The market awakens from it’s slumber

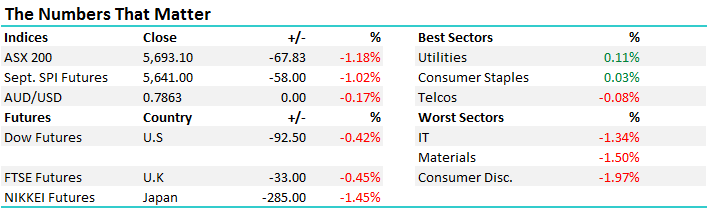

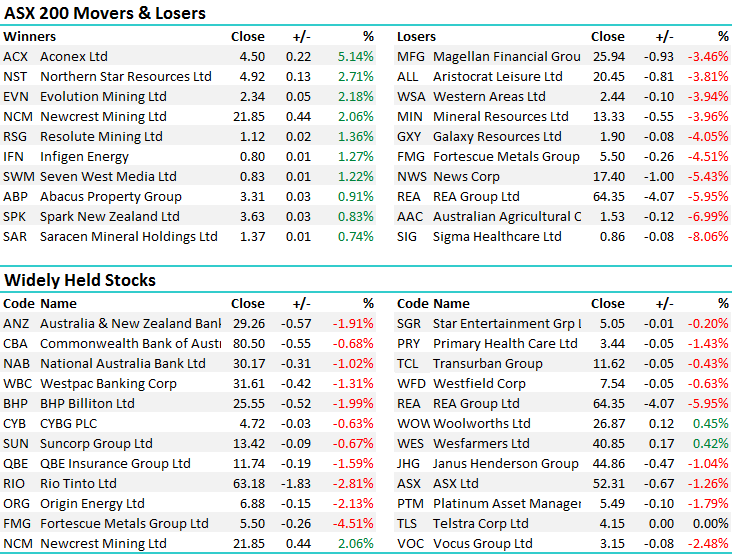

Weakness finally dominated the ASX today with the market being sold heavily thanks to Trumps war of words with Denis Rodman’s pal in North Korea. Most pain was felt in the consumer discretionary stocks followed closely by the Material names which were down -1.50% - an overall range of +/- 70 points, a high of 5744, a low of 5674 and a close of 5744, off -67pts or -1.18%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

We’ve been of the opinion recently that risks to the downside were bubbling away, yet the market wasn’t adequately pricing them, in terms of both complacency in the equities and importantly the options market. Overnight we saw the biggest selloff in U.S. equities since May and that sparked a big rush for protection in the options market. In terms of the mkt there, about 2.6 million puts and calls tied to the CBOE Volatility Index changed hands on Thursday, the most on record furthermore about 3.4 call volatility options - a bearish equities trade - have changed hands for every put contract. This is a theme we’ve spoken of recently and have been warning of for some time. That said, it’s unlikely to be the start of a big rout in our view unless the tensions materially escalate, which is always a possibility but not the ‘likely scenario’ in our view. This weakness, therefore should be viewed as a buying opportunity for those with cash on the sidelines as we do. We talk more about our views in the Weekly Video (below).

In terms of our views this week, we suggested early on that with North Korea and the US on the brink of war we now have a clear potential catalyst for the ASX200 to break out from its 12-week 5629-5836 range. If the situation unfortunately deteriorates we are likely to get a fall towards the 5500 area which we have targeted over recent weeks, alternatively a relatively quick and positive resolution now feels likely to send stocks higher. We now think 5500 becomes the obvious downside target, although we do concede that we’ll most likely spend some our 23.5% cash balance if the mkt drifts lower from here.

Our Market Matters video below – we cover the mkts weakness today, our views on reporting season and gold. Have a great weekend.

Have a great night & watch for the weekend report on Sunday

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/08/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here