The buyers win today, helped by consumer confidence (FXL, FLT)

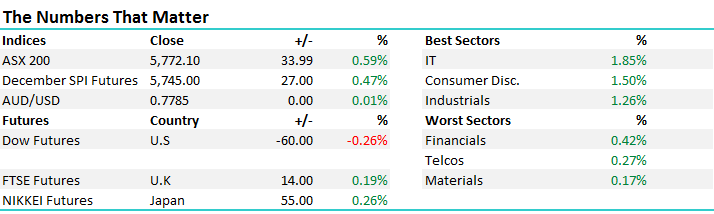

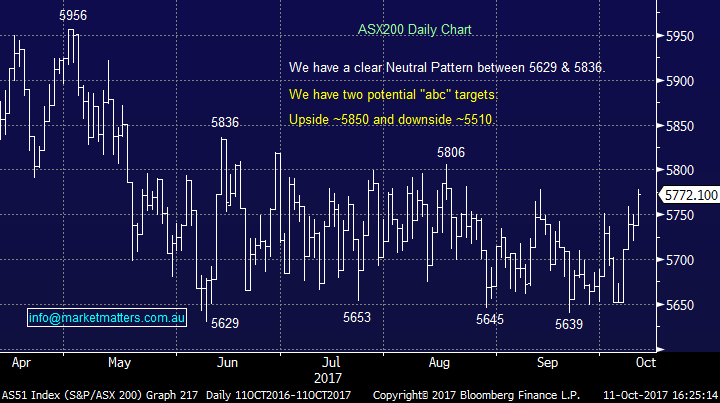

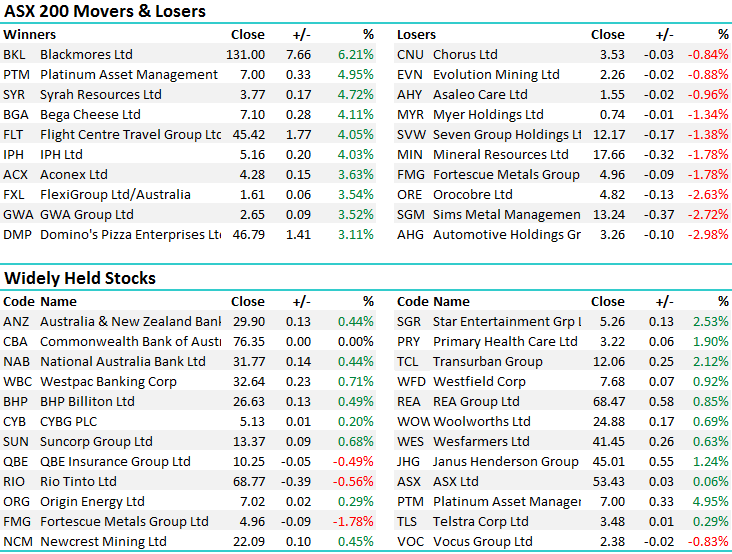

There was no sign of selling today, with gains seen across the board, notably led by the IT and consumer discretionary sector, up 1.85% and 1.50% respectively. Materials were the worst performers, however the sector still finished in the black, up 0.17%. An overall range of +/- 40 points, a high of 5778, a low of 5738 and a close of 5772, up 34pts or +0.59%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

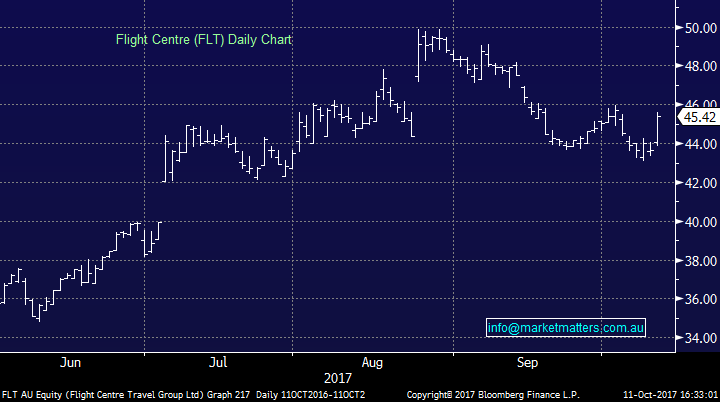

The monthly Westpac Consumer Confidence survey came out stronger than the previous month, assisting the consumer discretionary sector to outperform the broader market. Some relief for the sector after weak retail sales figures last week. Flight Centre (FLT) got the most demand today, jumping over 4%.

Flight Centre (FLT) Daily Chart

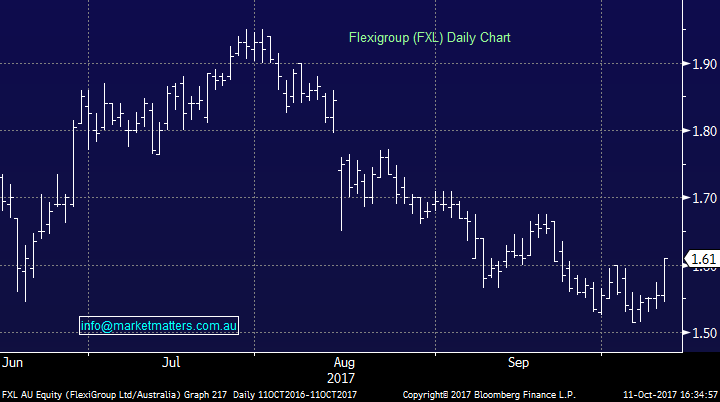

Flexigroup (FXL), a payment solutions business, also benefitted strongly from the data, up 3.5%, the biggest move since June 28, outperforming the ASX 200 by almost 6x. Flexigroup has been in a clear downtrend since its poor profit result in August, but it looks to have broken some resistance today. This is something we will keep an eye on, however this is a high risk play similar to many payment solutions businesses.

Flexigroup (FXL) Daily Chart

Finally, thank you to all that joined in today’s webinar. There will be a recording available tomorrow for those who missed out.

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/10/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here