The ‘reopening’ trade leads the ASX higher (CSL, MFG)

WHAT MATTERED TODAY

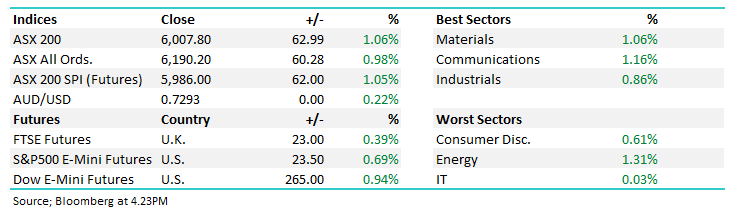

A strong session today keying off a positive lead from Europe (US closed) and as we often say, the composition of the ASX is far more correlated to European markets than it is the ASX. The ‘reopening stocks’ did best today, travel, some of the beaten up steel stocks, even the shopping centre operator Scentre (SCG) which owns Westfields did well adding +4% while its ugly cousin Vicinity (VCX) added more than 3%.

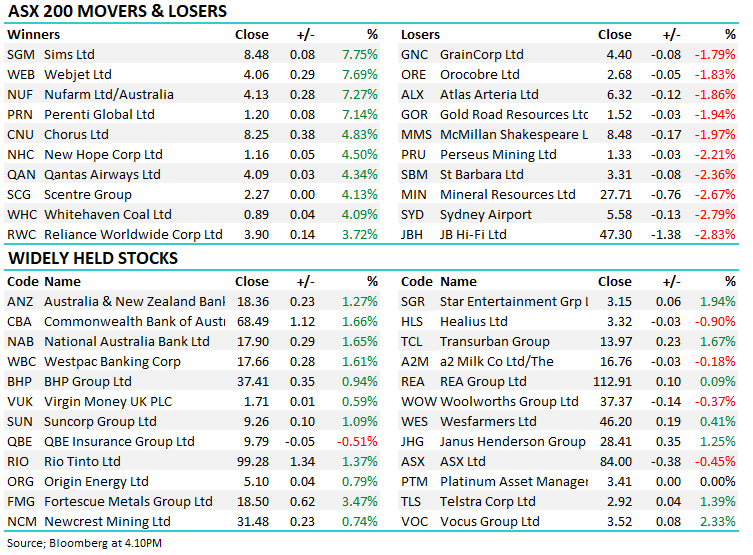

Interestingly, the stock’s funding todays move were those that have done well out of COVID, JB Hi-Fi (JBH) was off -2.83% against the backdrop of a strong market, Super Retail (SUL) fell -1.50%, Mineral Resources (MIN) bucked the strength on the broader materials sector. All in all, a pretty positive session with 75% of stocks making gains today.

In Asia there was green across the board while US Futures were trading up during our time zone, pointing to a ~300pt rally on the Dow when it opens tonight.

By the close, the ASX 200 was up +63pts / +1.06% to 6007.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

AUSBIZ this am: Quick update this morning on Auzbiz – no login required – click here or the image below – talk general markets, nothing too earthshattering really.

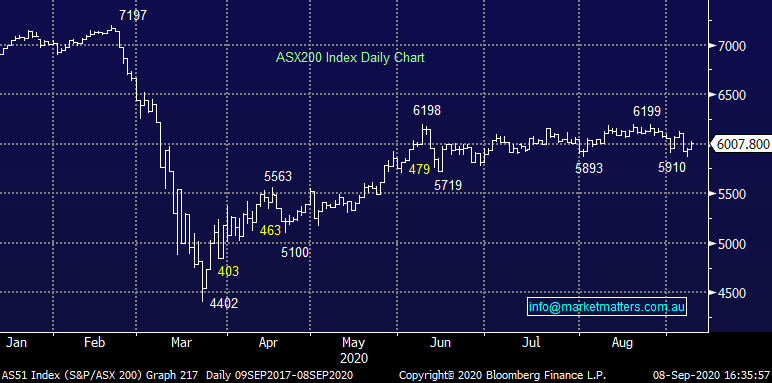

Index Contributors:Second session in a row where most love was directed towards Financials in the first instance which accounted for +20pts of the index gain today followed by the Materials. We’re starting to see the re-opening trade find some form, Webjet for instance is about to break out – ditto for QANTAS as the market starts to look 6 months + into the future. The obvious elephant in the ASX room has been the banks, its what’s held our market back, clearly, they’ve got some headwinds however it seems to me banks are finding some support at current levels. It will only take one slight catalyst to see an explosive move in the sector in MM’s view given the negative positioning currently employed by the market.

Index Points Breakdown today

Macquarie’s calls on results: Results wrap ups are clogging our inbox ATM however I think Macquarie’s summed up reporting pretty well writing….By the end of reporting season there were more beats than misses, although most beats arose because we cut estimates too far. There were some strong results, however with nine ASX 100 stocks posting June half EPSg >20%, including gold stocks (NCM, EVN, NST, SAR), OZL (gold + copper), Covid-19 winners (JBH, A2M, RMD) and WOR (Jacobs ECR acquisition). In small caps, the best results were often from retailers (e.g. TPW, NCK) who benefited from a spending boom that is unlikely to continue after wage stimulus is tapered. Small caps were more likely to post EPS beats than ASX 100 names. New economy stocks were also 60% more likely to beat than old economy ones (Source: Macquarie Research)

CSL+2.14%: Lots of press following the PM naming CSL as the manufacturer of any COVID-19 Vaccine, Morgan Stanley out with a note today putting some numbers around the gig, saying that their prospective agreement with AstraZeneca could provide a $60 million to $90 million lift to the CSL’s earnings (EBIT) in FY21 – that’s about a 2% benefit.

CSL Chart

BROKER MOVES

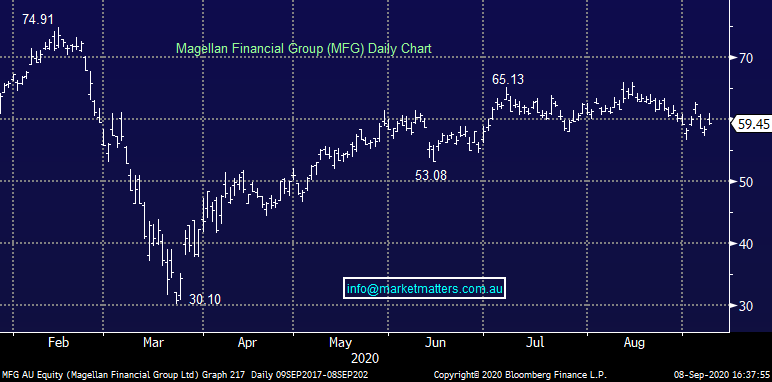

Credit Suisse upgraded Magellan (MFG) this morning talking up the prospects of their consolidation strategy (MFG plan to combine its three global equity funds into a single, open-ended strategy). CS lifted its price target by 8.3% to $65. We added the stock to the MM Growth Portfolio yesterday. Consensus price target for MFG sits at $60.42 however brokers are always chasing their tail on this one.

Magellan (MFG) Chart

Other moves…

· Beach Energy Raised to Outperform at Macquarie; PT A$1.70

· GUD Holdings Raised to Hold at Morningstar

· Spark Infra Raised to Buy at Morningstar

· Magellan Financial Raised to Outperform at Credit Suisse

· Newcrest Raised to Overweight at JPMorgan; PT A$35

· Regis Resources Raised to Neutral at JPMorgan; PT A$4.80

· Saracen Mineral Raised to Neutral at JPMorgan; PT A$4.70

· Pharmaxis Cut to Speculative Hold at Bell Potter

· Fortescue Raised to Overweight at JPMorgan; PT A$20

OUR CALLS

No changes today

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.