The market ends the week on a soft note despite bank buying (LLC)

WHAT MATTERED TODAY

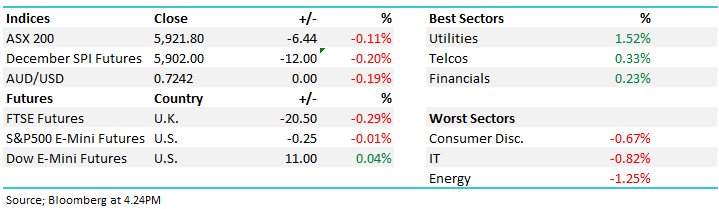

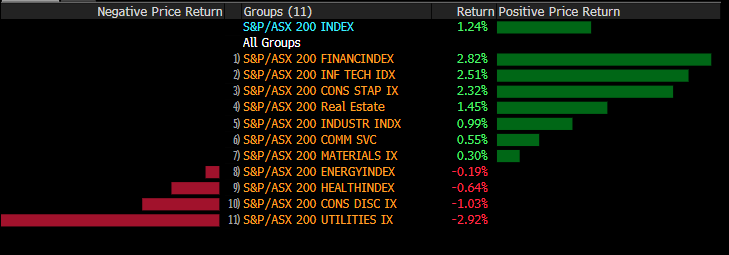

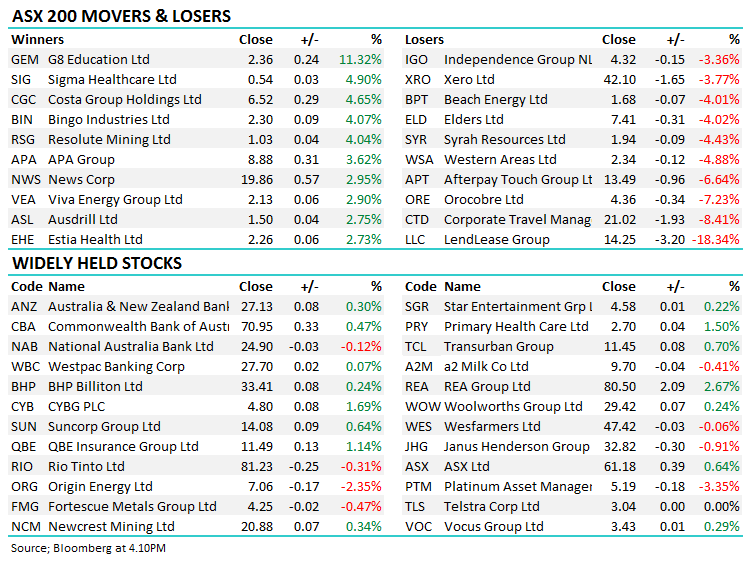

In a topsy turvey session, the market closed marginally lower this afternoon despite the best efforts from strength in the banks. Despite the slightly soft finish, the market managed a solid 1.2% gain on the week. Energy dragged today as oil prices entered bear market territory, sliding more that 20% from recent highs. A downgrade from Lend Lease ensured that the real estate stock was the worst in the top 200 thanks to a downgrade on poor engineering business performance. A bounce from APA saw utilities higher – the market is forecasting a revised bid for the gas pipeline company which was recently targeted by Hong Kong’s CKI.

Overall, the index closed down -6 points or -0.11% today to 5921 – up a +1.2% on the week. Dow Futures are trading up 11points / -0.04%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Wilsons put out a note on Afterpay (APT) downgrading the stock to hold. They say that while APT is showing “clear momentum” in the U.S., there is a risk that margin expectations for the next couple of years are too high. The acknowledge that the U.S. remains a significant opportunity given Afterpay has 900 retailers, with another 1,300 in the pipeline but warn that regulatory risks remain given ASIC report due in December, potential lawmaker inquiry in February. They cut to hold vs buy; PT slashed 38% to A$15.64 from A$25.03

RATINGS CHANGES:

· Netwealth Group Upgraded to Buy at Wilsons; PT A$8.49

· Platinum Asset Cut to Underperform at Credit Suisse; PT A$5

· CSL Upgraded to Buy at UBS; PT A$220

· REA Group Upgraded to Outperform at Macquarie; Price Target A$90

· REA Group Downgraded to Neutral at JPMorgan; Price Target A$79

· McMillan Shakespeare Raised to Outperform at Macquarie

· McMillan Shakespeare Raised to Outperform at Credit Suisse

· Lovisa Upgraded to Equal-weight at Morgan Stanley; PT A$8.40

· APA Group Upgraded to Hold at Morningstar

· ANZ Bank Downgraded to Hold at Morningstar

· Corporate Travel Raised to Add at Morgans Financial; PT A$26.72

· OceanaGold GDRs Rated New Neutral at Goldman; PT A$4.30

· Northern Star Reinstated at Goldman With Sell; PT A$7.50

· Resolute Mining Rated New Neutral at Goldman; PT A$1.10

· Regis Resources Reinstated at Goldman With Sell; PT A$3.80

· Saracen Mineral Rated New Buy at Goldman; PT A$2.80

· Evolution Mining Reinstated at Goldman With Buy; PT A$3.40

· St Barbara Reinstated at Goldman With Buy; PT A$4.90

· Newcrest Reinstated at Goldman With Neutral; PT A$21

Sectors this week; Banks lead the financials higher this week, while although APA bounced today, the weakness this week dragged utilities.

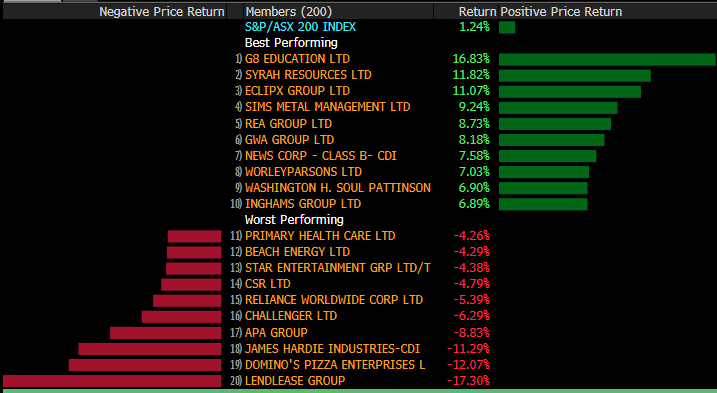

Stocks this week; Syrah rallied as production progress is made, and Eclipx bounced on merger news. On the other end, James Hardie and Domino’s soft updates to guidance ensured the two stocks struggled this week.

Lend lease (LLC) $14.20 / -18.34%; This morning Lend Lease (ASX:LLC) came out with a downgrade saying that they anticipate taking a ~$350m after tax impairment charge against its Engineering division in 1HFY 19. This has been a problematic part of the LLC operation for some time with such slim margins offering very little cushion if one of two projects have issues.

From the conference call with management;

· Cost inflation in projects

· Wet weather and lower productivity issues

· NorthConnex plus some smaller projects problematic

· Spin off of Engineering business a possibility

Importantly, this highlights the cost pressure coming through infrastructure projects and other companies to be potentially impacted would be (ASX:DOW), (ASX:BLD) and (ASX: CIM) – something we need to be conscious of given our CIM holding in the Growth Portfolio

LLC has spent a number of years de-risking the business however the one area that has always been problematic has today caused the share price to tumble around 18% at time of writing. It seems like when times are good, margins are under pressure and when its bad the margins are under pressure.

The market will now focus on whether or not LLC will spin out the engineering division, and the CEO alluded to that on the call. Citi put out a note back in October outlining why that could be a good strategy sighting;

1. LLC is worth more today without engineering based on applying a higher multiple to the stocks ex-engineering

2. Engineering is a management distraction

3. Engineering lacks scale and building scale will increase risk (which then had a negative influence on the multiple the market will pay for the group)

4. Limited synergies with development and funds management

5. An in-specie distribution avoids selling the business at the wrong time

Lend Lease (LLC) Chart

OUR CALLS

No changes the portfolios today.

Watch out for the weekend report. Have a great night,

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 9/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.