The ASX bounces back into form with a century (GNC, MTS)

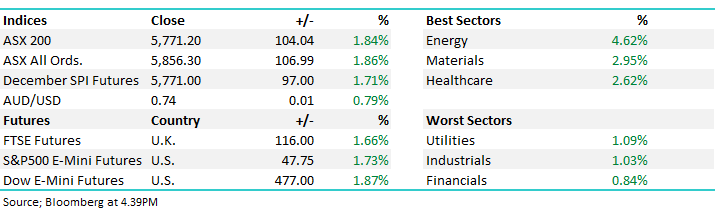

WHAT MATTERED TODAY

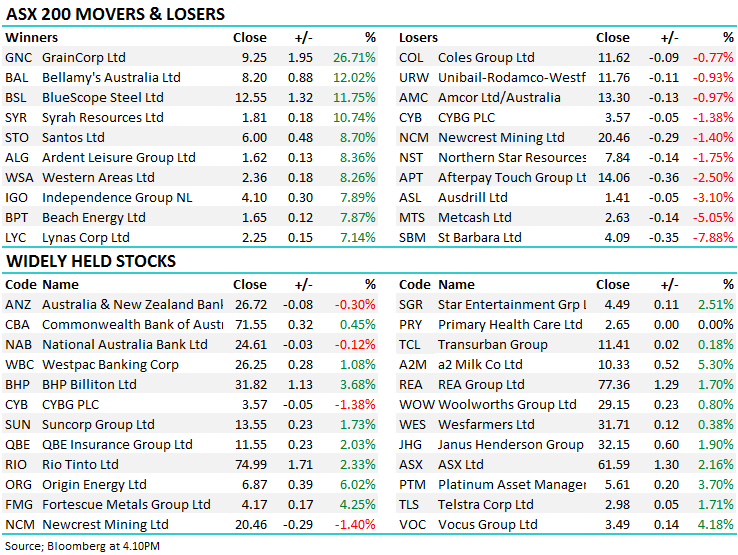

Summer is here, the cricket season is ramping up and the market has found some form managing a century in today's session. The G20 result sent investors into a buying frenzy today, and the local market managed to earn back all of Friday’s weakness plus change today. It was clear that the US-China talks had created a risk-on attitude as tech, resources (ex-gold) and energy names rallied the strongest, as well as anything with leverage into China. Some names of note – Bellamy’s (ASX: BAL) +12.02%, A2 Milk (ASX: A2M) +5.3% & Fortescue (ASX: FMG) +4.25%. Industrials & gold names lagged the market, even the relative safety of banks fell behind the markets strength. Despite the good news and the general market strength, volumes were noticeably lighter as it appears many in the market were positioned for some positive news to come out of the weekend and now expect the rally to continue.

At a stock specific level: Bluescope (ASX: BSL) jumped 11.75% today after announcing a new $250m buyback would be launched. The stock has come under pressure as steel demand slides thanks to fears about the local construction industry with many other comparables downgrading. Gold explorer St Barabara (ASX: SBM) suffered on the safety sell off, as well as a disappointing presentation the company gave in Papua New Guinea – no new news from the company there. Below we discuss the bid for Graincorp (ASX: GNC) as well as the soft outlook given by Metcash (ASX: MTS).

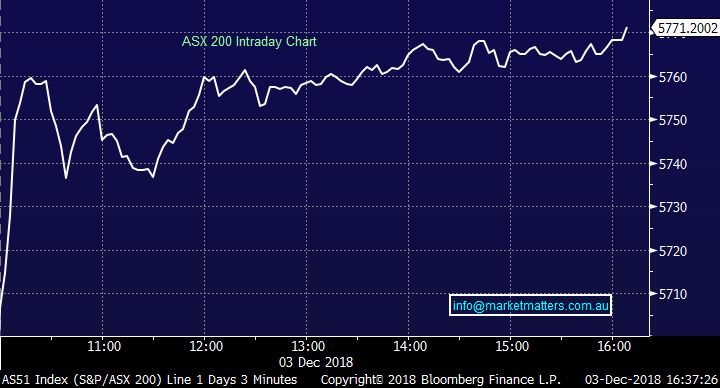

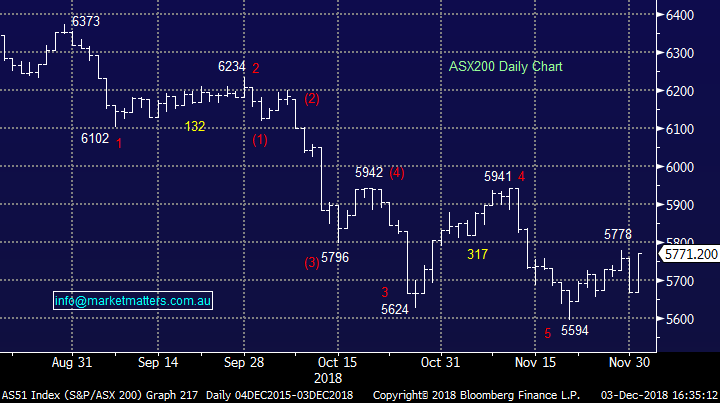

Overall, the ASX 200 closed up +104 points or +1.84% to 5771. Dow Futures are currently up 477 points or 1.87%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; A couple of upgrades to Coca-cola (ASX: CCL) coming through today following the socks AGM caused weakness on Friday. Both Deutsche and JP Morgan used to the dip to turn more neutral on the stock, however it was a note from Citi bank that caught the markets eye. Citi reiterated their sell rating citing continued delay’s to the company’s 5% EPS growth target – now at least 2 years away according to the analyst.

Coca-cola (ASX: CCL) Chart

RATINGS CHANGES:

· F&P Healthcare Downgraded to Sell at Goldman

· NAB Downgraded to Hold at Bell Potter; PT A$26.50

· Westpac Upgraded to Buy at Bell Potter; Price Target A$28.50

· CBA Downgraded to Hold at Bell Potter; PT A$76

· Coca-Cola Amatil Raised to Hold at Deutsche Bank; PT Set to A$8

· Coca-Cola Amatil Upgraded to Neutral at JPMorgan; PT A$8.50

Metcash (ASX: MTS) $2.63 / -5.05%; The supermarket & hardware name Metcash has slumped today following soft outlook statements despite a reasonable half result which saw profit grow by 3%. Metcash grew sales in the grocery, liquor & hardware businesses, with hardware EBIT growing 34% thanks to further synergies from the Home Timber & Hardware acquisition completed in 2017.

Despite the solid growth, the company has put a dampener on this momentum continuing by downplaying expectations. Hardware is expected to be impacted by a falling housing market, dragging on the home improvement sales that has driven much of this areas growth. The company also noted the food market continues to see increased competition which is ultimately squeezing margins for the wholesaler. Liquor is the one area expected to push on, with the company pointing to the ‘premiumisation’ of the market helping drive sales. Despite this, liquor was the one are that saw EBIT fall over the first half as costs crept higher.

It’s a business we like, although today’s comments validate why we aren’t holding a position in Metcash. Competition is only increasing in the supermarket space, which will squeeze Metcash. Both Coles (ASX: COL) & Woolworths (ASX:WOW) have shown their intentions to push more into the convenience grocery space which will only amplify this issue for Metcash. Couple that with the housing slow down impacting the other side of the business and it makes it hard to own Metcash yet.

Metcash (ASX: MTS) Chart

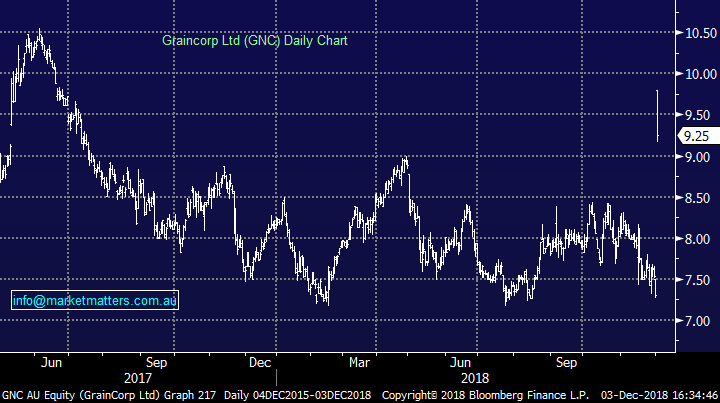

Graincorp (ASX: GNC) $9.25 / +26.71%; the grain supplier was easily best performer for the top 200 today after receiving a sizable all cash takeover offer from suitor Long-Term Asset Partners (LTAP). The offer at $2.4b works out to be $10.42/share, a huge 42.7% premium to Friday’s close. Graincorp closed at a 11.2% discount to the offer highlighting the markets scepticism. The stock has been weak this year with the drought and general poor performance dragging on the stock, which was trading almost 20% below its 52-week high as of last night.

The board of GNC is also yet to support the bid with, urging shareholders to sit on their hands at this stage. It is a big premium, and the suitors look keen to warp this up so it is certainly one to keep an eye on.

Grancorp (ASX: GNC) Chart

OUR CALLS

No changes today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 3/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.