Telstra rallies as TPG walks away building their own network (TLS, TPM, ECX, RMD, CCL)

WHAT MATTERED TODAY

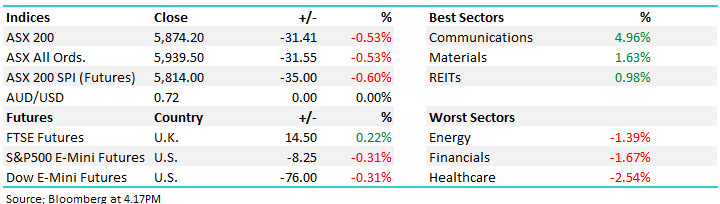

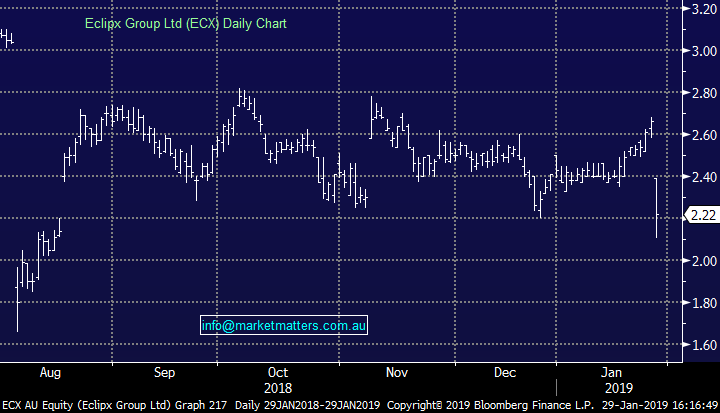

The ASX 200 came off the boil today with the index now looking set for a more protracted pullback into the ~5750 region or ~4% lower. After a reasonable open considering the weakness overseas, selling towards the banks ticked up and the market grinded down into a lunchtime low. Business conditions were weak in December according to the NAB survey - the results showing the steepest monthly fall since the GFC with retail being the worst-performing industry. The declines were "broad-based" and across every state and industry according to NAB with Retail remaining the weakest link.

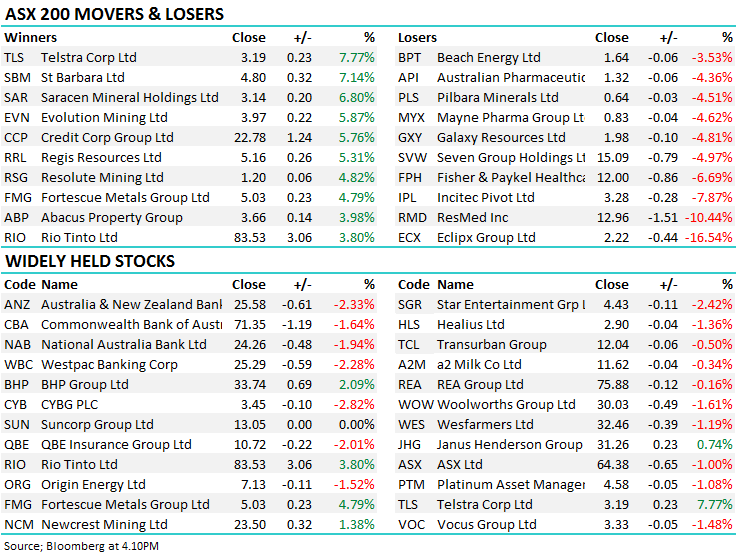

While that was a clear negative there was divergent performances across the bourse today with Telstra (ASX: TLS) rallying more than 7.77% to top the leader board of the ASX 200 – pretty rare event in recent times + its highest close since early October on more than 5x the usual daily volume after TPG said they’ll walk away from the planned 5G roll out – more on that below, while Resmed (ASX:RMD) fell another ~10% after some harsh broker downgrades this morning, the stock closing today at $12.96 down from $16.45 towards the end of last week.

The Iron Ore names got a boost today thanks to strength in the Iron Ore price, Fortescue Metals (ASX:FMG) the standout adding +4.79% to close at $5.03 after hitting a morning high of $5.12. While the recent news flow is bullish for Iron Ore Miners, selling strength remains our mantra and today we had the opportunity to remove FMG from the Income Portfolio for a ~20% profit around $5.10

Reporting kicks off in Australia now, although really heats up next week – click here to see full reporting Calendar. I’ll be on Your Money at 9am Tuesday to Friday for all of Feb providing insight on results as they drop – Foxtel Channel 601 and free to air channel 95. Quarterly reporting is underway in the US with 105 S&P 500 companies already reporting results. 72% have beaten expectations which is down on the average of 78%. APPLE out tonight which will be keenly watched. Consensus here for those interested

APPLE Consensus…Q1 2019 the row to look at

Overall, the ASX 200 closed down -31points or -0.53% to 58574. Dow Futures are currently trading down 76pts

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Macquarie have gone more defensive across their Australian Equity Strategy increasing exposures to more defensive style yield investments (REIT’s & Infrastructure) while they’ve cut mining to underweight. They increased weightings towards CBA, WBC, ANZ, GMG, RHC, AZJ & ORG while they added positions in QBE, GPT, MGR, TAH, LNK, COL, TCL & ALX. On the flipside, they cut JHG, IFL (ouch!), URM, LLC, OML, QAN, DOW, BLD, WOR, AWC, MIN and reduces WES, ALL, OSH, BHP & RIO.

ELSEWHERE:

· Contact Energy Downgraded to Neutral at Forsyth Barr; PT NZ$6.10

· Wesfarmers Downgraded to Sell at Morningstar

· Incitec Downgraded to Sell at Morningstar

· Mirvac Group Downgraded to Sell at Morningstar

· G8 Education Downgraded to Sell at Wilsons; PT A$2.53

· SkyCity Entertainment Downgraded to Hold at Morningstar

· NextDC Rated New Overweight at JPMorgan; PT A$8

· BHP Upgraded to Buy at Jefferies; PT A$38

· BHP Group PLC ADRs Upgraded to Buy at Jefferies; PT $47

· Fortescue Upgraded to Buy at Jefferies; PT A$5.50

· AMP Downgraded to Equal-weight at Morgan Stanley; PT A$2.50

· Iluka Upgraded to Outperform at Macquarie; PT A$9.10

· Galaxy Resources Downgraded to Neutral at Macquarie; PT A$2.20

· Sims Metal Downgraded to Neutral at Goldman; PT A$10.46

Platform Providers; The disrupters include Netwealth (ASX:NWL) , Onevue (ASX; OVH) , Praemium (ASX: PPS) & HUB24 (ASX: HUB) and they were all hit hard today after MLC cut admin fees across their platform. This is going to be an ongoing trend across the industry in the post royal commission world. While the new kids have experienced strong growth the incumbents will ultimately fight back, and that’s starting – we remain negative on platform providers overall given as the race to the bottom begins…

Praemium (ASX:PPS) Chart

Resmed (ASX:RMD) $12.96 / -10.44%; was sold off aggressively again today taking its 2 day decline to around 20% following a weak earnings result and some downbeat commentary from management. We stepped up and bought RMD today, allocating 3% of the MM Portfolio around $13.00. A couple of things to think about; RMD has fallen 20% in 2 days on the back of a miss to earnings and a muted outlook. The miss to earnings (and outlook) were a fraction of what the share price implies however we’ve obviously seen a big PE re-rate down for a stock that was incredibly well owned. RMD is now trading at a 10% discount to its 2 year average PE of 26.5x – which is understandable given 1) the miss 2) how well owned it is 3) the trend that most stocks simply get sin binned for a few months after a miss to earnings and a muted outlook. The concern of more downgrades will linger.

Without going into too much detail on the miss, the earnings were better due to strong margins however top line sales were weaker and that’s what the market is concerned about. Slower growth in a growth business = PE re-rate which we’ve clearly seen in the last 2 days. Morgan’s research on RMD is typically bullish and they have retained the rage on the stock, only downgrading earnings by ~3.5% however Macquarie and JP Morgan have turned bearish after the update and that combined call seems to have driven a big decline in the stock today. Macquarie though only downgraded EPS down by ~5% and cut PT to $13.70 while JP was more cautious particularly around 2H earnings.

Broker Calls – Resmed (ASX:RMD)

Ultimately, while it was a weak result in a stock that is well owned, the sell-off is excessive in our view, and the weakness today has prompted us to buy the stock, with an initial 3% weighting with room to move to 5% in time.

Resmed (ASX:RMD) Chart

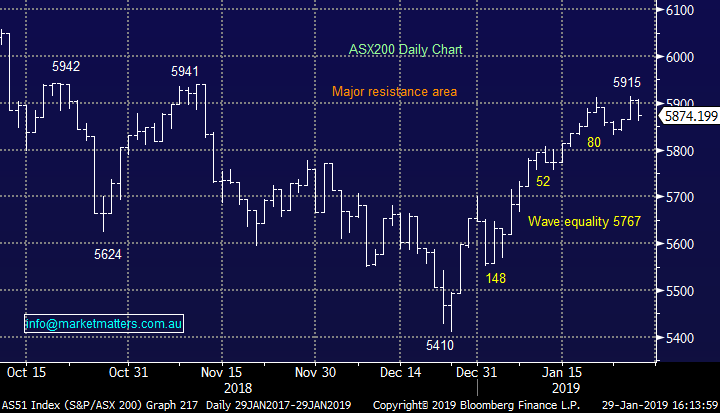

Credit Corp (ASX: CCP) $22.78 / +5.78%; Debt collector Credit Corp performed well today following the release of their first half numbers this morning. The company printed a profit number of $33.6m, which was in line with expectations, but surprised the market with an upgrade to full year guidance.

They revised full year guidance to $69-70m NPAT, around the same level as consensus, but higher than the previously guided $67-69m. Credit Corp noted much of the growth has been driven by US debt buying which has seen substantial growth since FY15 and is expected to add ~$5m to NPAT in FY19, exceeding expectations. Locally, the ANZ “debt buying segment sustained near-record collections.” We don’t see a catalyst that will see CCP trade outside its ~$16-$24 trading range at this stage.

Credit Corp (ASX: CCP) Chart

TPG Telecom Limited (ASX: TPM) $7.17 / +3.02% & Telstra (ASX: TLS) $3.19 / +7.77%; TPG surprised the market this morning announcing they would cease the roll out of their planned Australian mobile network which has caused the telco sector to jump today. The announcement from TPG comes following the Australian Government’s ban on using equipment from Chinese company Huawei on security grounds. TPG had spent $100m of a planned $600m on Huawei products before halting construction of the network when the ban was originally announced back in August 2018, as well as around $1.5b on investment in spectrum since 2017.

Telstra (ASX: TLS) Chart

Vodafone Australia & TPG still remain in merger talks, with the proposal currently being reviewed by the ACCC. The competition watchdog did raise some reservations for the merger last year however we doubt they will ultimately have a problem with the deal. Vodafone-Hutchinson (ASX: HTA), which has a 50% stake in Vodafone Australia, was set to be the biggest beneficiary of TPG’s new network as it would vastly improve their coverage.

TPG Telecom (ASX: TPM) Chart

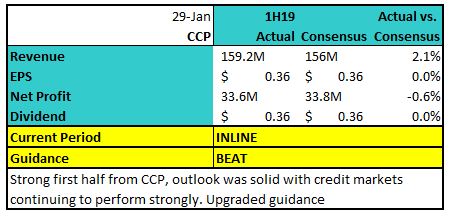

Eclipx (ASX:ECX) $2.22 / -16.54%; stock got hit today on weaker than expected earnings guidance but probably more importantly on concern that MMS may walk away from the proposed merger with the group. Here’s what they said today, sounds like they’re getting cold feet to me… “MMS has made, and Eclipx has responded to, extensive information requests in relation to the Eclipx FY19 year to date financial performance, outlook expectations and other matters. Eclipx has sought confirmation from MMS as to whether it intends to proceed in accordance with the scheme timetable. In response to this, MMS has advised that it intends to fully comply with its obligations under the SIA but needs time to consider next steps, including appropriate disclosure, additional risks and any impact on the future Combined Group, and scheme timetable, and has reserved its rights.”

Eclipx (ASX: ECX) Chart

OUR CALLS

Growth Portfolio; We sold our 5% position in the Emerging Markets ETF (ASX:IEM) for a small profit and bought Resmed (ASX:RMD) into weakness with a 3% allocation. Cash increased by 2% and now sits at 22%

Income Portfolio: We removed our 5% position in Fortescue Metals (ASX:FMG) and our 5% position in Nick Scali (ASX:NCK) today, both for a profit. Cash increased to 24.5%.

Clearly, we are now more cautiously positioned in both portfolios looking for a pullback in the market and / or opportunities through reporting season.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.