Telstra (ASX: TLS) divi cut again

Stock

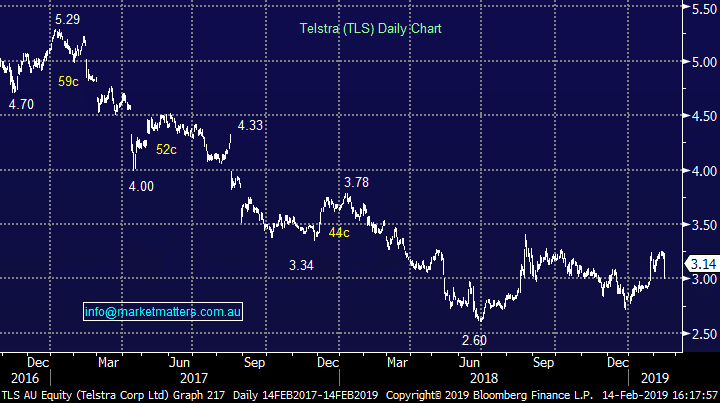

Telstra (ASX: TLS) $3.14 as at 14/02/2019

Event

Australia’s biggest telco announced its first half results today showing a substantial decline in earnings compared to the prior year as the NBN continues to erode Telstra’s earnings. We reviewed the stock last year here.

For the 6 months, net profit was $1.2b, down over 25% from the first half of 2018, while revenue saw a more muted fall of ~2% to $12.6b in the half. Despite the sizable fall on the previous year’s first half, the results are broadly in line with guidance, and with what the market was expecting.

The one big change to this result was the lack dividend guidance heading in. Telstra was known as the yield king for a long time, which soon turned into a yield trap that say many dividend and franking chasing investors burn plenty of capital in the stock. For the first time in a while, dividend guidance was not given to the market 6 month earlier. Telstra announced an 8c div, comprising of 5c interim and a 3c special, that was down from the 11c first half div from last year and missed the market’s expectations.

As DPS falls, so too does TLS as the market prices the stock based on the income. The implied 16c full year DPS had TLS on a sub 5% yield as at yesterday’s close price – not enough for the income investors and the reason for much of the stocks fall today. At $3.14, TLS moves to a 5.1% FF yield, more palatable for the investor.

Telstra (ASX: TLS) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook