The rally fades on bank selling (ANZ, EHL)

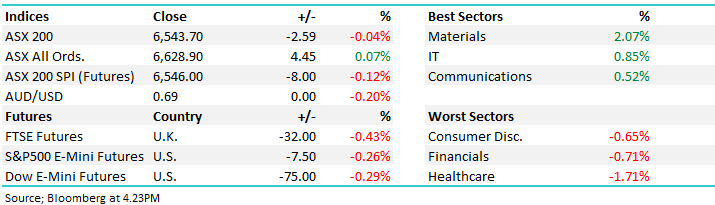

WHAT MATTERED TODAY

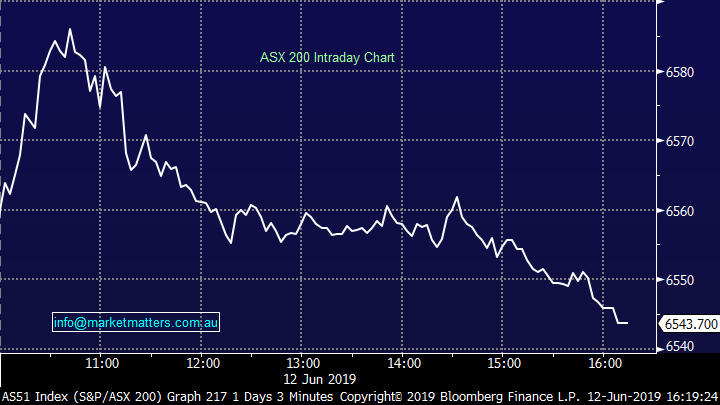

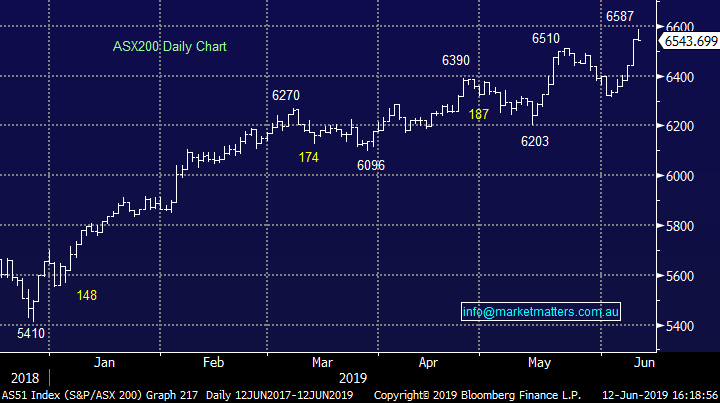

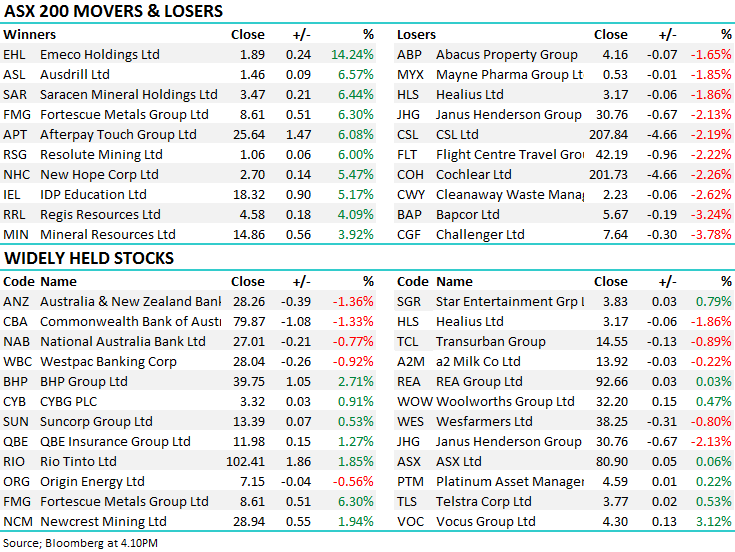

The local market quickly pushed on with yesterday’s rally to post an extra 41pts to rally to the intraday high within the first hour. The selling picked up from there however, and the ASX200 gave back all of the morning’s move, stumbling to its first fall in 6 sessions.

Healthcare fell today on a tumble by heavyweight CSL giving back yesterday’s rally, the banks took a hit today thanks to APRA, and the money flowed in to the miners thanks to a rally in iron ore. The price spiked once again overnight thanks to some news from China – the government has extended its bond policy so that money can be raised for infrastructure and development projects. More projects = more steel and so the already extended iron ore price rallies further.

We now look to US inflation data overnight for another read for the Fed’s next move – a print below the expected 2.1% should see equity markets higher. Locally we see Aussie employment data tomorrow morning at 11.30AM.

Overall today, the ASX 200 fell -2 points or -0.04% to 6543. Dow Futures are trading down -75pts / -0.29%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

The Banks; in a flat market the banks were walked all over today. Fortunes for the Big 4 had been better of late thanks to a Morrison Government, the RBA helping house prices and an APRA move to ease lending standards. Today though, APRA announced it planned push on with extra capital requirements for interest-only loans in time for 2022. The move will squeeze already tight margins on the banks – although some time before it will fully take hold.

ANZ Chart

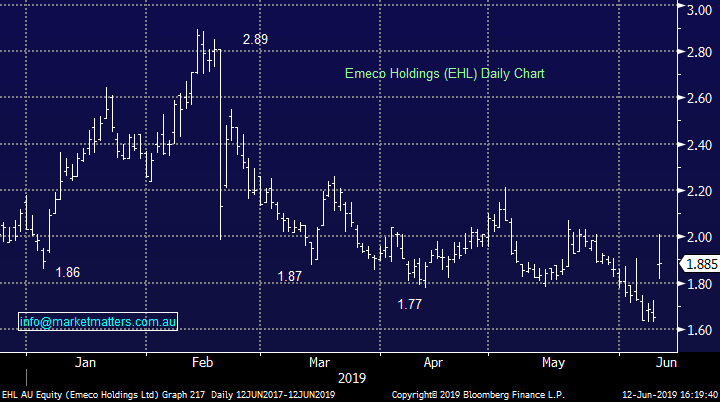

Emeco Holdings (EHL) +14.24%; the earthmoving equipment rental business was out today re-confirming guidance of EBITDA to be in the range of $211-$213m which represents a ~40% lift on FY18. The stock has been trading very poorly ahead of today’s announcement with clear concern around the potential for a weak result in August. Those fears are not without foundation, the company missing 6 of their last 7 earnings reports which is clearly one of the reasons why the stock is languishing near all-time lows. The market’s reaction tells this story pretty clearly, with a +20% pop in the share price on confirmation that they’ll at least meet market expectations which sat at EBITDA of $211m. More a relief than anything by the look.

We own EHL in the Growth Portfolio – bought recently at slightly higher levels – it’s a higher risk play however it’s on 8.5x expected FY19 earnings with decent earnings growth potential. Debt is high, however they’re addressing this and a reduction in financial leverage will reduce borrowing costs in time. We remain keen in EHL although concede it’s a candidate for tax loss selling into EOFY.

Emeco Holdings (EHL) Chart

Broker moves:

- ALS Upgraded to Hold at Deutsche Bank; PT Set to A$6.57

- Cochlear Downgraded to Sell at Morningstar

- Credit Corp Downgraded to Sell at Morningstar

- GPT Group Downgraded to Sell at Morningstar

- Star Entertainment Upgraded to Buy at Morningstar

- Star Entertainment Cut to Hold at Morgans Financial; PT A$4.04

- nib Downgraded to Sell at Morningstar

- Vocus Upgraded to Hold at Morningstar

- Magellan Financial Cut to Underweight at JPMorgan; PT A$40.50

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.