The Libs rattle the market today amidst mixed earnings results (BHP, AMC, HSO)

WHAT MATTERED TODAY

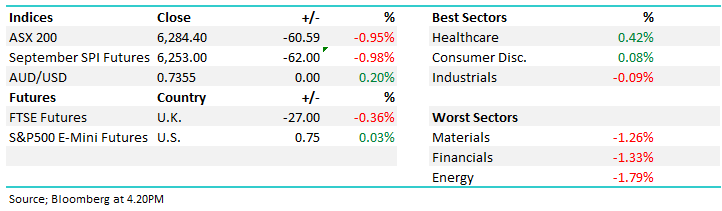

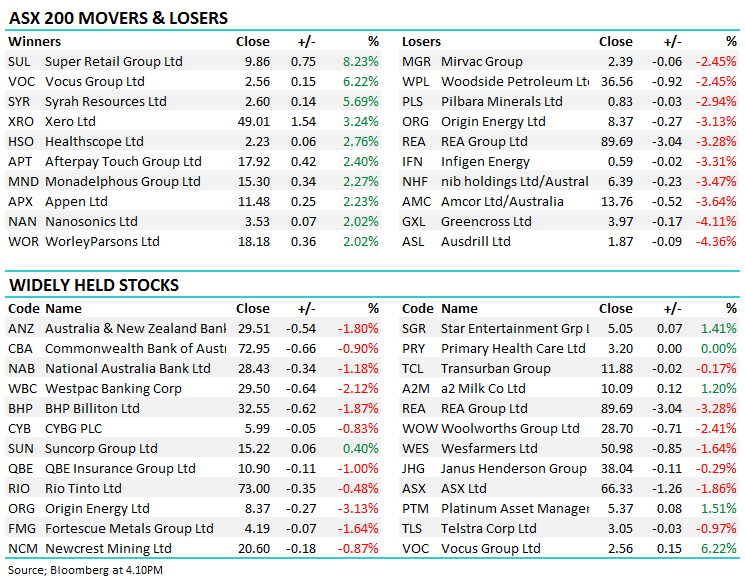

A wave of selling hit the market today following Peter Dutton’s failed tip at the Prime Ministership. Turnbull was ‘re-elected’ to the leadership in this morning’s party-room meeting, but Dutton’s failure was taken as a sign of instability within the Government, something the market clearly dislikes. The banks and the financials in general were the worst hit, the easy sell in any Liberal turmoil, while resources were also lower, but more so on the back of weaker commodity prices – all working to force the index back below 6300.

While the political mess was playing out, the market was also dining on BHP’s breakfast result – a messy one to say the least. Healthscope & Amcor also reported their FY18 numbers, more on these below. Super Retail Group continued the retail sectors strong reporting season and finished up 8.23%, while Oil Search had a tough time after a soft first half result.

James Gerrish, our Primary Contributor covered a number of the results in a Direct From The Desk recording around 11am today – CLICK HERE TO WATCH

Overall, the ASX200 fell -60 points today or -0.96% to close at 6284– Dow Futures are currently trading up +19points/0.07% at the time of writing.

Reporting continues tomorrow – the big names we expect to see are Newcrest, Sydney Airports, Western Areas & Lendlease among others. For a full list of company reporting dates – click here

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

· Ansell (ANN AU): Ansell Downgraded to Hold at Morgans Financial; PT A$25.16; Downgraded to Neutral at JPMorgan; PT A$24.70

· Gateway Lifestyle (GTY AU): Cut to Sell at Shaw and Partners; PT A$2.25

· NIB Holdings (NHF AU): Cut to Underperform at Credit Suisse; PT A$6.30

· Nanosonics (NAN AU): Cut to Hold at Bell Potter; Price Target A$3.42

· Primary Health (PRY AU): Downgraded to Neutral at JPMorgan; PT A$3.25

· Xero (XRO AU): Reinstated at William O’Neil & Co Incorporated With Buy

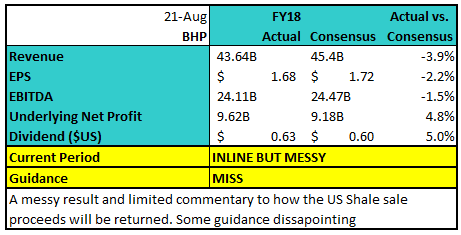

BHP Billiton (BHP) $32.55 / -1.87%; BHP was the next big miner to face the music in their FY18 numbers this morning, a reasonable result if not messy and although shares are traded lower today, it is mostly in line with comparable companies as the market also traded. The big news shareholders were hoping to gather from this announcement was also withheld – where will the ~$US10B from the sold US shale assets go? BHP gave no update except to say that the money will be returned to shareholders once the transaction is settled in October, and the company is still consulting shareholders in order to determine the best way to return the capital.

Looking deeper into the result, BHP lowered productivity guidance into FY19, reducing cost benefits from $2b to $1b mostly on the back of few assets to increase productivity, but also poor performance of the Queensland coal business and their Olympic Dam copper project. One word to sum it all up is messy, but heading in the right direction. BHP has done a great job in de-leveraging and debt levels are now around the lower end of their target, productivity is disappointing but many assets are running below capacity and any effort to lift output here will see top line growth. We like BHP but are looking for a further pullback to get set. Resources do well in a rising inflation environment, BHP has plenty to give back to shareholders and have plenty of room in the business to surprise investors to the upside. Any reasonable weakness in underlying commodities may help our efforts to set a position in the big Australian.

BHP Billiton (BHP) Chart

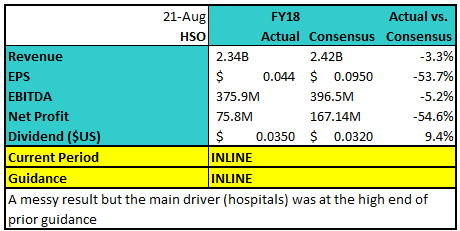

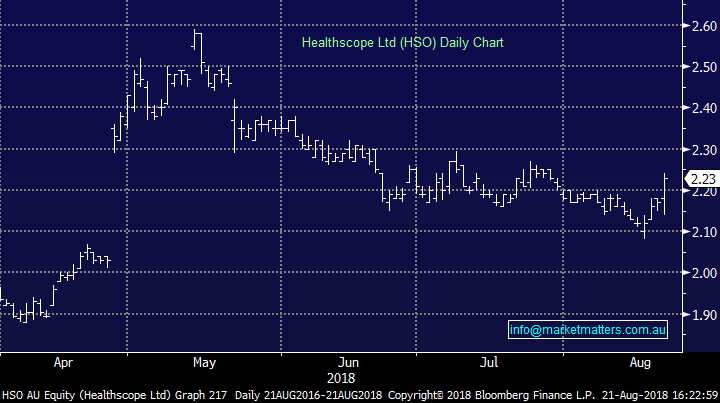

Healthscope (HSO) $2.23 / +2.23%; This was an interesting result from HSO and one that on first read through relative to consensus seemed like a big miss, however on an underlying basis the result was sound. Given the sale of assets, a hit from a bad lease which was a known known, the profit result was weak as shown below, however earnings from their hospital division which will be their main driver of earnings going forward (post Pathology spin out) was strong - at the upper end of company issued guidance back in May. They also reconfirmed guidance of at least 10% growth at the EBITDA line for FY19.

HSO also announced plans to spin out their real estate assets into a separate entity, retain 51% ownership and bring in another party for the remaining 49%. Current book value sits at about ~$1b which seems undercooked given current cap rates and demand for long life assets at the moment, offset to some degree by the fact that a new investor will have an non-controlling interest. Anyway, we liked the result from HSO today, again, a better outcome than perhaps the market had positioned for and now we see a catalyst (proposed spin out of property) for suitors to come back to the table and make a bid. If not, it seems HSO will do a private equity style restructure on itself!

Healthscope (HSO) Chart

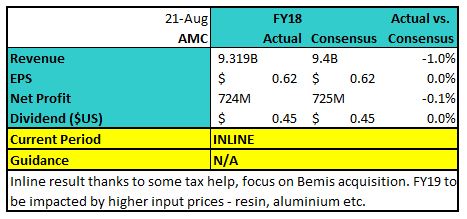

Amcor Limited (AMC) $13.76 / -3.64%; Packaging maker Amcor came under pressure today despite what looks to be a reasonable FY18 result. On first glance, their profit number is inline and dividend as expected, but much of the result is driven by a falling tax rate working to offset rising raw material costs. The company didn’t give specific guidance, only to say they expect solid growth which in our view likely implies mid-single digit growth which is below the market, although this is clearly not precise.

The focus now turns to their acquisition on US packaging giant Bemis. Shares have come under pressure since this was announced earlier this month with the dilution on the back of the pending Bemis purchase expected to be completed in early 2019, where shares will be dual-listed on the NYSE and the ASX. Management remain positive on the acquisition looking for synergies and growth in the combined entity.

A great deal of Amcor’s performance relies on two drivers – Bemis and input costs. We see the Bemis transaction as a great positive moving forward, and flagged synergies to be under-reported at this stage which will be a tailwind for the stock. Input prices however have been a headwind and this looks set to continue. AMC have been able to protect margins somewhat by passing some of these costs on to customers, however this is unlikely to make up the rising costs. We are somewhat neutral AMC here, looking for a price closer to $13 to be interested

Amcor (AMC) Chart

OUR CALLS

No trades across the MM portfolio’s today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here