The market gets into the grind – edges higher throughout the session (NVT, PPT, SYR)

WHAT MATTERED TODAY

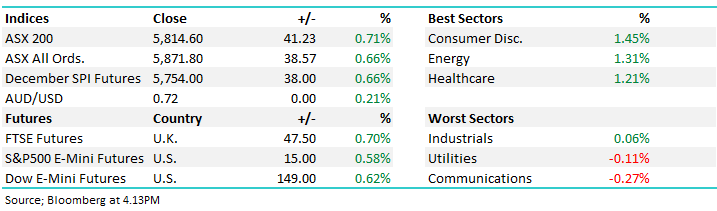

The volatility that played out during December seems to be drifting into the abyss with the volatility index back below the 20 handle and markets around the region grinding higher. Yesterday we bucked a weak lead from Asia plus weakness in US Futures to end flat, while today we saw a more positive backdrop in both regions / US Futures +150pts at close + Asian markets generally up more than ~1.5% which supported a good squirt higher for the Aussie index – mostly driven today by the consumer discretionary names, the sector that lead weakness yesterday. As we’ve written already this week, we think market will re-test the recent lows at some point, probably go below them however it’s just a question of how far they grind up before they sell off.

Looking around at fundies performance stats for the December quarter and there were some shockers, some down 10-20% for the 3 months to the end of December and interestingly, the long short style funds that I’ve looked at haven’t really been providing the hedged returns they talk about. Recapping the last quarter for MM, we were set nicely into October with shorts in place and high cash, we outperformed well into November however underperformed in December as we bought stock too early in the correction – ending down ~5% for the 3 months in the Growth Portfolio and down around ~4% in the Income. Tomorrow morning we’ll put out our 2019 Outlook piece that will cover our views for the year ahead - keep an eye out for that in the morning.

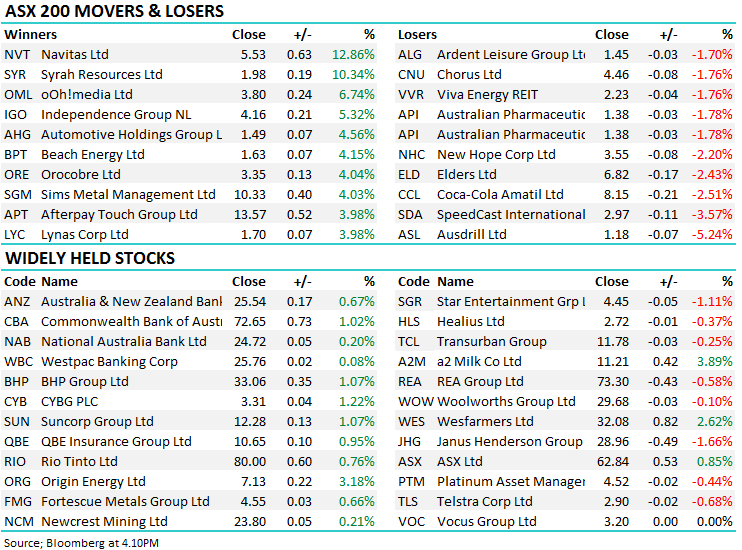

Overall today, the ASX 200 closed up +41 points or +0.71% to 5814. Dow Futures are currently trading up +153pts or 0.61%.

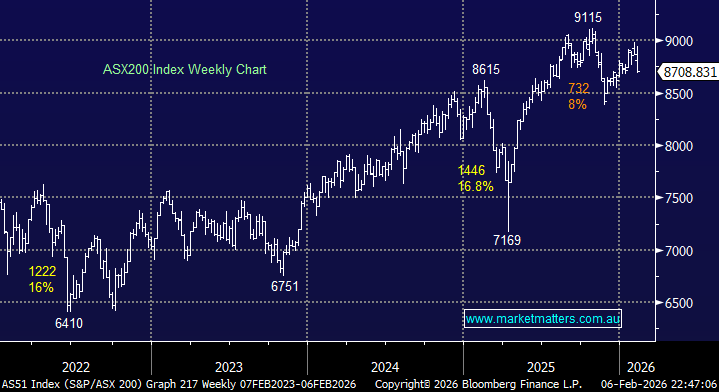

ASX 200 Chart – good grind higher today as Asian markets were firm, although volume still light.

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Goldman’s took the knife to their Iron Ore price forecasts and as a result downgraded Fortescue (ASX:FMG) to a sell, while a stock that caught my eye today was Nine Entertainment (ASX:NEC) which put on +3.38%, bouncing well after a fairly tough period. Citi saying that value is emerging despite a challenging ad market. If Clive Palmer is anything to go by, surely a NSW state + Federal election this year will give a short term boost to the networks…

Nine Entertainment (ASX:NEC) Chart

ELSEWHERE:

· Mayne Pharma Downgraded to Neutral at UBS; PT A$0.83

· Southern Cross Media Upgraded to Neutral at Citi; PT A$1.05

· Seven West Upgraded to Neutral at Citi; PT A$0.60

· Nine Entertainment Upgraded to Buy at Citi; PT A$1.60

· News Corp GDRs Upgraded to Buy at Citi; PT A$20

· HT&E Upgraded to Buy at Citi; PT Set to A$1.90

· Steadfast Downgraded to Hold at Morningstar

· Fortescue Downgraded to Sell at Goldman

· Fortescue Downgraded to Neutral at JPMorgan; PT A$4.90

· Costa Upgraded to Outperform at Credit Suisse; PT A$5.60

· Northern Star Downgraded to Neutral at JPMorgan; PT A$9

· St Barbara Downgraded to Neutral at JPMorgan; PT A$4.70

· Bellamy’s Downgraded to Neutral at Goldman; PT A$8.50

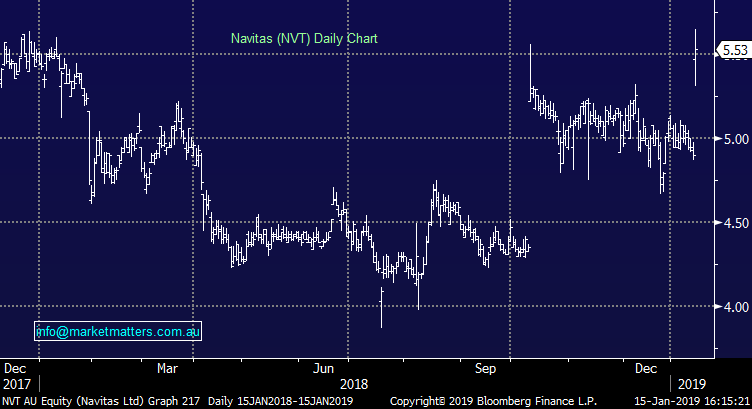

Navitas (ASX:NVT) $5.53 / +12.86%; A revised takeover deal for education provider Navitas saw that stock top the leader board adding more than 12% today. The initial bid, which we discussed here, has been increased by 5.9% from $5.50 to $5.825 as the consortium led by private capital firm BGH look to close out the deal. NVT, which provides pre-university and pathway courses globally, announced that the board intends to unanimously accept the new offer but also ensured the door will be left open for other suitors to propose superior offers. The company has been a long time takeover target for those looking for exposure in the booming international education market, however the stock price struggled for much of 2018 as the company slipped into a loss.- the deal looks likely to proceed.

Navitas (ASX:NVT) Chart

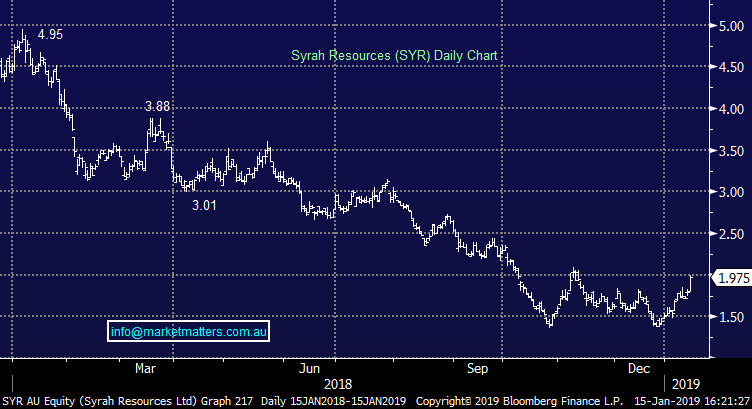

Syrah Resources (ASX:SYR) $1.975 / +10.34%; Bounced hard again to test the $2 region today – a far cry from the ~$4.60 level it was trading at last January, however a better production profile seems to have prompted short covering. SYR have 58m shares sold short or 17% of the register and a break of $2.00 could be the next upside catalyst…it got to $1.9975 today closing a shade lower. Continued production issues have plagued its Balama Graphite operation in Mozambique and the shorts have had a field day on this, however recent news that has been more positive could turn the tide here. A volume breakout over $2 looks bullish

Syrah Resources (ASX:SYR) Chart

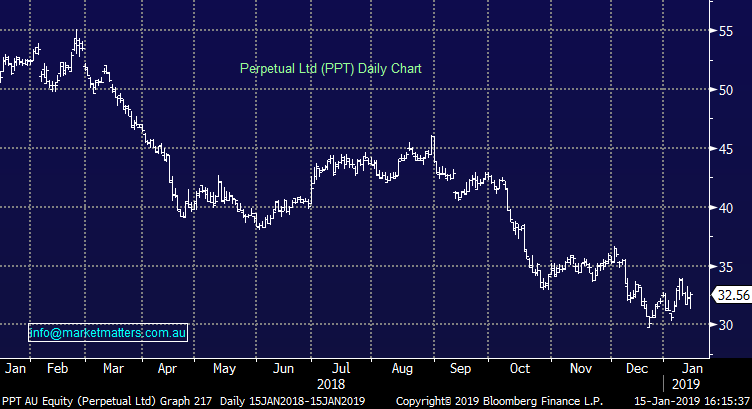

Perpetual (ASX:PPT) $32.56 / +0.62%; After a soft morning session buying came in to buy weakness in PPT today after a weak FUM update. As touched on yesterday, fund managers are highly leveraged to market returns and weakness throughout the December quarter has had a negative influence on PPT. Today they reported a drop in funds under management (FUM) of $2.5bn for the quarter, the bulk of which ($2.1bn) was related to weak performance. For the 3 months, the All Ords were down by -9.74%. Morgan Stanley released a good note yesterday on the sector which highlighted how ‘cheap’ asset managers have become flagging that they’re trading near 15 year lows on a group weighted average 12mths fwd, however they go onto say they’re cheap for a reason given the high level of FUM walking out the door.

‘While we expect a gradual recovery from here, we think the group will remain in outflows and a substantial re-rating is unlikely in the near term’ (Morgan Stanley)

However, the main catalyst for a turn of fortune in the sector is FUM, and given weakness in December we would expect that retail flows would again be weak into the March quarter of 2019. It’s cheap, pays good yield but needs a catalyst.

Perpetual (ASX: PPT) Chart

OUR CALLS

No changes today.

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.