The RBA wants an infrastructure boom – which stocks benefit?

**This is an extract from the Market Matters Morning Report from 5 July. Click here to get access to the full report and more

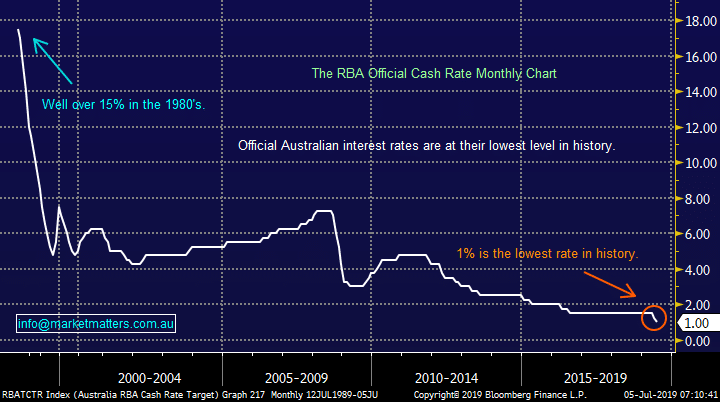

Infrastructure spending helps improve growth and jobs in the short term as the projects unfold plus also lifting productivity over the medium to longer term. With the RBA cash rate at only 1% and our 10-year bonds trading under 1.3% its easy to comprehend why Mr Lowe believes “there must be projects out there with a risk-adjusted return of more than 2 per cent".

Arguably the most important point is the RBA has very little room to cut interest rates any further as they will be at zero before we know it hence any alternative form of economic stimulus would make the economists in Martin Place feel much happier.

Australian RBA targeted Cash Rate Chart

Today we have looked at 5 stocks who are well positioned to benefit from ongoing increased infrastructure spending. I have focused more on the initial spending benefits like builders who compete for contracts and could be limited in the number of projects they can handle, as opposed suppliers who are limited only by production capacity and whose revenue is further down the path. Also of course we have stocks whose materials are used in construction, large government spending should create a nice tailwind for the businesses.

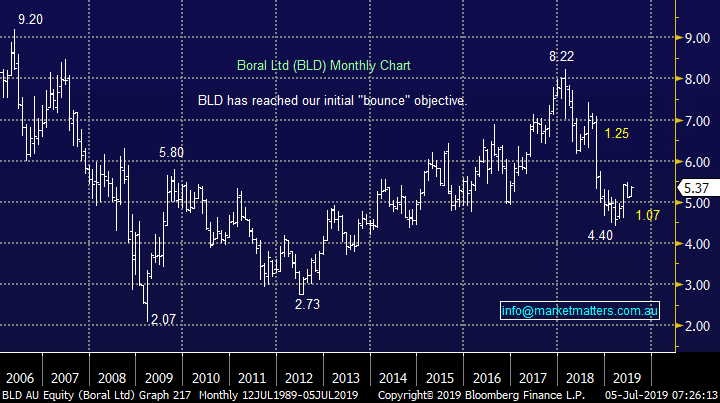

1 Boral (BLD) $5.37

Manufacturer and supplier of building /construction materials Boral has endured a very tough 18-months with its shares falling almost 40%, an extremely poor return in a booming market as they grappled with a big US acquisition which the market feels they paid too much for.

BLD should be well positioned as a beneficiary of an Australian infrastructure boom which should be spurred by both election promises and sheer need as pointed out by the RBA, the question is how much is already built into the stock price.

MM currently prefers CSR, a stock we already hold in our Income Portfolio to BLD.

Boral (BLD) Chart

Today we have looked at 5 stocks who are well positioned to benefit from ongoing increased infrastructure spending. I have focused more on the initial spending benefits like builders who compete for contracts and could be limited in the number of projects they can handle, as opposed suppliers who are limited only by production capacity and whose revenue is further down the path. Also of course we have stocks whose materials are used in construction, large government spending should create a nice tailwind for the businesses.

1 Boral (BLD) $5.37

Manufacturer and supplier of building /construction materials Boral has endured a very tough 18-months with its shares falling almost 40%, an extremely poor return in a booming market as they grappled with a big US acquisition which the market feels they paid too much for.

BLD should be well positioned as a beneficiary of an Australian infrastructure boom which should be spurred by both election promises and sheer need as pointed out by the RBA, the question is how much is already built into the stock price.

MM currently prefers CSR, a stock we already hold in our Income Portfolio to BLD.

Boral (BLD) Chart

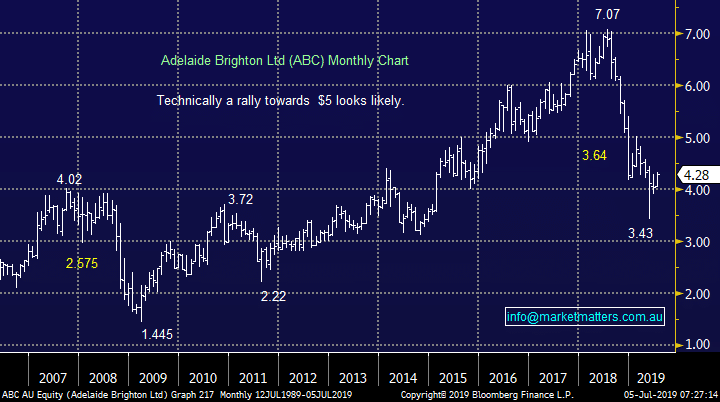

2 Adelaide Brighton (ABC) $4.28.

ABC is Australia’s largest cement maker and is therefore well placed to ride any boom in infrastructure spending, although as is often the case, strong rhetoric / a good story has not translated to positive SP performance in recent times with the stock having a horror 18-months tumbling ~40%. ABC has just over 30% of its exposure to residential and infrastructure respectively with the remaining 40% made up by commercial and mining projects.

The stocks not particularly cheap trading on an Est P/E of 16.9x for 2019 but they do yield well over 5% fully franked. Technically MM likes ABC for an initial 15-20% recovery.

MM likes ABC as an aggressive play on infrastructure.

Adelaide Brighton (ABC) Chart

2 Adelaide Brighton (ABC) $4.28.

ABC is Australia’s largest cement maker and is therefore well placed to ride any boom in infrastructure spending, although as is often the case, strong rhetoric / a good story has not translated to positive SP performance in recent times with the stock having a horror 18-months tumbling ~40%. ABC has just over 30% of its exposure to residential and infrastructure respectively with the remaining 40% made up by commercial and mining projects.

The stocks not particularly cheap trading on an Est P/E of 16.9x for 2019 but they do yield well over 5% fully franked. Technically MM likes ABC for an initial 15-20% recovery.

MM likes ABC as an aggressive play on infrastructure.

Adelaide Brighton (ABC) Chart

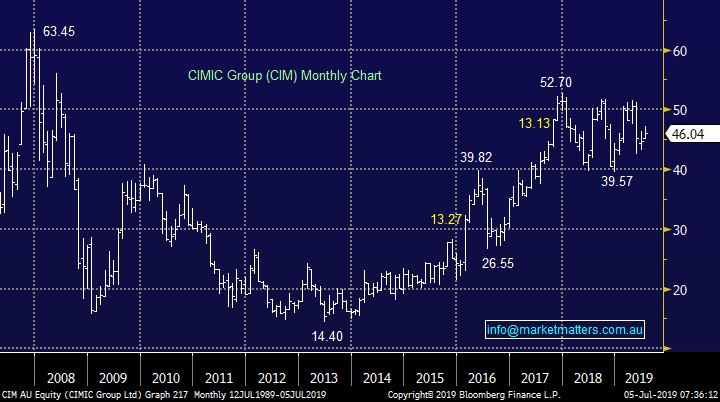

3 CIMIC (CIM) $46.04.

CIM is an engineering-led construction, mining, services, and public private partnerships company whose shares were recently targeted by an overseas short seller. Hong Kong-based research firm GMT Research analysts claim that CIMIC “inflated profits by around 100% in the last two years through aggressive revenue recognition, acquisition accounting and avoidance of JV losses.” Basically what they are saying is CIM’s profits are an illusion!

Technically CIM is neutral / positive but has failed 3 times above $50, perhaps next time will be 4th time lucky!

On balance MM is neutral CIM.

CIMIC (CIM) Chart

3 CIMIC (CIM) $46.04.

CIM is an engineering-led construction, mining, services, and public private partnerships company whose shares were recently targeted by an overseas short seller. Hong Kong-based research firm GMT Research analysts claim that CIMIC “inflated profits by around 100% in the last two years through aggressive revenue recognition, acquisition accounting and avoidance of JV losses.” Basically what they are saying is CIM’s profits are an illusion!

Technically CIM is neutral / positive but has failed 3 times above $50, perhaps next time will be 4th time lucky!

On balance MM is neutral CIM.

CIMIC (CIM) Chart

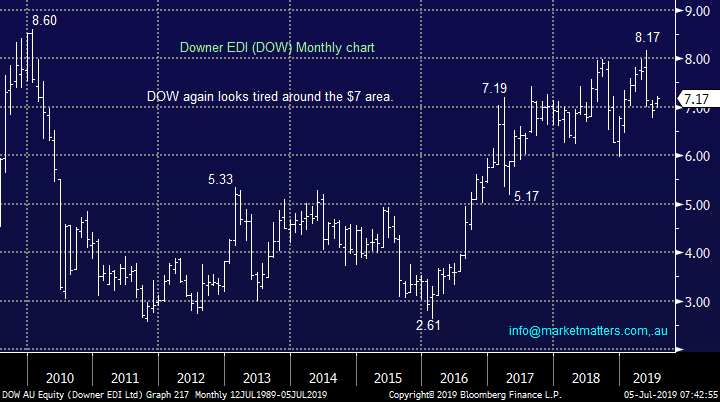

4 Downer (DOW) $7.17.

Engineering and infrastructure management services business DOW was downgraded by Credit Suisse in late May plus they then shocked the market with the warning that its joint engineering partner (Senvion) for the Murra Murra wind farm project had filed “self-administration” (i.e. bankruptcy) in Germany. DOW subsequently warned that this could have meaningful financial impact on its own business and the project especially because: “Downer holds a substantial bank guarantee from Senvion”.

Technically Dow is slightly bearish with a potential target ~$6 and it’s unlikely that its sub 4% part franked yield is going to attract current monies searching for income. A resolution / clarity around Senvion will be the main driver from here.

MM has no interest in DOW.

Downer (DOW) Chart

4 Downer (DOW) $7.17.

Engineering and infrastructure management services business DOW was downgraded by Credit Suisse in late May plus they then shocked the market with the warning that its joint engineering partner (Senvion) for the Murra Murra wind farm project had filed “self-administration” (i.e. bankruptcy) in Germany. DOW subsequently warned that this could have meaningful financial impact on its own business and the project especially because: “Downer holds a substantial bank guarantee from Senvion”.

Technically Dow is slightly bearish with a potential target ~$6 and it’s unlikely that its sub 4% part franked yield is going to attract current monies searching for income. A resolution / clarity around Senvion will be the main driver from here.

MM has no interest in DOW.

Downer (DOW) Chart

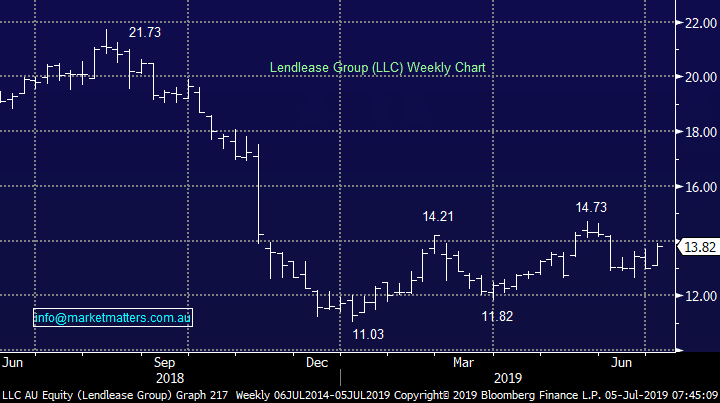

5 Lend Lease (LLC) $13.82.

LLC has been a serial underperformer since mid-2018 which saw its shares almost halve in rapid time. International property and infrastructure was rumoured to be in the takeover sights of a major Japanese company, suspected to be Mitsui, but the share price doesn’t appear to be taking the comments particularly seriously. The Japanese company was rumoured to be interested in acquiring the company and then breaking it up and offloading different parts to other suitors.

The business does appear to have cleared the decks back in February when it announced H1 revenue of $7.68 billion, down 11% on the same period in the previous year, with profit falling 96.3% to just $15.7 million.

Technically LLC looks ok / neutral while it can hold above $13.

MM is neutral LLC.

Lend Lease (LLC) Chart

5 Lend Lease (LLC) $13.82.

LLC has been a serial underperformer since mid-2018 which saw its shares almost halve in rapid time. International property and infrastructure was rumoured to be in the takeover sights of a major Japanese company, suspected to be Mitsui, but the share price doesn’t appear to be taking the comments particularly seriously. The Japanese company was rumoured to be interested in acquiring the company and then breaking it up and offloading different parts to other suitors.

The business does appear to have cleared the decks back in February when it announced H1 revenue of $7.68 billion, down 11% on the same period in the previous year, with profit falling 96.3% to just $15.7 million.

Technically LLC looks ok / neutral while it can hold above $13.

MM is neutral LLC.

Lend Lease (LLC) Chart