The rally runs out of puff (VOC, ANZ)

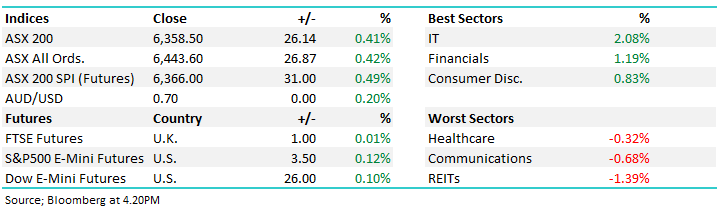

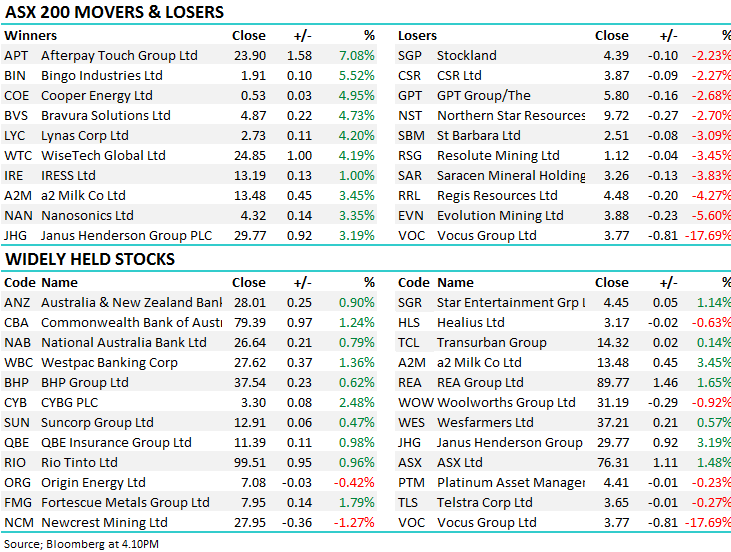

WHAT MATTERED TODAY

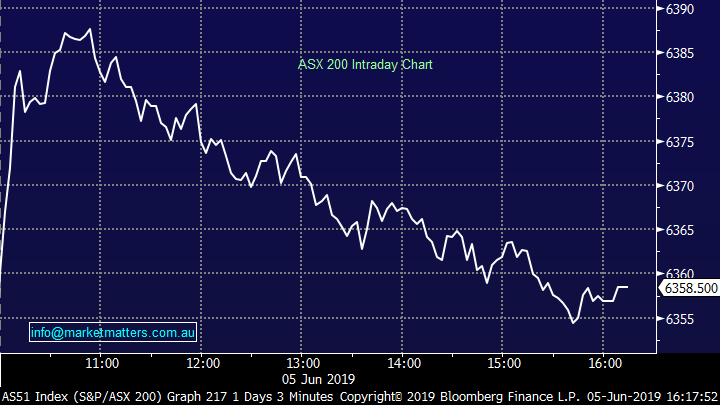

The market edged higher today, however gains were very lacklustre considering the +2% rally in US markets overnight. The ASX 200 peaked early on 6387, up ~55pts before a slow and steady grind lower into the close, as the intra-day chart shows below. The catalyst of the selling was a combination of weaker than expected domestic GDP Data printing 0.4% on the quarter bringing the YoY growth to a sluggish 1.8%, while we also saw weaker than expected services data from China.

Economic Data Today

A the sector level, tech did well thanks to a strong NASDAQ and also a decent Afterpay announcement. REITs provided most drag .

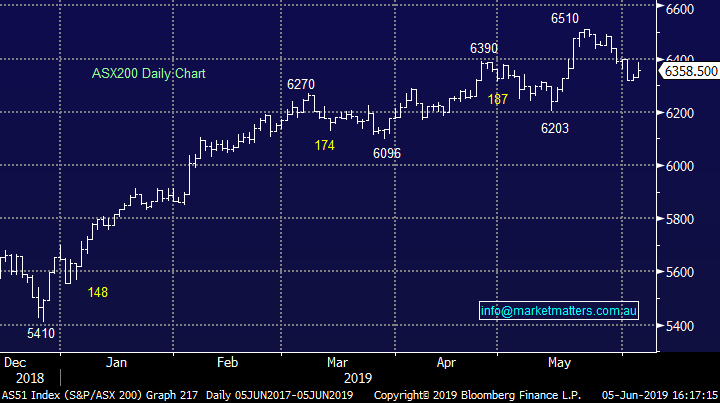

Overall today, the ASX 200 added +26 points or +0.41% to 6358. Dow Futures are trading up +26pts / +0.10%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Vocus (VOC) -17.69%: EQT left as quickly as they came in a whirlwind 8-days in the data room of Vocus. The Swedish private equity name has gotten back on the plane without a more formal offer being put forward since their $5.25 proposal announced last Monday. Shares tumbled today to trade below the pre-offer level with many investors appearing to throw in the towel. The fear for those selling is that the data room threw some curveballs that frightened EQT with Vocus potentially sitting on a soft result heading into the end of financial year. Vocus did reiterate EBITDA guidance of $350m-$370m with an investor update due at the end of June.

It doesn’t look like this will be the last play at Vocus with EQT not the only interested party. AGL Energy was reportedly running the numbers prior to the EQT bid, and Vocus clearly has a data room up and running for any suitor that may want to put a figure on the table. Despite the CEO saying they aren’t running just for a takeover, it appears he and the board would be happy to sell.

Vocus (VOC) Chart

Broker moves:

UBS downgraded the banks today, reducing earnings expectations for FY20-22 on the back of lower interest rates which will likely put pressure on margins. In FY20 they cut earnings by 1.6% to 3% with CBA being least impacted v WBC being hardest hit while in FY22, the earnings impact ranges from 3.9% to 6.4%, again with CBA and WBC on either end of the spectrum. It now means that UBS expect no growth in ANZ’s earnings per share between FY20-22, a decline of -1.9% for CBA, a bigger decline in NAB of 7% & a decline for WBC of 5% - some fairly bearish assumptions. They prefer ANZ & CBA in the sector. We covered banks in today’s income note (click here)

ANZ Chart

- NRW Holdings Upgraded to Buy at UBS; PT A$3.05

- NRW Holdings Downgraded to Neutral at Hartleys Ltd; PT A$2.32

- Senex Upgraded to Buy at Citi; PT A$0.39

- Beach Energy Upgraded to Buy at Citi; PT A$2.01

- Oil Search Upgraded to Neutral at Citi; PT A$7.08

- ARQ Group Ltd Downgraded to Hold at Wilsons; PT A$1.75

- Seven Group Upgraded to Hold at Morningstar

- Crown Resorts Upgraded to Buy at Morningstar

- Credit Corp Upgraded to Hold at Morningstar

- Bionmoics Cut to Speculative Hold at Bell Potter; PT A$0.13

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/06/19

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.