Subscriber Questions – Yield curves, CCP & RHC

**This is an extract from the Market Matters Morning Report from 23 March. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 1

“Hi, what is the explanation in the steepening of the 2/10y US and Au yield curve and general rise in yield in the last couple of days?” – thanks Jin O.

Hi Jin,

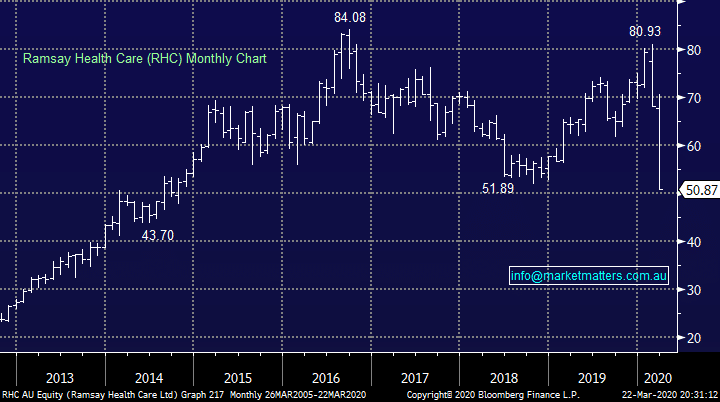

The yield curve is the focus of many professional investors at present, by definition being the differential of 2 different duration bond yields it’s made up of 2 halves:

1: 2-year bond yields are trending down towards zero as they follow the Fed’s aggressive cutting of official interest rates, no surprises here.

2: 10-year bond yields have bounced strongly surprising many who expected a classic flight to quality / safety of US bonds; note not MM, we called longer dated bond yields to rally. The down turn in these longer dated bonds which sent the inversely correlated yields higher we feel has initially been fuelled by the “dash for cash” as redemptions flowed through financial markets, secondly there is the supply issue as central banks will need to issue huge tranches of bonds to pay for their massive stimulus measures and lastly we see inflation being an issue in the coming years which is likely to send longer dated bonds higher.

NB Central banks are also considering QE which effectively means buying longer dated bonds to maintain order and decent prices in a market where they are trying to issue fresh paper, sounds messy and it is!

MM expects the yield curve to continue steepening.

US 2 & 10-year Bond Yields Chart

Question 2

“James CCP was a former market darling with strong valuations all sitting between $30 to $35. As at the release of 1H20 at the end of January, all was rosy. Updated their FY20 guidance and the Balance Sheet was excellent. Since late February they have underperformed the market and lost around 60% from peak to 17/3 close. What's driving the price down beyond the market performance of -33%? Recession? Concerns about replicating the GFC LVR problems??” – Philip WW.

“Hey just wondering if you have any insight into why CCP is continuing to tank despite many shares giving some hints of green. You made a comment about CCP early last week and I would really appreciate your thoughts re CCP’s future performance please?” - Thanks, and kind regards Tamzin H.

Morning All,

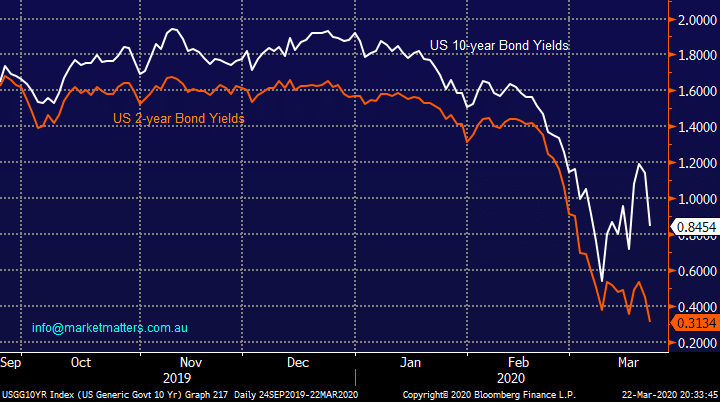

My answer today is very similar to what I wrote for the Income Report on Wednesday when the stock was over $13, or well over 20% higher – CCP is simply in the too hard basket in today’s environment.

The stock peaked on 21st February at ~$38 and closed on Friday at $9.83, down ~75%. CCP now trades on an Est P/E of 6.5x and is projected to yield ~7% fully franked over the next 12 months based on about a 50% historical payout ratio. This is a stock the market has traditionally loved with a consensus target still sitting at $33.88, although that hasn’t changed since before the rout, so I understand why so many asks are if the aggressive re-rate on huge volumes is justified?

A few things at play here however the main issue is debt / balance sheet strength. The stocks that have been most heavily sold are those that carry higher debt and CCP fits that bill. At last reporting date in January they had net debt of $206m with gearing of 30%, however they have a covenant in their lending arrangements which says that they need to keep gearing at less than 60% of financial asset carrying value. The takeaway here is that this is a leveraged business where debt is higher than we’d like and the value of the assets underpinning that debt has likely declined.

Collection House (CLH) is one of their competitors and in mid-February they were suspended from trade with an alarming announcement. In short they effectively said that collection practices were too aggressive and need to be changed, The change would result in lower earnings from their purchased debt ledgers (PDLs) and that in turn would reduce the value of the PDLs on their balance sheet. That move seems to have triggered an issue with senior lenders. In short, we think CLH is in a world of trouble and that has focussed attention on CCP.

While CCP is a higher quality business than CLH, it seems clear that traditional debt collection practices are under the microscope and this could have a negative impact on the value of their inventory (which is essentially purchased debt). If the carrying value of inventory changes it puts pressure on the balance sheet at a time when the market is very focussed (and rightly so) in financial strength rather than growth. I can also remember CCP during the GCF, it traded down to ~60c and very nearly went out the back door.

MM still has no interest in CCP despite the sharp decline

Credit Corp (CCP) Chart

Question 2

“James CCP was a former market darling with strong valuations all sitting between $30 to $35. As at the release of 1H20 at the end of January, all was rosy. Updated their FY20 guidance and the Balance Sheet was excellent. Since late February they have underperformed the market and lost around 60% from peak to 17/3 close. What's driving the price down beyond the market performance of -33%? Recession? Concerns about replicating the GFC LVR problems??” – Philip WW.

“Hey just wondering if you have any insight into why CCP is continuing to tank despite many shares giving some hints of green. You made a comment about CCP early last week and I would really appreciate your thoughts re CCP’s future performance please?” - Thanks, and kind regards Tamzin H.

Morning All,

My answer today is very similar to what I wrote for the Income Report on Wednesday when the stock was over $13, or well over 20% higher – CCP is simply in the too hard basket in today’s environment.

The stock peaked on 21st February at ~$38 and closed on Friday at $9.83, down ~75%. CCP now trades on an Est P/E of 6.5x and is projected to yield ~7% fully franked over the next 12 months based on about a 50% historical payout ratio. This is a stock the market has traditionally loved with a consensus target still sitting at $33.88, although that hasn’t changed since before the rout, so I understand why so many asks are if the aggressive re-rate on huge volumes is justified?

A few things at play here however the main issue is debt / balance sheet strength. The stocks that have been most heavily sold are those that carry higher debt and CCP fits that bill. At last reporting date in January they had net debt of $206m with gearing of 30%, however they have a covenant in their lending arrangements which says that they need to keep gearing at less than 60% of financial asset carrying value. The takeaway here is that this is a leveraged business where debt is higher than we’d like and the value of the assets underpinning that debt has likely declined.

Collection House (CLH) is one of their competitors and in mid-February they were suspended from trade with an alarming announcement. In short they effectively said that collection practices were too aggressive and need to be changed, The change would result in lower earnings from their purchased debt ledgers (PDLs) and that in turn would reduce the value of the PDLs on their balance sheet. That move seems to have triggered an issue with senior lenders. In short, we think CLH is in a world of trouble and that has focussed attention on CCP.

While CCP is a higher quality business than CLH, it seems clear that traditional debt collection practices are under the microscope and this could have a negative impact on the value of their inventory (which is essentially purchased debt). If the carrying value of inventory changes it puts pressure on the balance sheet at a time when the market is very focussed (and rightly so) in financial strength rather than growth. I can also remember CCP during the GCF, it traded down to ~60c and very nearly went out the back door.

MM still has no interest in CCP despite the sharp decline

Credit Corp (CCP) Chart

Question 3

“Hi Helpful Guys! With all the health woes now and forecast, what is your view on the health sector? RHC has hit rock bottom, may be! But is there an upside with the pressure being applied to hospitals etc.?” - Keep up the good work. Kind regards, Ted K.

Hi Ted,

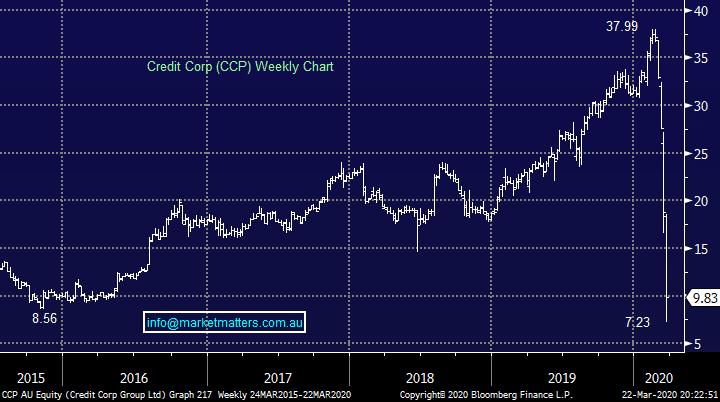

Thanks for the vote of confidence in these tough & testing times, we actually discussed the healthcare sector in the latest Weekend Report and RHC was one of 3 stocks we liked along with stalwarts CSL Ltd (CSL) and Cochlear who we believe will maintain their competitive advantage post COVID-19.

In terms of hospital operator Ramsay Healthcare, the main issue will be the deferral of elective surgeries in their hospitals given the outbreak. While I hear that RHC is still pushing these to be done, it seems also inevitable that if the outbreak spreads more widely then they will struggle to keep that stance.

The Healthcare sector currently represents 13.3% of the ASX200, although the MM Growth Portfolio has no exposure given valuations were too high previously. That has changed somewhat into this pullback and the sector is now well and truly on our radar.

MM likes RHC below $50.

Ramsay Healthcare (RHC) Chart

Question 3

“Hi Helpful Guys! With all the health woes now and forecast, what is your view on the health sector? RHC has hit rock bottom, may be! But is there an upside with the pressure being applied to hospitals etc.?” - Keep up the good work. Kind regards, Ted K.

Hi Ted,

Thanks for the vote of confidence in these tough & testing times, we actually discussed the healthcare sector in the latest Weekend Report and RHC was one of 3 stocks we liked along with stalwarts CSL Ltd (CSL) and Cochlear who we believe will maintain their competitive advantage post COVID-19.

In terms of hospital operator Ramsay Healthcare, the main issue will be the deferral of elective surgeries in their hospitals given the outbreak. While I hear that RHC is still pushing these to be done, it seems also inevitable that if the outbreak spreads more widely then they will struggle to keep that stance.

The Healthcare sector currently represents 13.3% of the ASX200, although the MM Growth Portfolio has no exposure given valuations were too high previously. That has changed somewhat into this pullback and the sector is now well and truly on our radar.

MM likes RHC below $50.

Ramsay Healthcare (RHC) Chart