Suncorp & Magellan smash expectations (SUN, MFG)

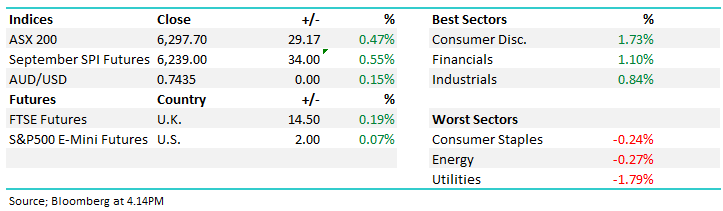

WHAT MATTERED TODAY

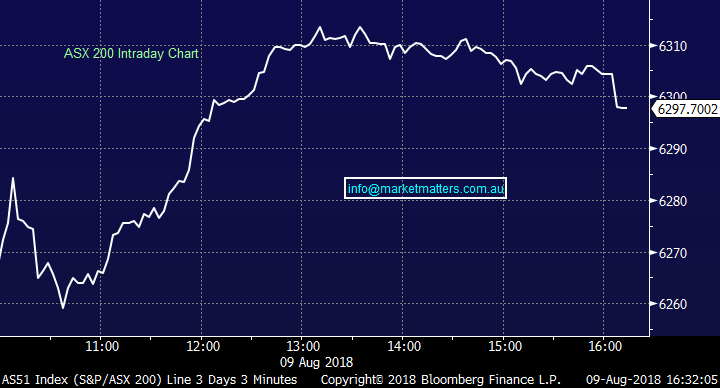

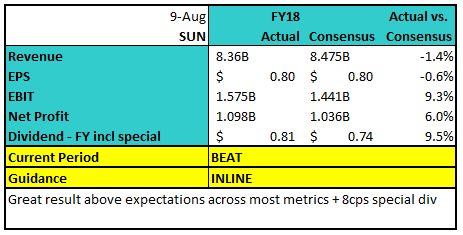

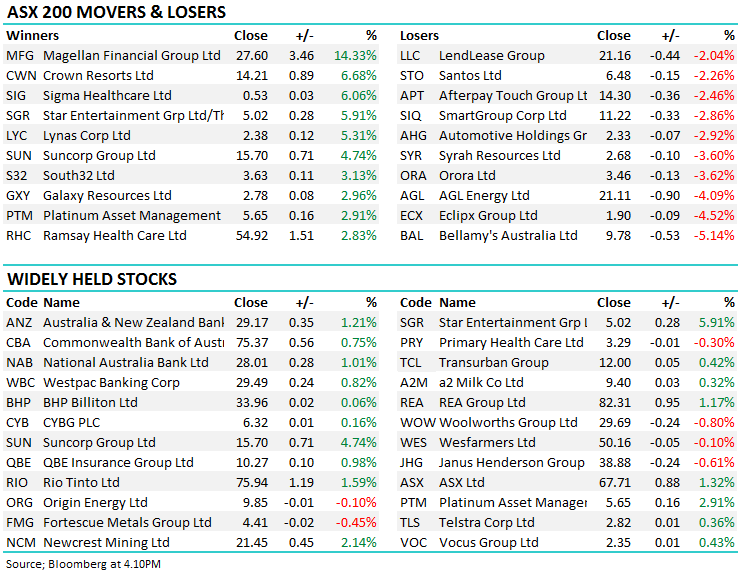

A more bullish session played out today than was foreshadowed by overseas markets while our own SPI Futures were very muted this morning, however follow through buying from yesterday’s better than expected result out of CBA plus some support from the other banks helped the index track higher throughout the session. Suncorp (SUN) obviously helped today after delivering a cracker FY18 result with a ~5% beat in terms of profit and a surprise 8cps special dividend – more on that result below with the stock ending the session 4.74% higher at $15.70

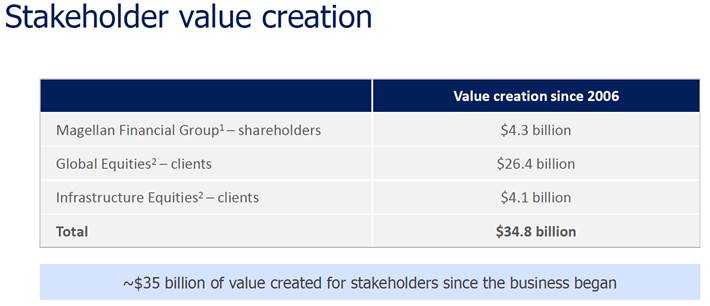

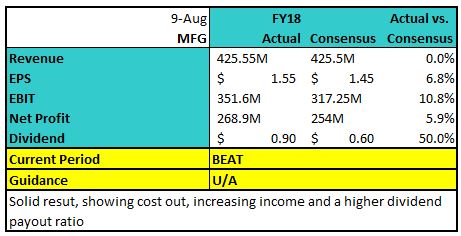

Elsewhere, Magellan (MFG) had a great session adding 14% after they announced a sensational set of full year results, topping expectations by a meaningful margin largely on a reduction in costs while they also amended their dividend policy and will now distribute the bulk of their earnings back to shareholders. This is a result worth digging into more (in terms of an income investment) as it seems that Hamish Douglas and co are now focussed on profits and dividends after having grown the business to have ~$59bn under management – simply an astonishing Australian success story and from our perspective a real lesson in how to develop a great funds management operation. The key takeout is; be unique, be different and above all create value with MFG saying they have added ~$35bn in value since the business began.

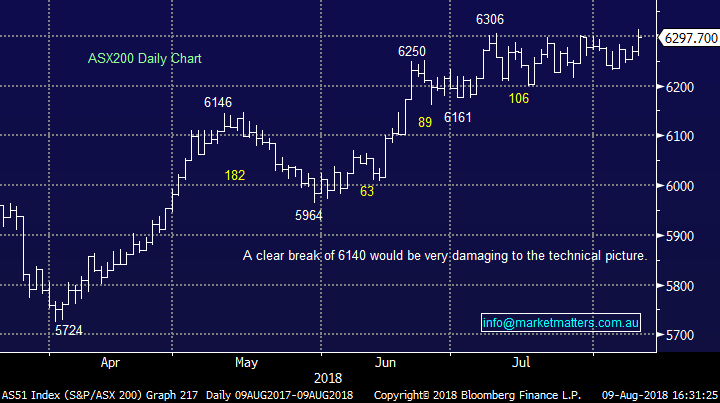

Overall, the ASX200 added +29 points today or 0.47% to close at 6297 after pushing up to a 6313 high midway through the session – Dow Futures are currently trading down -4pts. We are now neutral the ASX200 with a break of 6140 required to turn outright bearish.

Australian Reporting season is underway – for a full list of company reporting dates – click here

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; AP Eagers (APE) is a stock to watch specifically for income. It was a foundation member of the MM Income Portfolio and it’s a solid business, however Wilsons downgraded the stock a few days ago and it’s come off hard to now trade at $7.69– value is starting to emerge in the Nick Politis controlled car yard (s).

· SpeedCast Upgraded to Add at Morgans Financial; PT A$7.21

· Eclipx Downgraded to Hold at Deutsche Bank; PT Set to A$2.10

· AMP Downgraded to Hold at Morgans Financial; PT A$3.88

· Folkestone Downgraded to Hold at Canaccord; PT A$2.89

· Lifestyle Communities Downgraded to Hold at Canaccord; PT A$5.48

· Whitehaven Upgraded to Hold at Morningstar

· Aristocrat Upgraded to Hold at Morningstar

· AP Eagers Downgraded to Sell at Wilsons; PT A$6.54

· Tabcorp Upgraded to Neutral at JPMorgan; PT A$4.50

· Adelaide Brighton Downgraded to Underweight at JPMorgan; PT A$6

· CBA Upgraded to Buy at Bell Potter; PT A$80

Suncorp (SUN) $15.70 / +4.74%; reported their FY 2018 results this morning with a number of clear takeaways. This was a stronger result than expected pretty much across the board with a 5% beat in terms of cash NPAT, an 8cps special dividend coming as a surprise and the sale of their Life Insurance Business with $600m (~46cps) going back to shareholders on completion, however the main takeaway for us is acknowledgment that momentum in the business thanks to the ongoing business improvement program is strong while costs are being well managed = strong future leverage.

Six months ago, SUN hung their hat on a strong second half, they backed themselves in from a long way out and it seems they’re on track to deliver on most metrics. The business improvement program is working with SUN exceeding their net benefits target of $30m for the year while they’ve addressed the Life Insurance issue by flicking the business for $725m with $600m going back to shareholders on completion. There was pressure on the CEO Michael Cameron to start delivering on a range of promises and todays result should go a long way to satisfy the markets concerns.

The bears will concentrate on the softer than expected result in SUN’s banking division and there is some substance to those calls. Banking income fell by 4% from 1H18 to 2H18 and was flat from FY17 to FY18, however as shown yesterday through CBA’s result, times are fairly tough in this market.

Net Interest Margins (NIM) came in at 1.84% versus expectations for 1.86% while the banks dad debt charge was $27m or 5bp. Tier 1 capital was in line at 9.1%. So, an okay set of numbers from the banking division however the insurance result is what had driven the beat here.

Suncorp (SUN) chart

Magellan Financial Group (MFG); $27.60 / 14.63%; Simply a great set of numbers from MFG today, not so much on the top line (revenue) which is well understood / flagged by the market given continuous disclosure around funds under management, however the cost side of the business is being better managed than analysts thought while the uptick in dividend thanks a revised dividend policy means that more of the profits generated will find their way into shareholder pockets. Hamish Douglas remains the biggest shareholder in MFG with a 12.37% stake valued at ~$600m and will pocket more than $10m from this dividend alone. A great result and great Australia success story. We’ll revisit MFG in coming notes.

Magellan Financial Group (MFG) Chart

OUR CALLS

We trimmed 2% from our Suncorp (SUN) position in the Growth Portfolio today, leaving an 8% holding in the Growth Portfolio and a 6% holding in the Income Portfolio.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here