Temple & Webster (TPW) share price falls despite impressive performance

Temple & Webster (TPW) -17.18%

Market darling gave back all of its impressive October performance today as the AGM failed to light up investor expectations. The comments from the CEO were outstanding – Revenue up 138% for the period to 19 October, EBITDA for the first quarter at $8.6m already ahead of the whole of FY20, contribution margins above 15% and October comping at greater than 100%. The comments have a similar tone to those made at the full year result back in July where the company flagged a quick start to the year.

The market had extrapolated these comments to mean that growth on growth would accelerate through the year – and while there is no real sign growth has slowed, it hasn’t picked up pace either. At yesterday’s close, the market cap of TPW was over $1.6b, a big number for a company on an EBITDA run rate of $34.4m based on the first quarter. The move today screens poorly ahead of first trade for two online retail comps in the coming days – MyDeals listing tomorrow, and Adore Beauty (ABY) hitting the boards on Friday.

Still though, these both raised cash in the IPO at considerable discounts to the lofty multiples TPW traded at today despite the drop. All in all, it seems TPW was simply a crowded trade, no upgrades and the stock gets sold. There’ll be a place to step up and buy this, but not yet.

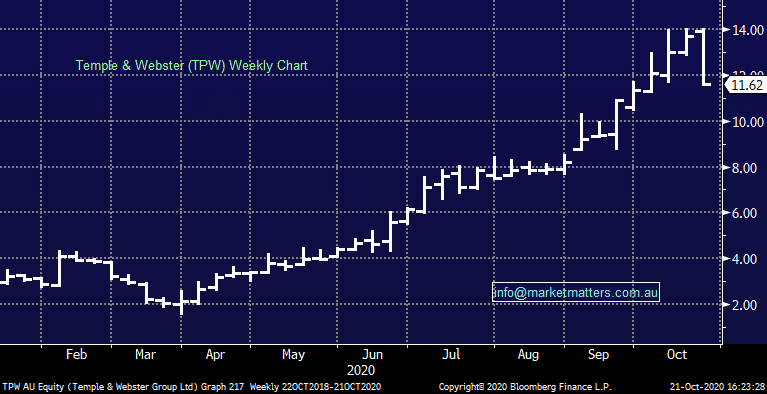

Temple & Webster (TPW) Chart