That’s a wrap! A volatile week ends on a positive note

WHAT MATTERED TODAY

The week started on the back foot with the market getting hit early thanks largely to weakness coming from overseas, however it was obvious even on those days of weakness, that the mood towards our influential financial stocks was starting to change. Banks and the broader financial space are such an important component of the ASX 200 – the biggest sector by a multiple of nearly 2x – when they fire, our market does well which was the case at the latter part of this week.

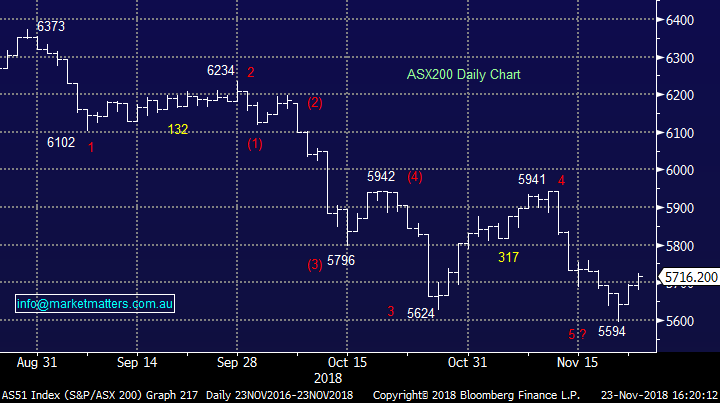

On Wednesday morning, following Dow’s 551pt fall we went out on a limb suggesting that we continue believe the ASX200 is looking for a low before a decent rally into Christmas. The strong recovery yesterday from around 2.30pm adds weight from a technical perspective i.e. the downside momentum is declining as we approach the major 5600 support area. We believe buying this current weakness will pay dividends into 2019 but perhaps not too far beyond.

On Wednesday the market traded down to a 5994 low before a strong recover played out closing today at 5724. While a few positive days doesn’t necessarily create a trend, we do like the technical picture that has played out this week, and overall, I think there’s a good chance we may have now seen the finale of Novembers selling - time will certainly tell.

We have been active in our Growth Portfolio this week particularly in the ‘growth’ area of the market committing almost 10% of the portfolio to the high growth / valuation stocks, a sector we have generally avoided for the last 6-months. Hopefully the catch cry will soon be “all aboard the Christmas rally” we are certainly now positioned for one. Standing back for a moment of reflection on a Friday afternoon following a busy week, it’s important to comprehend our expectations for the ASX200 into 2019, and beyond. The below chart was included last weekend, and outlined our anticipated path forward – that view still holdings and we’re now tracking along the green arrow.

ASX200 Chart

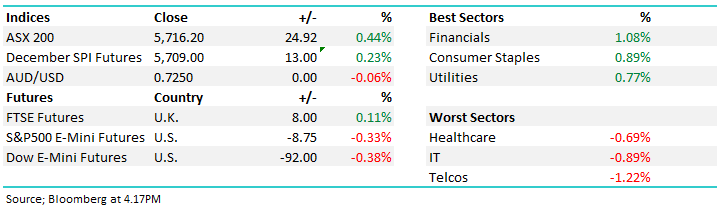

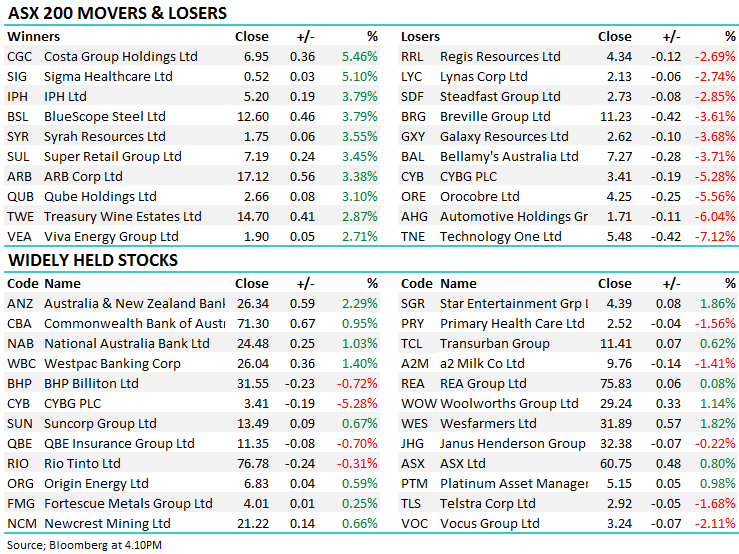

Today the market was solid, although quiet given the US was off for Thanksgiving. Financials were strong while we’re seeing some of the heat come out of the more defensive telco’s.

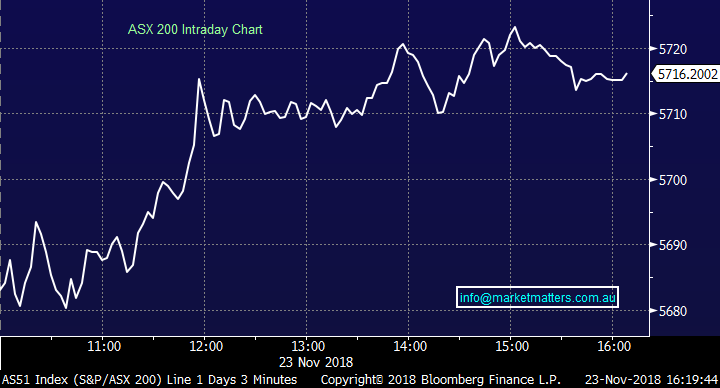

Overall, the index closed up +25 points or +0.44% today to 5716 and was down -0.25% on the week. Dow Futures are trading down 87 points / -0.36%.

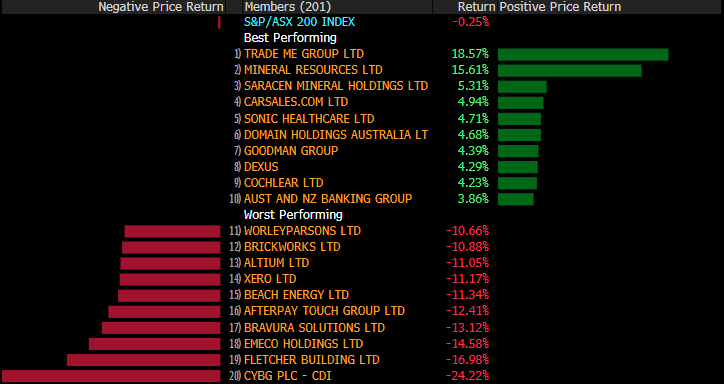

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; A positive note to end the week on with Citi Analyst Tony Brennan calling for the market to be at 6500 in 2019….implying ~14% upside from current levels

RATINGS CHANGES:

· Coles Group Rated New Underperform at Credit Suisse; PT A$12.33

· Coles Group Rated New Buy at Citi; PT A$14.70

· Coles Group Rated New Buy at Goldman; PT A$14.80

· ARB Upgraded to Buy at Citi; PT A$19.58

· Wesfarmers Downgraded to Sell at Citi; PT A$29.20

· Wesfarmers Upgraded to Outperform at Credit Suisse; PT A$34.07

· Mineral Resources Raised to Buy at Deutsche Bank; PT A$18.50

· Costa Upgraded to Outperform at Macquarie; PT A$7.60

· Evolution Mining Downgraded to Neutral at Macquarie; PT A$3.10

· Stride Property Cut to Neutral at First NZ Capital; PT NZ$1.92

· Domino’s Pizza Enterprises Upgraded to Buy at Morningstar

· Sonic Healthcare Upgraded to Neutral at Credit Suisse; PT A$23

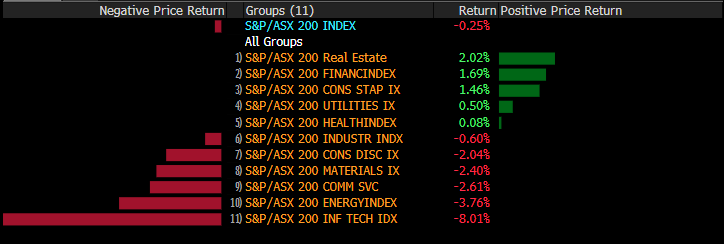

Sectors this week; A week of two halves with the 0.25% drop on the index overall a poor reflection of the actual underlying volatility. We were certainly kept on our toes this week!

Stocks this week; Corporate activity underpinned the top performers while CYBG delivered an ‘stinking’ set of numbers

During the week we covered a diverse range of topics in our notes, with a number of actionable insights…

Viva Energy (ASX: VEA): the biggest IPO of the year kicked off the week with a downgrade as the share price languishes will below the listing price. The owner of a number of Shell petrol stations has struggled with rising petrol prices impacting retail sales, while margins & a power outage at its Geelong refinery added to the companies woes. Read More.

Coles (ASX: COL) goes it alone, is it worth a look; On Wednesday, Coles restarted life as its own listed entity after demerging from Wesfarmers (ASX: WES). We discussed the move in this week’s income report here. The proposition is interesting, and demergers of recent times have had mixed results, but ultimately it’s hard to like Coles with distribution upgrades being carried out and further competition to enter the Australian market.

Clydesdale Bank (ASX: CYB) crashes; speaking of demerges, the old UK arm of NAB, now its own listed entity CYBG took a huge hit this week after announcing their FY18 results. There was a number of issues with the numbers, in particular was a lack of growth and some funky accounting hiding eh true cost base within the bank. The stock closed today almost 24% below the pre-result close on Tuesday. Read More.

Fletcher Building (ASX: FBU) lowers guidance; there seems to some issues in the construction and engineering industry at the moment, with a number of names guiding poorly, or outright downgrades like LendLease (ASX: LLC) for example. Read More

Retail land saw a couple of takeovers and an upgrade; it’s been a long time since there was positive action for retail, but this week saw dual takeover bids for The Reject Shop (ASX: TRS) & Trade Me (ASX: TME). Here’s what we had to say at the time. Women’s fashion retailer Noni B also upgraded guidance, and added a nice buyback today which saw the stock rally, recovering some of the losses of the financial year to date. Read More.

OUR CALLS

No changes the portfolios today.

Watch out for the weekend report. Have a great night,

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.