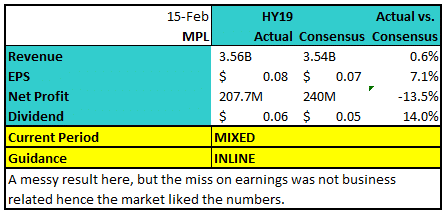

The market doesn’t mind Medibank’s profit slip

Stock

Medibank (ASX: MPL) $2.88 as at 15/02/2019

Event

The local health insurance giant has traded higher today after posting a messy result before the open. The profit might have slipped over 15%, but investors have focussed on the positives particularly given that drop was driven by poor investment income and not underlying business performance.

Revenue rose 2.7% even in the face of a poor health insurance market with gains in both premiums and the number of policy holders. The group operating profit managed to edge 2.4% higher on the first half of 2018, however investment income fell 93% to $4.1m driving the slide in net profit.

Guidance was murky – although management didn’t throw any red flags, private health insurance is in a slow to no growth phase. Medibank is looking to slowly increase market share.

The outlook statement did include comments regarding potential acquisitions, and with a sizable cash balance and strong capital position in a market that is trading historically cheap the market seems to have enjoyed the outlook.

It does come at an odd time for MPL though. The company has reportedly hired a takeover defense team ahead of the ownership restrictions which are to be lifted later this year. Since being privatized, no single entity has been able to own over 15% of MPL, but this all changes in November.

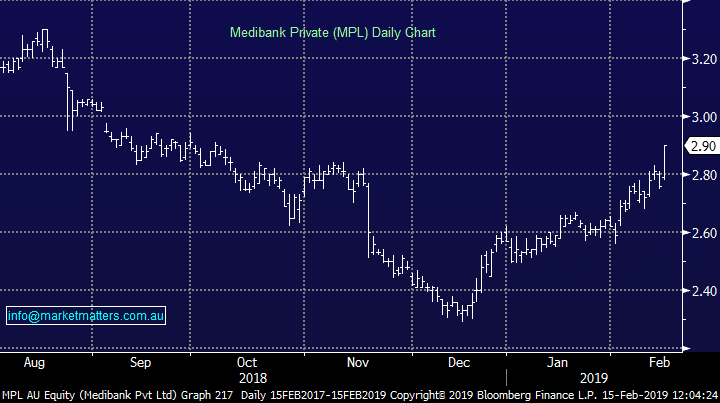

Medibank (ASX: MPL) Chart

Guidance was murky – although management didn’t throw any red flags, private health insurance is in a slow to no growth phase. Medibank is looking to slowly increase market share.

The outlook statement did include comments regarding potential acquisitions, and with a sizable cash balance and strong capital position in a market that is trading historically cheap the market seems to have enjoyed the outlook.

It does come at an odd time for MPL though. The company has reportedly hired a takeover defense team ahead of the ownership restrictions which are to be lifted later this year. Since being privatized, no single entity has been able to own over 15% of MPL, but this all changes in November.

Medibank (ASX: MPL) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook