Subscriber Questions – OTW, AMP & more

**This is an extract from the Market Matters Morning Report from 2 December. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 3

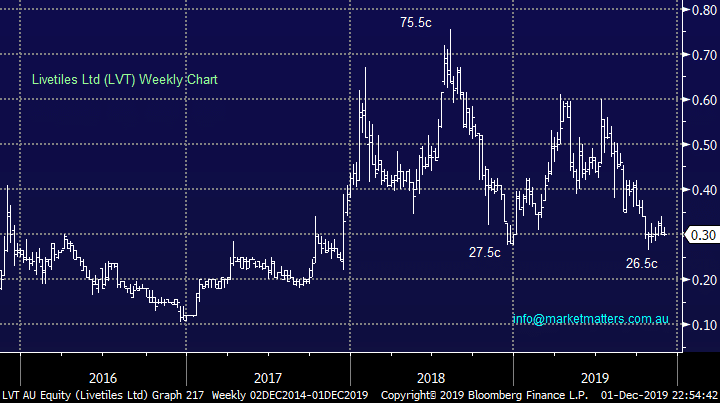

“Hi James and team, I noticed directors getting out of some stock. Albeit a portion of their large holdings. Given your dislike of this happening, I am wondering if you are still keen on OTW? This might be of wider interest to MM readers.” - Kind Regards, Peter H.

Hi Peter,

Telco and data centre business OTW still looks good to us and an eventual push towards $6 feels likely. As you say ED Brett Paddon sold $4.6m worth of shares around $4.60 but directors still hold a healthy +$130m worth of shares hence at this stage no great concern on that front.

This $260m business is not an option for MM because of its very low day to day liquidity.

MM is bullish OTW.

Over The Wire Holdings (OTW) Chart

Question 4

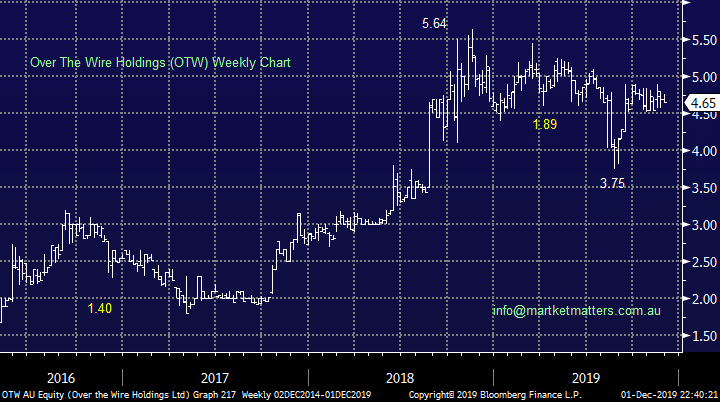

AMP Capital Notes 2 - “Interested in your thoughts for the Income Portfolio?” - Regards, Scott D.

Hi Scott,

We discussed last week in our Income Report and we are adding it to the income portfolio here.

The book build was heavily overbid, from my insight, about 2.5x.

AMP Ltd (AMP) Chart

Question 4

AMP Capital Notes 2 - “Interested in your thoughts for the Income Portfolio?” - Regards, Scott D.

Hi Scott,

We discussed last week in our Income Report and we are adding it to the income portfolio here.

The book build was heavily overbid, from my insight, about 2.5x.

AMP Ltd (AMP) Chart

Question 5

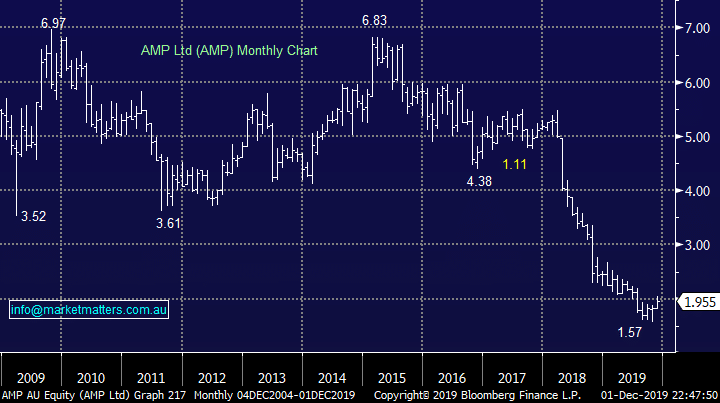

“I have noted on a number of occasions you have been quite negative on the outlook for Suncorp with a price target of around $11/12.00. What negative factors are you seeing in the stock as opposed to say Bell Potter who have a 12 month price target of $14.80.” - Thank you Ian C.

Hi Ian,

Suncorp (SUN) has been one of our favourite vehicles for MM since the company’s inception with the company following our fundamental and technical outlook well to-date, until it falls out of this rhythm we won’t fight it:

1 – MM is not keen on regional banks or insurers at present, SUN’s banking arm is under the regulators microscope at present and with the issues around weather related claims pressuring insures the stocks simply too hard in our opinion.

2 – Technically we called the spike up towards $16 for years followed by a correction back under $12, this has been following our playbook so far hence again we see no reason to own SUN.

MM is neutral / bearish SUN.

Suncorp (SUN) Chart

Question 5

“I have noted on a number of occasions you have been quite negative on the outlook for Suncorp with a price target of around $11/12.00. What negative factors are you seeing in the stock as opposed to say Bell Potter who have a 12 month price target of $14.80.” - Thank you Ian C.

Hi Ian,

Suncorp (SUN) has been one of our favourite vehicles for MM since the company’s inception with the company following our fundamental and technical outlook well to-date, until it falls out of this rhythm we won’t fight it:

1 – MM is not keen on regional banks or insurers at present, SUN’s banking arm is under the regulators microscope at present and with the issues around weather related claims pressuring insures the stocks simply too hard in our opinion.

2 – Technically we called the spike up towards $16 for years followed by a correction back under $12, this has been following our playbook so far hence again we see no reason to own SUN.

MM is neutral / bearish SUN.

Suncorp (SUN) Chart

Question 6

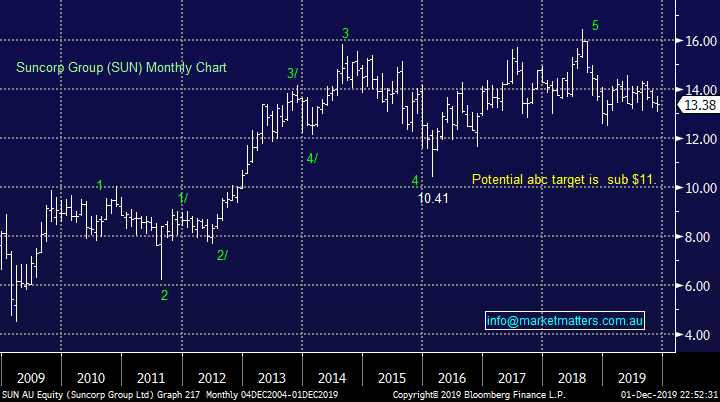

“To James & The Team, I am a recent contributor to MM and The information flow and insights are fantastic. My question is about LVT, a stock that appears to be full of promise but endures constant selling and results in a stock that is difficult to own. Soon to turn cash flow positive might be the catalyst for a re-rating. They forecast a great year ahead. Can you give me your take on the story?” -Thank you, kind regards John H.

Hi John,

Firstly welcome to MM and thanks for the kind words, we’re really excited for 2020 with plans to make our offering substantially better!

For those unfamiliar with LVT it’s a software business with a market cap just under$250m whose share price has clearly been on a rollercoaster ride in 2018/9. We believe the company’s prospects could be exciting, it already enjoys over $40m of annualised reoccurring revenue (ARR) and although clearly a ”specie” at current levels it feels a reasonable “punt”.

We met management a few months ago, and came away thinking they would raise capital, something they have now done. That cum-raise hangover has now gone and some clear air is now possible if they produce decent numbers i.e mkt simply not thinking they are about the raise.

MM likes LVT as an aggressive play around 30c.

Livetiles Ltd (LVT) Chart

Question 6

“To James & The Team, I am a recent contributor to MM and The information flow and insights are fantastic. My question is about LVT, a stock that appears to be full of promise but endures constant selling and results in a stock that is difficult to own. Soon to turn cash flow positive might be the catalyst for a re-rating. They forecast a great year ahead. Can you give me your take on the story?” -Thank you, kind regards John H.

Hi John,

Firstly welcome to MM and thanks for the kind words, we’re really excited for 2020 with plans to make our offering substantially better!

For those unfamiliar with LVT it’s a software business with a market cap just under$250m whose share price has clearly been on a rollercoaster ride in 2018/9. We believe the company’s prospects could be exciting, it already enjoys over $40m of annualised reoccurring revenue (ARR) and although clearly a ”specie” at current levels it feels a reasonable “punt”.

We met management a few months ago, and came away thinking they would raise capital, something they have now done. That cum-raise hangover has now gone and some clear air is now possible if they produce decent numbers i.e mkt simply not thinking they are about the raise.

MM likes LVT as an aggressive play around 30c.

Livetiles Ltd (LVT) Chart