Why Suncorp (SUN) shares are down today

Stock

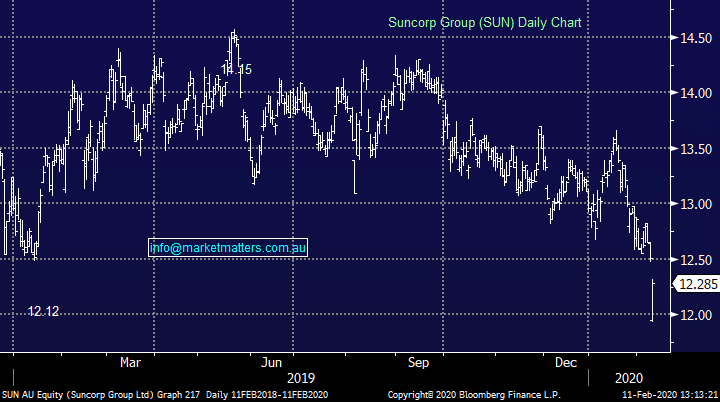

Suncorp (SUN) $12.28 as at 11/02/2020

Event

Following on from their recent update on insurance claims, Suncorp has today released their half year results which have missed the mark. Shares are trading around 2% lower today to be one of the worst performing stocks in the ASX200 which is trading strongly higher.

1st half NPAT more than doubled to $642m, however this included a large realized gain on the sales of Capital SMART & ACM Parts and as a result, cash earnings were 13% below consensus at $365m. The miss reflects poor performance across the business, not just within the insurance arm.

Starting with insurance though, profit after tax fell 4% to $123m on the back of strong claims despite gross written premiums rising 1.9%. Natural hazard claims were $104m above allowance in the half to $489m. The NZ arm was hit harder, with PAT falling 10% vs the 1st half 19, with claims rising a whopping 16.8%.

Even the banking & wealth arm took a hit to profit, falling 6.6% to $171m in the half. While NIM was higher to 1.92%, operating expenses climbed 5.9% and lending fell 1.4%. Ultra-low bad debts propped up some of the costs squeeze however it wasn’t enough to save the bank.

Suncorp (SUN) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook