The bulls step back onto the dance floor (CGC, PGH, PLS)

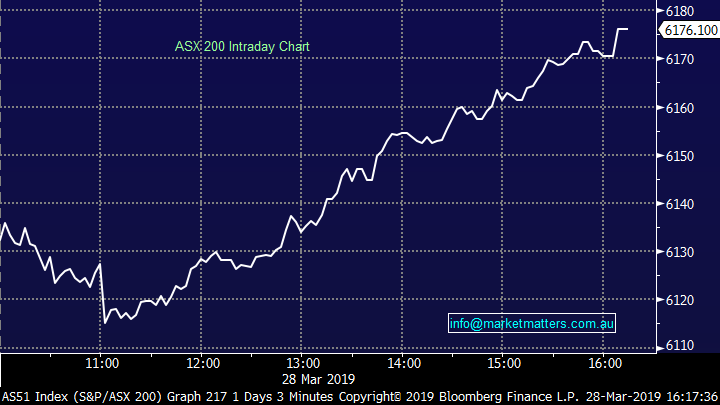

WHAT MATTERED TODAY

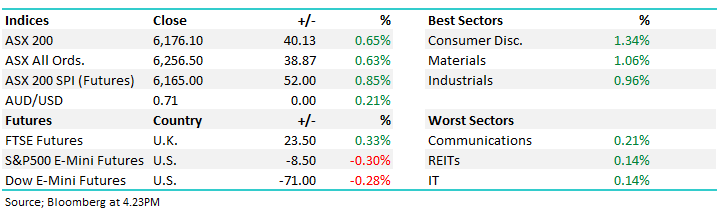

A bullish day for Aussie equities with the market latching onto strength from our cousins across the ditch, simply ignoring the weakness playing out across US Futures while Asia was fairly mixed across the board. It’s been a while since we’ve seen such sustained buying throughout the day with the ASX 200 running hard from its 11am low – a move of +61pts bought from early weakness after the market pulled back -21points in early trade. Rally’s like that often come from left field and dealing with into traders around the market today, it caught many on the hop – probably why it was sustained buying / grinded higher into the close. As we alluded to earlier in the week, a heap of dividends being paid this week and money clearly finding its way back into the market + we had stock options expiry today which adds a bit of spice to things .

Overall today, the ASX 200 added +40 points or +0.65% to 6176. Dow Futures are trading down -80pts / -0.25%

ASX 200 Chart – Sustained buying throughout the day

ASX 200 Chart

CATCHING OUR EYE;

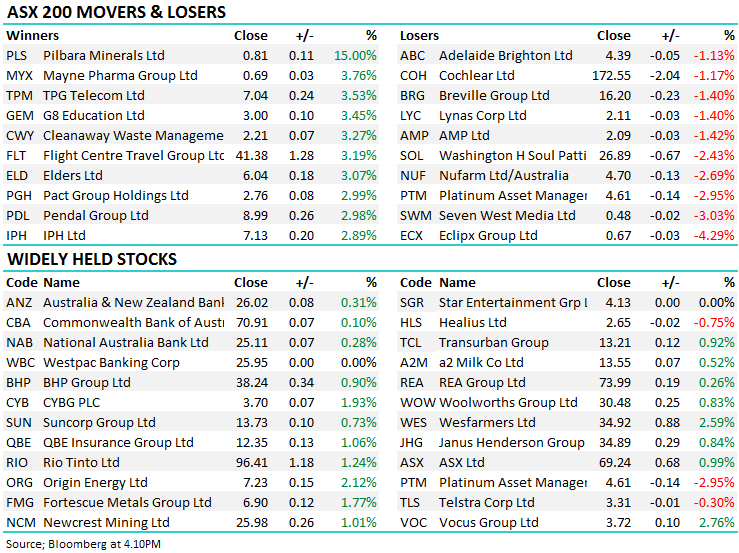

A lot going on today across the desk with stock options expiry along with some large portfolios going through the screens – the grind higher from the lows showing clear buyer interest across the market. A few stocks from a trade / price perspective catching my eye…Some of the beaten down value plays starting to run, the agricultural sector for one with Costa (CGC) covered below doing well, Elders (ELD) put on +3.07%, G8 Education (GEM) saw some decent buying into recent weakness adding +3.45% while Emeco (EHL) traded down to a marginal new low and bounced pretty well, closing down ~1% at $1.905 on the session but up from low of $1.855.

We also saw a lot of action early between Coles (COL) and Wesfarmers (WES), with COL’s sold hard only to recover while we saw strong, sustained buying in WES throughout the session – looked like decent money coming out of COL and into WES early on before buyers stepped up into Coles.

Costa Group (CGC) +1.59% we own in the MM Growth Portfolio having bought into recent weakness, although a shade above todays close. Citi initiated coverage today with a BUY and $5.80 price target. The rationale is two-fold. More people eating more fruit and veg like mushrooms, snaking tomatoes and berries, and Costa is increasing planted hectares both in Australia, China and Morocco. I know our fridge has more of those things in them. Citi expect revenue growth of +10% pa out to FY21 dropping down to EBITDA growth of +25% from FY18 to FY21. CGC was hit recently on weak demand for some products which impacted prices, however as we said at the time, buying structurally strong businesses into cyclical weakness makes sense in our view…

Costa Group (CGC) Chart

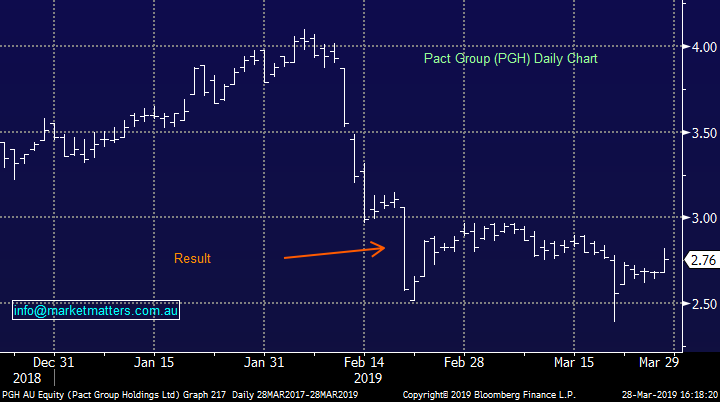

Pact Group (PGH) +2.99% announced a new MD this morning and the stock was bid up on the back of it. A fairly muted open however as the news worked across the market buyers stepped in. While not earth shattering, the appointment of the Sanjay Dayal as Managing Director and Chief Executive Officer is an incremental positive, poached from the executive team at BlueScope in time to take the reins from stand in CEO and current Chairman Raphael Geminder next week.

He joins the packaging group at a time where earnings have gone backwards as rising input costs hit. The stock traded as high as $5.95 last year before a profit warning sent the stock tumbling. Sanjay has been brought in for his extensive innovation and restructuring experience at both Bluescope (BSL), and prior to that Orica (ORI). The task at hand will be to lower production costs while trying to protect earnings from the swings and roundabouts of resin pricing. We own PGH and see plenty of upside if they can get this right.

Pact Group (PGH) Chart

Pilbara Minerals (PLS), +15%, had a muted start to the day but found its grove as the session went on. The Lithium name announced pre-market that had achieved commercial production rates with sustained concentrate extraction over the first 6 months of operation at its Pilgangoora project. Pilbara is still ramping up production here while beginning the second stage of expansion of the site. Looks bullish technically targeting 90c

Pilbara Minerals (PLS) Chart

Broker Moves:

· Amcor Rated New Hold at Vertical Research; PT A$14

· Costa Rated New Buy at Citi; PT A$5.80

· Bluescope Upgraded to Hold at Morningstar

· Platinum Asset Upgraded to Buy at Morningstar

· CYBG GDRs Upgraded to Buy at Bell Potter; Price Target A$4

OUR CALLS

No changes today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.