The Biden Bid supports stocks today, ASX rallies +70pts (WBC, FLT, MTS, TPM)

WHAT MATTERED TODAY

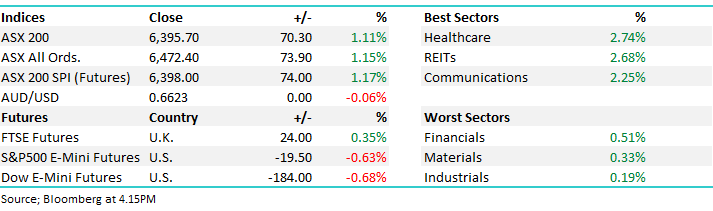

The ‘Biden bid’ came through overnight as Democratic nominee Joe Biden got the wood on Bernie Sanders, an extreme candidate which the market wouldn’t appreciate. That led to a +1100pts move in the Dow Jones overnight with our mkt starting the day on the front foot, up more than 100pts at its best in early trade. Once again though, sellers emerged and we tickled back into the afternoon session, before a late flurry saw the mkt close +70pts higher on the day.

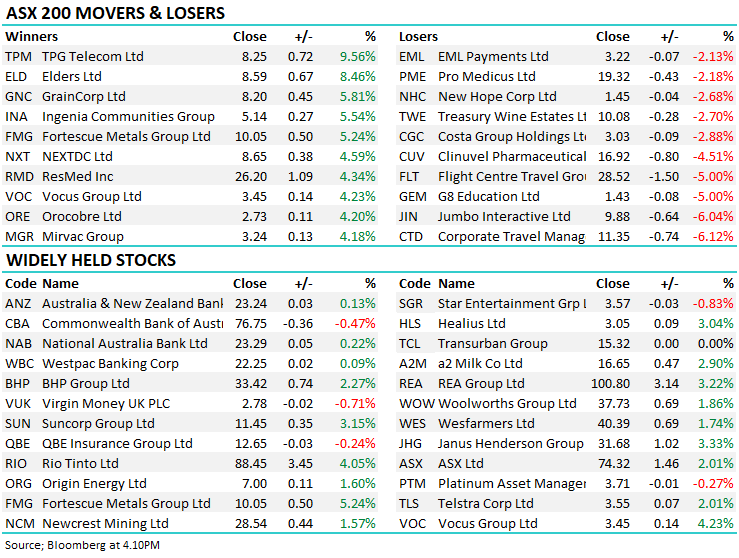

Healthcare was strong led by Resmed (RMD) which out on ~4%, Ramsay Healthcare (RHC) was down although that was a result of them trading ex-dividend. Across our portfolios, we saw a good move in Macquarie (MQG) up more than 3%, ditto for Bingo (BIN) and Janus Henderson (JHG), while both BHP and RIO traded ex-dividend today. Banks had another soft session relative to the rest, I cover the reason why below.

Asian markets were higher today, between 1-2% across the board while US Futures traded off their highs during out time zone, but not materially so given the +4% upside overnight.

From the peak of 7197 just 10 trading days ago, the mkt had a low of 6245 on Monday morning before closing today’s session at 6395, the drop from high to low being a fairly stark 952pts / -13.2%.

Overall, the ASX 200 added +70pts / +1.11% today to close at 6395 Dow Futures are trading down -132pts/-0.49%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

AFR Article on RBA: Interesting article in the AFR today about the approach the RBA would take from an unconventional policy sense. In essence they would target lower rates across the yield curve in two ways. "The first is the direct price impact of buying government bonds, which lowers their yields. "And the second is through market expectations or a signalling effect, with the bond purchases reinforcing the credibility of the Reserve Bank's commitment to keep the cash rate low for an extended period."

The consequence of this is obviously lower rates and a flattening of the curve which is ultimately a drag for banks, who borrow short and lend long - they are more profitable with a steep yield curve, when short-term rates are much lower than long term rates. Ultimately, the RBA are not keen to go down this path, I suspect they’d rather see the Government step up to the plate with fiscal measures and that makes a lot more sense to me. Over the you Sco-Mo

Westpac (WBC) Chart

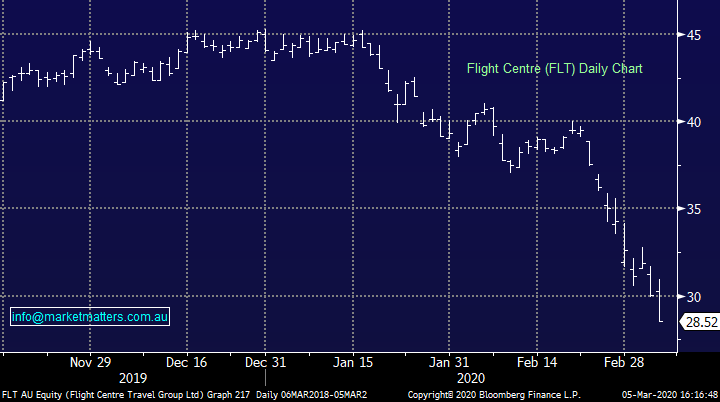

UGLY Stocks: Start with the travel stocks if you want to glance your eye over some ugly charts, these are simply in free fall at the moment with few buyers in sight, Flight Centre (FLT) is leading the charge here. I mentioned in a report this week that they’ll be a place and time to buy Webjet (WEB) but not yet, however we wouldn’t touch FLT, a few queried this stance.

Ultimately FLT has been in a downgrade cycle even before the virus took hold, the market rates their corporate expansion strategy which is where the growth is coming from, however their domestic retail business is struggling. They reported half yearly numbers yesterday, although these were already encapsulated in a recent downgrade, although management again reiterated that they are confident that demand will come back!!! There are two things going for FLT, their big cash balance & their corporate business but ultimately, we prefer WEB, but we’re certainly avoiding Corporate Travel (CTD).

Flight Centre (FLT) Chart

Metcash (MTS) +3.75%: A good move in recent days from Metcash despite the announcement today of their retiring CFO, they’re now on a search for a new one. MTS benefitting from the rush to the toilet paper isle, a theme I don’t understand but plenty of others do. MTS is a recent addition to the income portfolio, pre-crisis however it held up well in the face current volatility. At the time, we sold Genworth (GMA) taking a +56% profit and put the funds into MTS, with the following rationale ….

The ugly duckling of the sector, although it is a different sort of proposition to Woollies and Coles. Metcash services around 1600 independently owned supermarkets dominated by the IGA and Foodland brands. They also service liquor along with hardware through Mitre 10 and Home Timber & Hardware. Trading on an Est P/E of just 11.8x although earnings are under pressure and expected to decline by low single digits out to FY22. The yield is more attractive at an estimated 5.22% fully franked with the obvious questions being, has the current valuation now priced in the projected earnings decline? MM is bullish MTS for income

Metcash (MTS) Chart

TPG Telecom (TPM) +9.56%: ACCC announced they would not block the merger with Vodafone Australia following the Federal Court’s ruling last month. In a blow to the competition watchdog, the Federal Court blasted the initial ruling by Rod Sims and ACCC saying that the merger will in fact increase competition in key mobile markets in Australia.

It was widely expected that decision would be appealed however it seems the judge was so scathing that Rod was too embarrassed to face the Court again, instead offering to pay the legal fees (on behalf of taxpayers)! The merger will result in a proper challenger to the big telco hitters – Vodafone’s mobile offering to be enhanced with more coverage while TPG will continue to build out their home line and internet products. On a side note, Washington H Soul Patts (SOL) is a beneficiary of the deal in owning around a quarter of TPG.

TPG Telecom (TPM) Chart

BROKER MOVES; Platforms like HUB are under pressure from weaker mkts – all things being equal, they’ve taken a 10% hit to revenue this month

· Aerometrex Rated New Add at Morgans Financial Limited

· Newcrest Raised to Hold at Blue Ocean; PT A$27.50

· Acrow Formwork Raised to Buy at Bell Potter

· Breville Raised to Buy at UBS; PT A$22.70

· Woodside Raised to Outperform at Macquarie; PT A$33

· Bank of Queensland Raised to Buy at Morningstar

· CSR Raised to Hold at Morningstar

· IOOF Holdings Raised to Buy at Morningstar

· Bendigo & Adelaide Raised to Buy at Morningstar

· Perpetual Raised to Buy at Morningstar

· Ramsay Health Raised to Hold at Morningstar

· Pendal Group Raised to Buy at Morningstar

· Platinum Asset Raised to Buy at Morningstar

· Treasury Wine Raised to Buy at Morningstar

· Coles Group Raised to Overweight at JPMorgan; PT A$16.75

· South32 Raised to Outperform at Exane; PT A$2.76

· Hub24 Cut to Neutral at Evans & Partners Pty Ltd; PT A$12.60

· GPT Group Raised to Buy at Goldman; PT A$5.97

· WiseTech Raised to Hold at Bell Potter; PT A$16

· Computershare Cut to Neutral at Evans & Partners Pty Ltd

OUR CALLS

To changes today – we sat tight for now on PDL and PGH, although they remain in our sights.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.