The ASX continues to drift (XRO, NUF, STO, BPT, WTC)

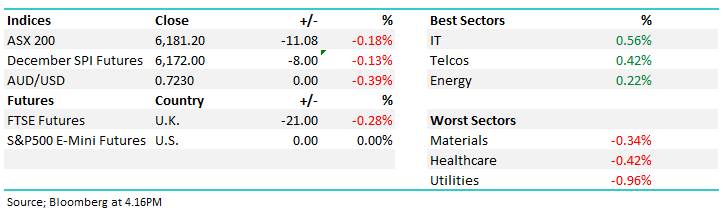

WHAT MATTERED TODAY

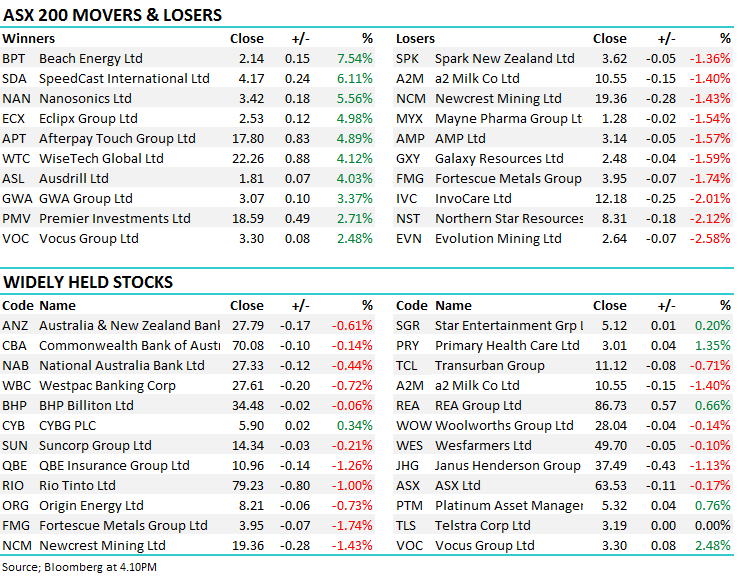

The local market didn’t have the fall many were probably expecting post the US Fed rate meeting this morning which saw the 3 US indices turn lower. The ASX200 did see some weakness in the morning but recovered and hovered in and out of positive territory for the rest of the day. Banks took a hit again as the market prepares for the Royal Commission’s interim report due out before Sunday – rumours suggest it will be handed in at 11AM tomorrow.

Energy ticked higher again, Beach Energy in particular added 7.54% while holding their annual investor day. The stock reached a high of $2.23, once more setting fresh all-time highs it has made over the past 3 trading sessions. Santos was up 1.1% with some interesting research out of Bernstein which concluded the company would be able generate $13b out to 2025 in cash flow with an oil price of $65/bbl allowing it to reduce gearing and still pay dividends. Although the analysis uses a conservative oil figure well below today’s prices, it remains near impossible to predict what Santos will deliver given the volatility in energy prices – we wrote about Santos in yesterday’s report here.

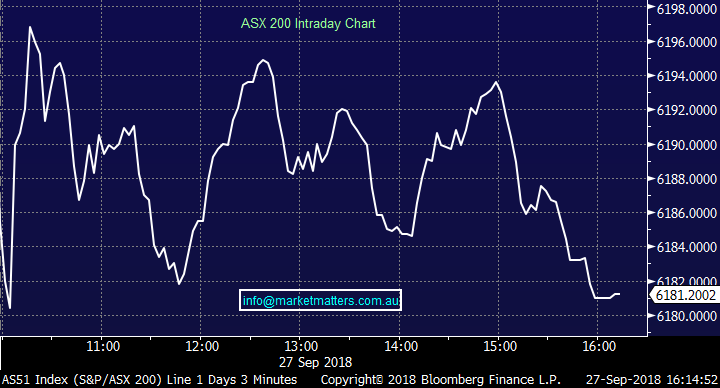

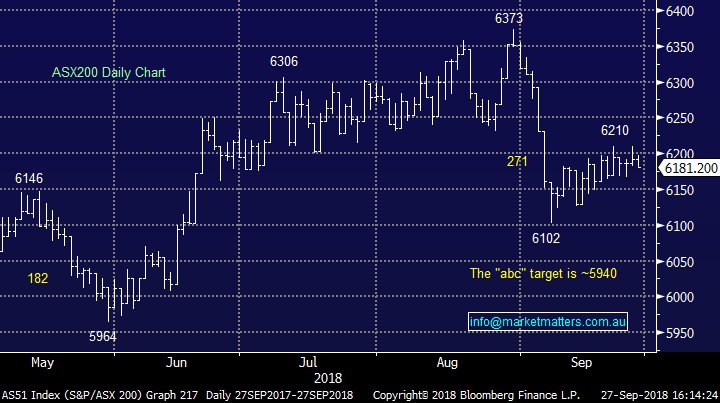

Today’s close of 6181 now represents the 16th trading day the local bourse has closed within an incredibly tight 66 point / 1.1% range with the lowest close of 6128 on the 6th of September, and the highest at 6194 on the 21st. After such a volatile start to September, any direction in the market has dried up with just 1 trading day left in the month. Within this period however, we have seen RIO jump 12.7%, Santos is up nearly 10%, but Sydney Airports fall over -6% and CSL nearly -7% - so although there doesn’t appear to be too much happening on the surface, there is clearly some sector rotation happening underneath. We expect the market to breakout soon – our view is that it will happen to the downside and the index will slide once again.

Overall, the index closed down -11 points or -0.18% today to 6181. Dow Futures are currently trading flat.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; A quite day on the broker front – plenty of notes out about the Nufarm results yesterday and raise which was announced on Tuesday. The analysts are broadly neutral to positive NUF with not one analysts having a sell on the stock and their first glance look at the situation is broadly positive with most keeping their recommendation but lowering targets. Plenty pondered the need for the company to raise capital just days before the result but kept the overweight, and now many are saying the raise to pay off debt will reduce the risks in the business and potentially see it re-rate. The stock remains in a trading halt, likely to return to the boards after the long weekend.

RATINGS CHANGES:

· Nufarm Downgraded to Hold at Morgans Financial; PT A$6.85

· Gentrack Rated New Outperform at Forsyth Barr; PT NZ$7.90

· GWA Group Upgraded to Buy at Wilsons; PT A$3.72

· Global Construction Rated New Buy at Hartleys Ltd; PT A$0.91

Wisetech (WTC) $22.26 / +4.12%; After a month of consolidation money is coming back into the tech space with both Wisetech and Afterpay seeing some good flow today - adding 4.12% and 4.89% respectively. These are clearly high growth momentum plays and from today's price action it seems the shorter term players are once again getting behind the sector. WTC looks particularly bullish after a period of consolidation while APT experienced a deeper pullback from its August highs, although it has raised around $100m in new equity during that period. Momentum players could buy WTC with stops below $20.00, which is okay risk/reward however we're overall cautious the growth stocks at this point in time.

Wisetech (WTC) Chart

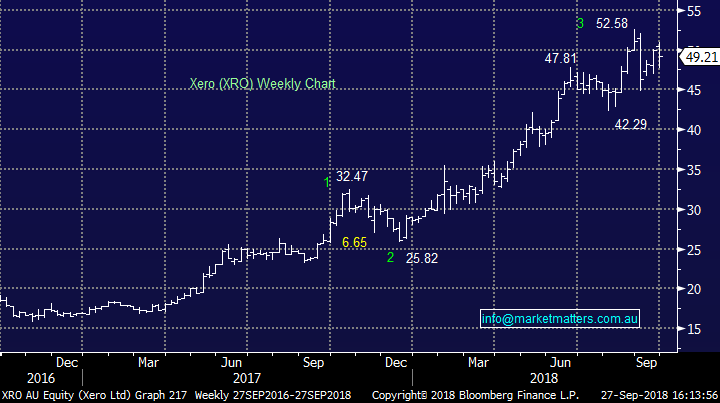

Xero (XRO) $49.21 / -0.97%; The accounting software company today announced they are raising $US 300m through a convertible notes offer, priced at an interest rate of 2.375% p.a. with an initial conversion exercise price 30% higher than the current share price. Although the deal doesn’t come with any specific references to how the capital will be used, it will likely help fund Xero’s continued acquisition hunt which has seen the company add a number of business in the past few years, including 2 in the past 12 months.

Shares are trading lower today likely a result of new note holders reducing their overall exposure to the company, but the agreed conversion price shows the markets faith in the company’s model and growth prospects. We like Xero’s product and trajectory but see risks in the growth and tech names with interest rates rising. Xero has locked in what looks like a good deal here, now we wait to see how the funds will be spent.

Xero (XRO) chart

OUR CALLS

No trades in the MM Portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.