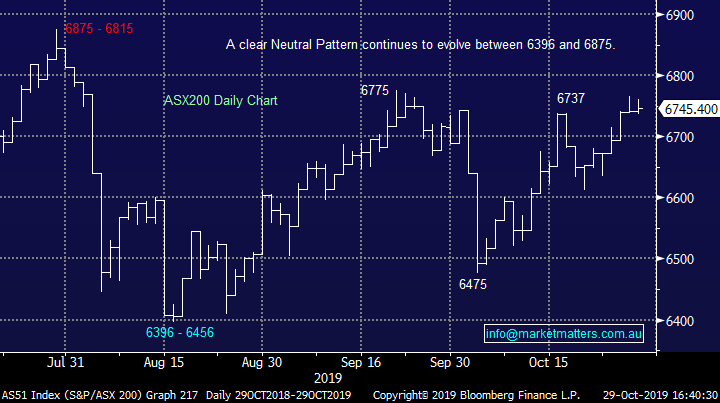

Another session of low conviction and light volumes with early optimism again sold into. The market is certainly struggling to hold any meaningful assault on the 6800 level, although any weakness is also being bought. Today saw another agricultural stock downgrade earnings, this time Bega (BGA) out with some disappointing guidance implying a 14% downgrade to market consensus – the drought is clearly starting to bite many in the space with Costa (CGC) currently handing the cap around for $176m in new equity following a 36% downgrade yesterday.

On the flipside of that, IT stocks bounced today however it was a mixed bag at the company level. Z1P Co (Z1P) the best in the sector adding +7.14% outshining sector leader AfterPay (APT) which put on +1.57%, Xero (XRO) was also strong adding +2.67% however there were a few that struggled, Jumbo Interactive (JIN) pulling back from recent highs to close down -3.43% to $24.51. It’s a very fickle market at the moment – hard to take a high conviction stance across portfolios– overall we remain neutral the ASX with a slight positive bias.

Asian markets were mixed today, although mostly lower while US Futures were also fairly muted throughout our time zone. The AUD was supported today trading around 68.55c at time of writing.

The ASX 200 closed +4pts higher today to 6745, Dow Futures are trading flat

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

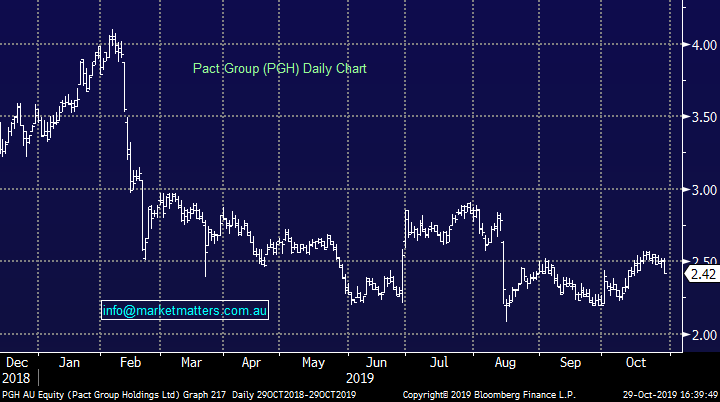

Cheap stocks with high debt: A few stocks we hold in the cross hairs today with two names front and centre Pact Group (PGH) and Emeco (EHL) down -3.59% & -1.95% respectively. Both stocks are cheap turnaround style plays which we’ve bought into weakness however with the high number of downgrades circling through the market it’s understandable that traders are reducing risk to stocks exposed to the domestic economic picture that are carrying more elevated debt levels. It makes sense given downgrades can then lead to capital raises and so on. We’ll give some more thought to these positions in the coming days.

Pact Group (PGH) Chart

Bega Cheese (BGA) -12.8%; downgraded at their AGM today with the company noting the drought had continued to have a negative impact on earnings into FY20 after it had significantly impacted the FY19 result 2 months ago. As the drought rolls on, farmers are seeing milk volumes slide driving prices higher as competition for product increases. The trend was identified at the full year result however Bega said it has occurred “at a faster and deeper rate.” This has caused Bega to guide EBITDA to $95m-$105m, down 13% from last year and a 14% miss to expectations.

Coming in from the other side, Bega has also seen demand soften in a number of export markets as the trade war bites. The company has moved to review their supply chains and cost structures in an attempt to reduce the impact of this in the medium term however earnings will be hit in the current year and with earnings going backwards is hard to justify on a PE of ~20x. Shares briefly traded to a 6 year low before recovering somewhat today. It’s difficult to determine where the low will be set in the short term.

Bega Cheese (BGA) Chart

Lovisa (LOV) -4.41%: Down today after commentary at their AGM. The Jewelry business is undergoing rapid expansion globally and therefore they are going through a period of big investment building out their store base across 15 countries. At an operational level today they saidsame-store sales were up +2.3% in the first 17 weeks of the new year which is below their 3-5% internal targets + growth has slowed since August. No FY20 profit guidance was provided after FY19 delivered +3% growth in earnings thanks to big investment. Market consensus sits at +15% earnings growth for FY20 – the stock sold off from recent highs today. Morgan’s upgraded their PT this afternoon to $14.12 from $13.66 – the market loves this stock with 5 buys and 2 holds (no sells).

Lovisa (LOV) Chart

Coles (COL) +3.09%; out with their first quarter trading update which was better than many expected. The stock had been sold down into the report with the market concerned about a fall in LFL sales given the sugar hit received this time last year with the Little Shop promo – I’m still stepping on little cartons of milk around the house!!! Sales were up +0.1% which was enough to see the stock back above $15 today. It is hard to get excited about it here with low growth in the industry, higher competition and costs coming while it trades on a low yield – I guess the predictability of earnings the key for COLs which has underpinned the SP strength over the past 12 months.

Coles (COL) Chart

Broker moves; Costa (CGC) saw a couple of downgrades today following the announcement yesterday. Macquarie cut from neutral and $3.40 PT to underperform and $2.51 PT. Their rationale obviously stems from the downgrade to FY19 numbers and the cap raise however they effectively don’t believe that CGC will meet the $150m EBITDA guidance in FY20. Citi also downgraded them from a buy to a hold and reduced PT 31% to $2.90.

· Domino’s Pizza Enterprises cut to Neutral at UBS; PT A$50

· Regis Resources raised to Buy at Citi; PT A$5.40

· Sims Metal raised to Buy at Citi; PT A$10.50

· Costa cut to Neutral at Citi; PT A$2.90

· Damstra Holdings Pty Ltd Rated New Overweight at Morgan Stanley

· Cleanaway raised to Hold at Morningstar

· CBA Rated New Underperform at Jefferies; PT A$69

· Computershare reinstated Buy at Goldman; PT A$17.74

OUR CALLS

No changes today

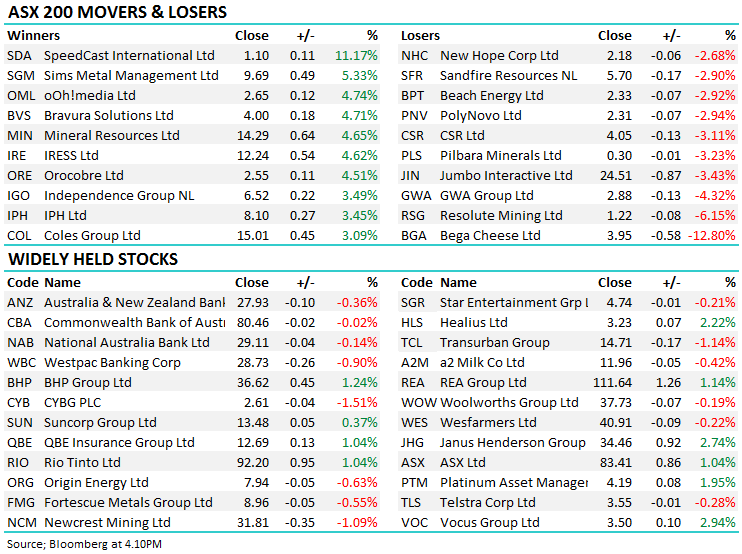

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.