The market loves a tax cut! ASX 200 hits our target ~6250 (RHC, APO)

WHAT MATTERED TODAY

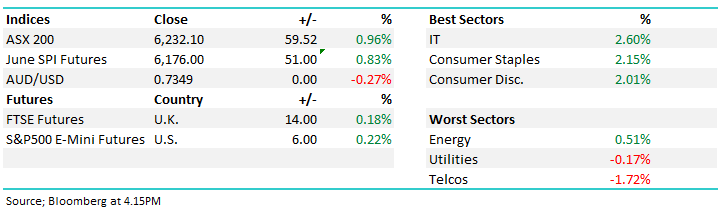

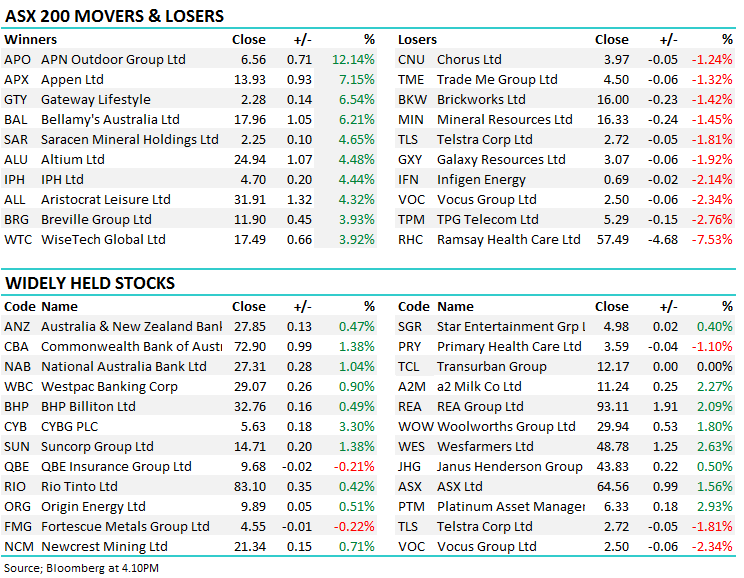

The ASX ran up again today, underpinned by another strong session in the banks as they shuffle out of the naughty corner. Tax cuts through the Senate (thanks Pauline) and a report out from Moody’s, suggesting the “worst is over, as less housing supply and Australia’s strengthening economy will support income and rental growth, and thus dwelling values, beginning next year.” Obviously a positive thought but how much weight do Moody’s actually pull? Anyway, as we’ve suggested for some time, the banks have simply needed less bad news to come their way and the barrage of selling would give way – that’s certainly been the case this week with CBA up +8% from last week’s lows. Elsewhere, IT stocks did well, adding 2.60% collectively, followed by the consumer names - the miners also bounced back, but by a lesser amount - Rio and BHP each rallying around 0.7%.

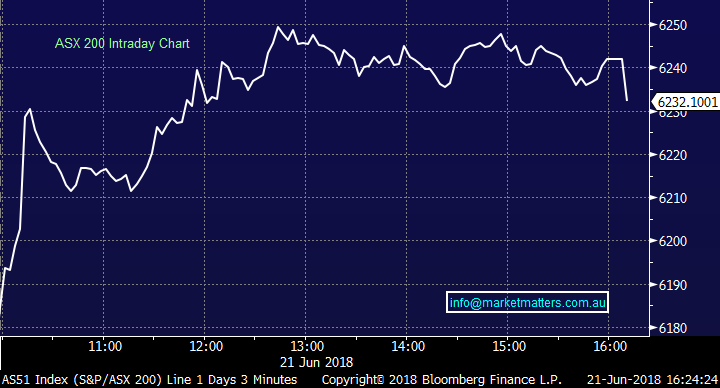

On the index level the ASX 200 hit our target (6249.3) – a level we’ve discussed for some time and that corresponds with the highest level since Jan. 2008. We’re now getting a lot more inbound calls about buying banks which is typical after a rally, however in the short term some consolidation on both an index level and specifically banks would not surprise. Oil will be in focus in the next 24 hours ahead of the OPEC meeting tomorrow – obviously some choppy price action in Crude leading into the meeting.

Overall the ASX 200 index put on +0.96% or +59 points to 6232 while the DOW Futures are trading up around +26pts at time of writing.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; APN Outdoor, long looking for opportunities to expand, now faces a crucial junction: buy a local Australian rival or accept a takeover offer by one of the world’s biggest outdoor advertising firms.

· CYBG GDRs Upgraded to Neutral at JPMorgan; PT A$5.54

· Contact Energy Downgraded to Neutral at Forsyth Barr; PT NZ$5.85

· Computershare Downgraded to Sell at Morningstar

· Beach Energy Downgraded to Sell at Morningstar

· IMF Bentham Rated New Buy at Goldman; PT A$3.80

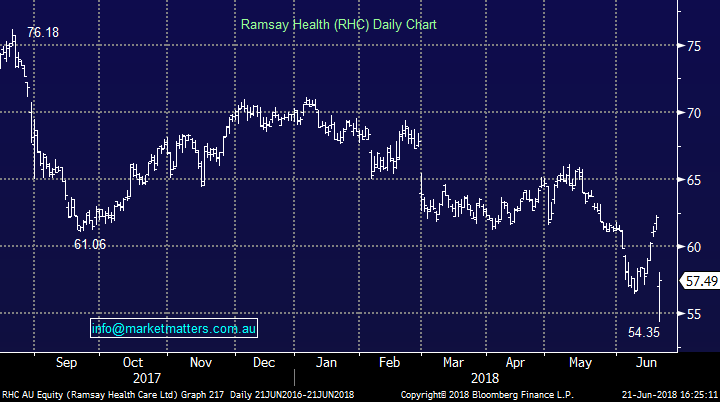

Ramsay Healthcare $57.49 / -7.53%; Ramsay made a poor announcement this morning taking a non-cash write down on some UK assets, but more importantly, they amended their FY guidance down from earnings per share (eps) growth of 8-10% to now expecting growth of 7%. The prior guidance implied eps of $2.86 while market consensus was sitting just below that at $2.84. New guidance implies eps of $2.80 for FY 18, still reasonable growth, but clearly the 20+% levels of the past are now harder to come by.

That however is now well and truly in the price with the stock trading on 20x the new guidance. We had targeted $55 in RHC on the downside and today it has reached that target. While we would have liked to buy the stock nearer the daily lows, we’re still comfortable buying around $57.50 give or take 50c. Liquidity in this stock is an issue – and we found it pretty difficult to buy today – although subscribers can be rest assured by our MM Fill at $57.72 that we’re grappling with the same constraints as everyone else moving decent lines of stock!

Ramsay Healthcare Earnings versus share price – this is pre-downgraded EPS numbers, however new guidance implies $2.80 on our numbers.

Here’s what we wrote back in the start of June….

RHC fell 2.2% yesterday to its lowest level since February 2016 not a great performance by the largest hospital operator in Australia. The company clearly has tailwinds due to the countries ageing population so we question why the much loved stock finds itself down over 28% over the last 2-years. The rising cost of private health insurance is probably the largest single factor with the greatest volume of people ever leaving the private health system last year – as we’ve discussed the average Australian is carrying a large pile of debt and this is one way they can cut back. Other negative factors are also coming through competition from not-for-profit hospitals and general trust in the industry – will the press turn here next after the banking royal commission ends?

RHC is a prime target for EOFY selling and due to the above reasons we have no interest in the stock unless it falls another 8-10%. Ideally we will get some negative news / downgrades moving forward that explains this recent poor performance which may be the catalyst for a low risk / value entry. (today we had the downgrade)

· At MM we have been bearish RHC for well over a year targeting the $55 area which is now ~8% away – MM is a buyer of RHC around $55.

Ramsay Healthcare (RHC) Chart

APN Outdoor (APO) $6.56 / +12.14%; the Australian & NZ outdoor advertising company was the best performer in the top 200 today after receiving a bid from the French based JCDecaux this morning. The bid offers $6.52/share, over an 11% premium to last night’s close, which looks like an attempt by JCDecaux to hold market share in their Australian unit following APN showing intentions to creep into the bus advertising space.

The takeover will come under ACCC scrutiny, noting that a merger between APN and Ooh!Media (ASX:OML) was blocked competition watchdog last year. The market didn’t seem to mind though, with the share price rallying through the bid signalling the markets view is that a follow up bid will come. The deal values APN on a PE of 16x forward earnings, while many international comparable companies trade around the 20-30x range.

APN Outdoor Chart

OUR CALLS

We trimmed A2 Milk (A2M) today by 3% into strength and allocated 3% into Ramsay Healthcare (RHC)

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/06/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here