The ASX gives back recent outperformance while ANZ downgrades (IVC, ANZ, MYO, AWC)

WHAT MATTERED TODAY

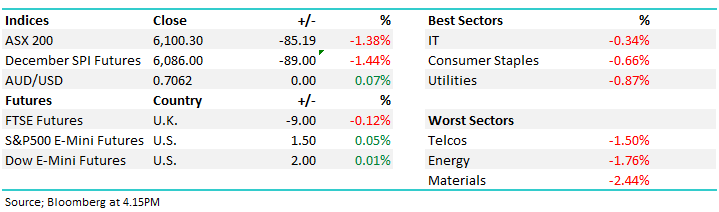

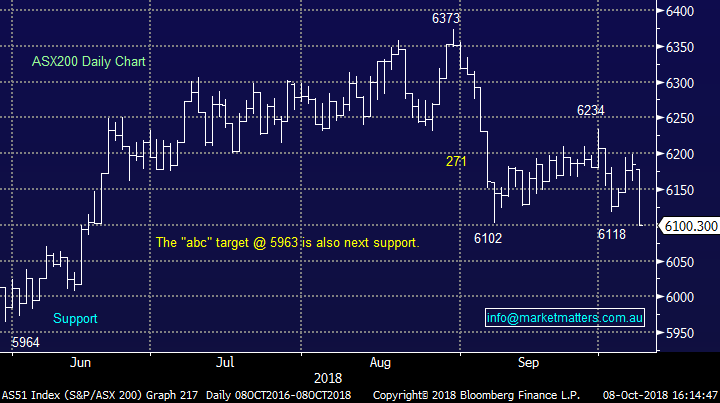

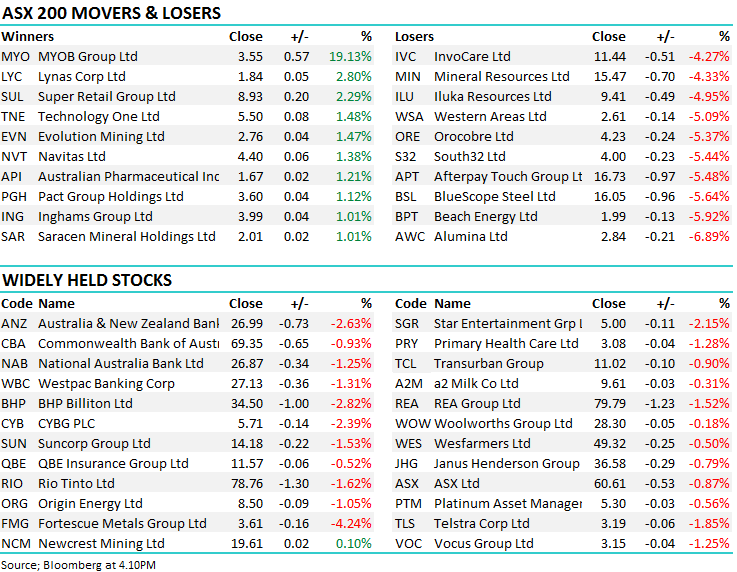

BANG, stocks hit -85pts today following the weak US markets down the slide. Commodities saw most selling while the Energy names dropped out of favour. Selling was persistent and aggressive throughout the day likely signalling there is more to come - the index closed at its lowest point since June and on the lows of the day. A BIG line on the sell side went through in the last 10 mins + local futures are trading down another 12points at time of writing.

No sector managed a positive day today, but the tech sector had the most muted losses – thanks to a takeover bid for MYOB from private equity. On the other end, materials and energy were hit the worst. The big 4 took 17.4pts off the ASX 200, while BHP’s -2.82% loss was worth -10.3 points.

Alumina (AWC) & South 32 (S32) gave back last week’s gains following the announcement the Brazilian Government granted Norsk Hydro a permit to resume operations using technology that reduces the need for runoff water that created the problem in the first place. We wrote about the shut down last week here. Below we discuss the ANZ & InvoCare downgrades, along with the MYOB takeover offer.

Overall, an interesting day with the index down 85 points or -1.38% today to 6100. Dow Futures are currently trading more or less flat, Hang Seng (Hong Kong Futures) are down -0.2%/55pts.

ASX 200 Chart

ASX 200 Chart – Bang, the market wakes from its slumber

CATCHING OUR EYE

Broker Moves; Some conflicting views (not uncommon!!) with Morgan Stanley putting out a bullish note on Australian Resources supported largely by China’s stimulus in reaction to its trade dispute with the U.S. as well as stronger oil prices. They name RIO and Santos as two preferred picks. On the flipside, JP Morgan have cut their ratings on Woodside and Senex.

RATINGS CHANGES:

· Woodside Downgraded to Underweight at JPMorgan; PT A$37

· Senex Downgraded to Underweight at JPMorgan; PT A$0.47

· CYBG Rated New Sell at SocGen; PT 2.90 Pounds

InvoCare (IVC) $11.44 / -4.27%; Funeral home operator InvoCare warned the market about weaker than expected trends so far this year, saying that… In August, IVC reported that the funeral case volume for H1 (in the markets it operates in within Australia) had been soft (down 1.5% in Q2) and that if this situation continued in H2, it would negatively impact full year results. In simple terms, IVC saying that there has not been the volume of deaths they had forecasted, which is clearly good for some, but not so for IVC. A mild winter and an effective flu vaccine contributing to the falling number of deaths, down 5.9% between June & August.

The company went on to say that market share has been growing, working to offset some of the fall in deaths. Currently they’re looking at a $17m fall in revenue, as well as falling margins while “IVC is managing its cost base to mitigate the impact of those factors on its result.”

InvoCare (IVC) Chart

ANZ $26.99/ -2.63%; There’s just a few weeks before three of the big four rule off their financial year, and today we got our second look at how the Royal Commission has impacted the banks. This morning ANZ announced;

A total of $711M in after-tax expenses and revenue reduction for 2H18 which comprised of:

1. $213M for refunds to customers and related remediation costs;

2. $161M for the cost of the program to determine the customer remediation payments;

3. $206M for software write-offs associated with the sale of international businesses. Since those businesses will no longer provide revenue to ANZ, related software costs need to be expensed immediately;

4. $104M relating to redundancy and other costs associated with agile working; and

5. $27M directly relating to the Royal Commission.

While not all charges are associated with the Royal Commission, a total of $374m will go to compensation of customers for breaches highlighted in the commission, $127m to issues within the wealth division sold to IOOF last year, and $310m goes to software and technology amortisation and upgrades with the remainder used for external legal costs.

The figure is more than double Westpac’s flagged $235m charge for compensation and highlights the need for compliance technology upgrades to ensure the banks stay in front of the fired up ASIC, as well as the margin squeeze that is happening as a result of misconduct.

ANZ Chart

MYOB (MYO) $3.55 / +19.13%; The accounting software company jumped on news that private equity company KKR purchased a further 17.6% stake from private equity firm Bain Capital and lobbed a bid for the remaining shares on issue at $3.70. KKR is now the biggest shareholder in MYOB with 19.9% of shares on issue and the bid represents a 24% premium to Friday’s close price of $2.98. Interestingly, the Bain Capital holding was originally placed through an auction of the company that KKR also bid for back in 2011.

The MYOB share price has come under pressure over the past 12 months, falling 22% from its high back in November 2017 to Friday’s close, in contrast, competitor XRO rose 55% over the same time period. Missed growth targets and a failed takeover of competitor Reckon caused the market to turn negative MYO while short sellers attacked the stock. Now KKR wasn’t to revamp the company, whilst also using the current management team to set a strategy before the takeover is finalised. The stock closed 4.23% below the bid price.

MYOB (MYO) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 8/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.