Subscriber Questions – LYL, MSB, SVW and QBE

**This is an extract from the Market Matters Morning Report from 23 December. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 1

“Firstly, many thanks for your informative service over the year, and all the best for Christmas and the New Year - may it be fruitful for us all! Can I sneak in a cheeky two questions for Monday? First - if we assume as an exercise interest rate have bottomed and may rise from here, what stocks do well in that environment? Secondly, what does your analysis tell you about LYL? I am looking at this stock for income. All the best!” – Karl B.

Hi Karl,

Thanks for the kind words to everyone, I have obviously split your question in 2 halves this morning:

1 During times of rising bond yields investors generally want to be exposed to Value Stocks like the Resources & Banks while avoiding the Growth, yield sensitive and high valuation stocks e.g. Utilities and IT stocks. Stocks with higher debt do worse as do those seen as a quasi-bond.

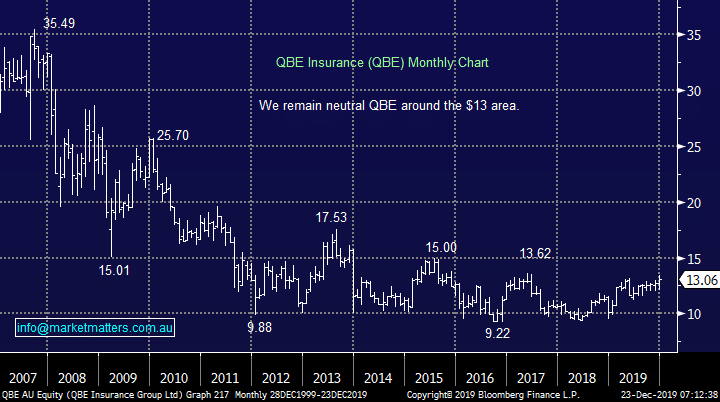

2 Lycopodium (LYL) is an engineering consulting firm with a market cap of over $200m. The stock’s had a great few years but it still only trades on an Est P/E for 2020 of 12.4x while yielding 5.7% fully franked. This is cheap relative to the market however generally this is a sector that trades at some discount given the cyclicality of earnings. i.e. we hold NWH in the sector which is also cheap. While this is not a stock MM has invested in the past but on the surface both technically and fundamentally it looks excellent buying between $4 and $4.50.

Lycopodium (LYL) Chart

Question 2

“Hi James and team, another educational query. I hold Mesoblast (MSB) shares but I don’t know about their ADRs or how to purchase. They came up in your report this afternoon, could you please explain?” - Kind Regards, Peter H.

Hi Peter,

Along with being listed on the ASX, Mesoblast (MSB) has now been listed as an American Depository Receipt (ADR) in the US allowing US investors to buy it in their local currency. The only reason an Australian investor would buy MSB via the ADR is if they wanted to own the stock in $US terms. There are many examples of ASX listed companies that also list as ADR’s overseas, essentially to make it easier for overseas investors to buy in.

https://www.nasdaq.com/market-activity/stocks/meso

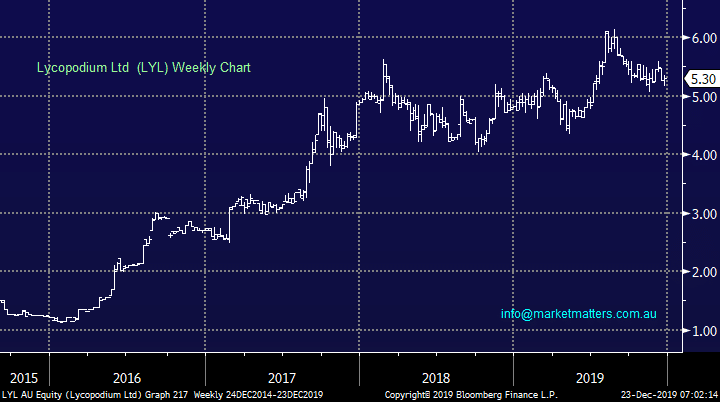

MM likes MSB as an aggressive play but stops need to be under $1.60.

Mesoblast (MSB) Chart

Question 2

“Hi James and team, another educational query. I hold Mesoblast (MSB) shares but I don’t know about their ADRs or how to purchase. They came up in your report this afternoon, could you please explain?” - Kind Regards, Peter H.

Hi Peter,

Along with being listed on the ASX, Mesoblast (MSB) has now been listed as an American Depository Receipt (ADR) in the US allowing US investors to buy it in their local currency. The only reason an Australian investor would buy MSB via the ADR is if they wanted to own the stock in $US terms. There are many examples of ASX listed companies that also list as ADR’s overseas, essentially to make it easier for overseas investors to buy in.

https://www.nasdaq.com/market-activity/stocks/meso

MM likes MSB as an aggressive play but stops need to be under $1.60.

Mesoblast (MSB) Chart

Question 3

“Hi James, thanks for an invaluable daily read. In regard SVW, at what point, or TP would you consider selling IF you were a holder?” – David J.

Hi David,

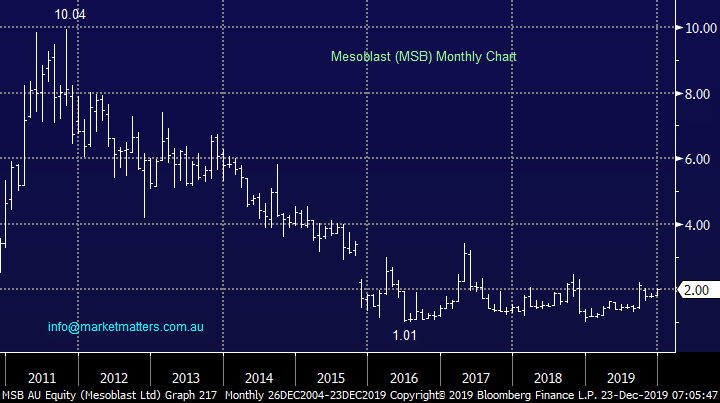

Seven Group Holdings (SVW) is a stock we’ve discussed a few times over recent weeks with a definite bullish bias. Currently we would be running stops below $18.20 which offers solid risk / reward in our opinion.

MM likes SVW with stops under $18.20.

Seven Group Holdings (SVW) Chart

Question 3

“Hi James, thanks for an invaluable daily read. In regard SVW, at what point, or TP would you consider selling IF you were a holder?” – David J.

Hi David,

Seven Group Holdings (SVW) is a stock we’ve discussed a few times over recent weeks with a definite bullish bias. Currently we would be running stops below $18.20 which offers solid risk / reward in our opinion.

MM likes SVW with stops under $18.20.

Seven Group Holdings (SVW) Chart

Question 4

“James, I typically stay well clear of Insurance stocks as I just don't trust their earnings capability and I think QBE sits in the box seat with that one. In the article below they state they are receiving increased premiums, I don't know what might be occurring out there in the corporate world in relation to Insurance premiums but for individuals such as me if I see a large increase in premium on any insurance I hold I will immediately shop around and go elsewhere. Case in point, many years ago we held insurance with QBE until they started raising premiums heavily, we shopped around and went elsewhere and to this day we have never gone back even when of late I've checked their premiums against others and they are still too expensive for me. I really can't see how they can sustain themselves by increasing premiums, if you're on the ball and check insurance elsewhere most people will walk away, and I personally know people who have done exactly that in relation to QBE. Quite frankly I wouldn't buy an insurance stock if it were the last stock listed on the stock exchange and I certainly wouldn't touch QBE unless things drastically change for the better. I'm with Brett, I think they've got big hurdles to get over.” – Thanks Steve S.

Hi Steve,

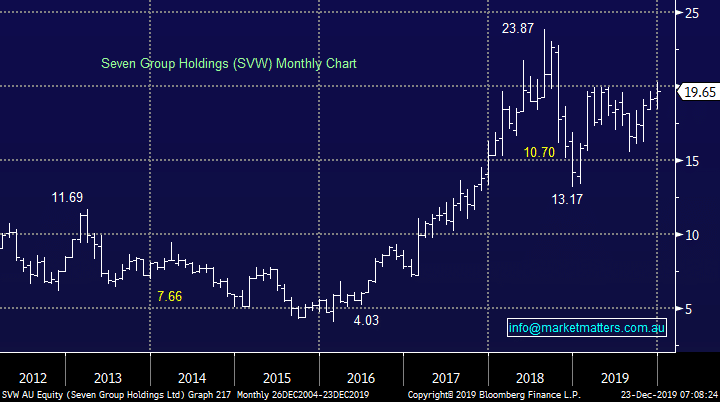

QBE has been a vehicle of wealth destruction post the GFC, its collapsed while the markets soared adding definite weight to your argument. I agree that as we become a more digital society price comparisons will play an ever increasing role in consumers decision making process. However, I most definitely would never say never, at MM we believe investors should always remain openminded, most stocks have value at a price. Shaw’s analyst in the sector is an outlier in terms of his calls on many stocks and QBE is certainly one of those. He has a $9 price target and a sell, glaringly different from the ‘streets’ expectations.

QBE Broker Calls

Question 4

“James, I typically stay well clear of Insurance stocks as I just don't trust their earnings capability and I think QBE sits in the box seat with that one. In the article below they state they are receiving increased premiums, I don't know what might be occurring out there in the corporate world in relation to Insurance premiums but for individuals such as me if I see a large increase in premium on any insurance I hold I will immediately shop around and go elsewhere. Case in point, many years ago we held insurance with QBE until they started raising premiums heavily, we shopped around and went elsewhere and to this day we have never gone back even when of late I've checked their premiums against others and they are still too expensive for me. I really can't see how they can sustain themselves by increasing premiums, if you're on the ball and check insurance elsewhere most people will walk away, and I personally know people who have done exactly that in relation to QBE. Quite frankly I wouldn't buy an insurance stock if it were the last stock listed on the stock exchange and I certainly wouldn't touch QBE unless things drastically change for the better. I'm with Brett, I think they've got big hurdles to get over.” – Thanks Steve S.

Hi Steve,

QBE has been a vehicle of wealth destruction post the GFC, its collapsed while the markets soared adding definite weight to your argument. I agree that as we become a more digital society price comparisons will play an ever increasing role in consumers decision making process. However, I most definitely would never say never, at MM we believe investors should always remain openminded, most stocks have value at a price. Shaw’s analyst in the sector is an outlier in terms of his calls on many stocks and QBE is certainly one of those. He has a $9 price target and a sell, glaringly different from the ‘streets’ expectations.

QBE Broker Calls

Source: Bloomberg

MM is neutral QBE.

QBE Insurance (QBE) Chart

Source: Bloomberg

MM is neutral QBE.

QBE Insurance (QBE) Chart