Subscriber Questions – Corona virus, Hybrids and more

**This is an extract from the Market Matters Morning Report from 2 March. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 1

“Just wondering what impact, you think the horrific Chinese data from yesterday will have. I see another bad day here and in the US.” - Cheers David M.

Hi David,

The data was simply awful showing China is undoubtedly contracting faster on the economic front than many feared, not overly surprising with 500 million people living in a state of lockdown. However to give a balanced answer I think the China situation may have already bottomed, I’m more concerned with the likely slowdown through the likes of the US & Europe, if this gathers momentum stocks are likely to see more downside.

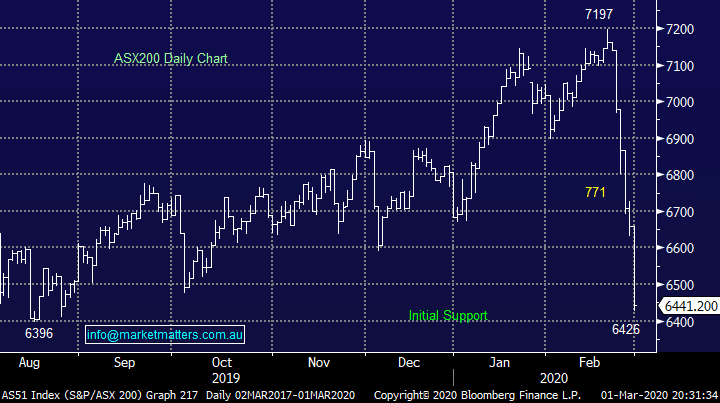

MM’s best guess is the ASX200 will open down 50-points this morning.

ASX200 Index Chart

Question 2

“Hi James, A quick question for Monday. With the current sell-off, do you think there is much to gain in holding bank hybrids and income stocks, such as MXT and NBI? Would the returns not be greater in the future by selling these stocks, and investing the proceeds into good stocks which have fallen significantly?” - best wishes John K.

Hi John,

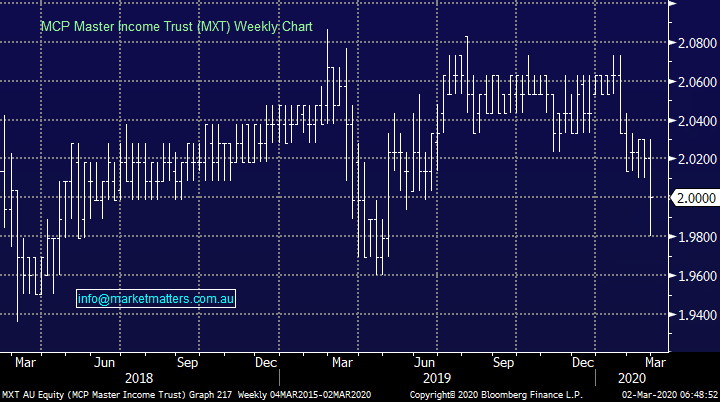

Asset allocation depends on each individuals circumstances, something we do not take into consideration at MM, however our view is bond yields are close to a major bottom which implies it is time start tweaking allocations, reducing the uncomfortable switch from the stability of hybrids / income securities to battered equities given relative value from stocks has improved, with a focus on those that pay a decent sustainable yield. However, we feel stocks are in accumulation phase at present, not an aggressive “all in” situation hence a scaled approach is what we do in our Income Portfolio.

As it stands, we are skewed 42.5% towards income securities, 55% towards equities and 2.5% in cash. We view this as a fairly neutral stance for this income focussed portfolio. The most aggressive stance we would take here is 70% towards equities, meaning we have room to scale.

MM believes equities will outperform income securities / hybrids medium-term BUT short-term its obviously news dependant.

MCP Master Income Trust (MXT) Chart

Question 2

“Hi James, A quick question for Monday. With the current sell-off, do you think there is much to gain in holding bank hybrids and income stocks, such as MXT and NBI? Would the returns not be greater in the future by selling these stocks, and investing the proceeds into good stocks which have fallen significantly?” - best wishes John K.

Hi John,

Asset allocation depends on each individuals circumstances, something we do not take into consideration at MM, however our view is bond yields are close to a major bottom which implies it is time start tweaking allocations, reducing the uncomfortable switch from the stability of hybrids / income securities to battered equities given relative value from stocks has improved, with a focus on those that pay a decent sustainable yield. However, we feel stocks are in accumulation phase at present, not an aggressive “all in” situation hence a scaled approach is what we do in our Income Portfolio.

As it stands, we are skewed 42.5% towards income securities, 55% towards equities and 2.5% in cash. We view this as a fairly neutral stance for this income focussed portfolio. The most aggressive stance we would take here is 70% towards equities, meaning we have room to scale.

MM believes equities will outperform income securities / hybrids medium-term BUT short-term its obviously news dependant.

MCP Master Income Trust (MXT) Chart

Question 3

“Hi MM team. A query for Monday. There seems to be a strange silence from MM re portfolio positioning during this tough time. No buy sell or insuring calls. Do we just sit and watch this unfold or have we missed the boat on something (buy BBOZ or similar)” - Regards Neil W.

Morning Neil,

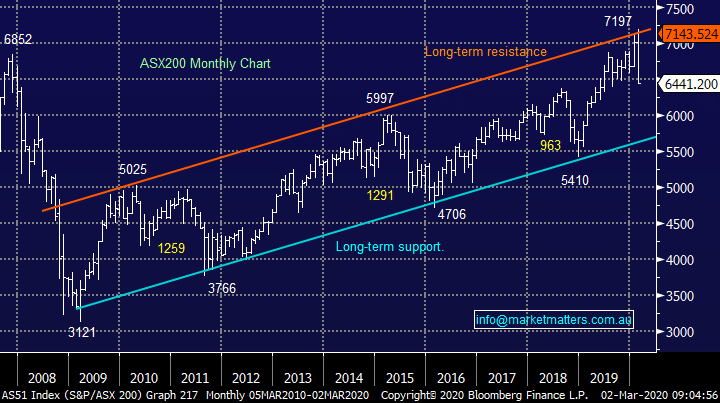

Thanks for the feedback, as you may know we previously increased our cash levels up towards the 7200 area in our Growth Portfolio before putting out a number of buy/switch alerts on Tuesday of last week into market weakness but unfortunately our pullback prognosis was way too conservative – I’m sure all subscribers understand it’s impossible to forecast a full blown pandemic, doomsday merchants have lost a fortune over the last decade!

I actually thought we were active last week, too active on the buy-side as it turned out.

We do anticipate being proactive in the weeks ahead across our 4 Portfolios, we outlined much of our thoughts and plans in this Weekends Report (click here) – in hindsight aggressive selling last week of the acceleration lower would have paid dividends short-term but history tells us this is not usually the prudent path. At MM we intend to focus on structuring our portfolios for the future not the next 24-hours panic and fortunately the current blind panic should assist us with the adding of value in this area.

MM prefers Value stocks overgrowth and actually believe its again time to cautiously buy weakness.

NB Last week on a number of occasions we saw a usual month’s activity in one day hence MM may become more active accordingly.

ASX200 Index Chart

Question 3

“Hi MM team. A query for Monday. There seems to be a strange silence from MM re portfolio positioning during this tough time. No buy sell or insuring calls. Do we just sit and watch this unfold or have we missed the boat on something (buy BBOZ or similar)” - Regards Neil W.

Morning Neil,

Thanks for the feedback, as you may know we previously increased our cash levels up towards the 7200 area in our Growth Portfolio before putting out a number of buy/switch alerts on Tuesday of last week into market weakness but unfortunately our pullback prognosis was way too conservative – I’m sure all subscribers understand it’s impossible to forecast a full blown pandemic, doomsday merchants have lost a fortune over the last decade!

I actually thought we were active last week, too active on the buy-side as it turned out.

We do anticipate being proactive in the weeks ahead across our 4 Portfolios, we outlined much of our thoughts and plans in this Weekends Report (click here) – in hindsight aggressive selling last week of the acceleration lower would have paid dividends short-term but history tells us this is not usually the prudent path. At MM we intend to focus on structuring our portfolios for the future not the next 24-hours panic and fortunately the current blind panic should assist us with the adding of value in this area.

MM prefers Value stocks overgrowth and actually believe its again time to cautiously buy weakness.

NB Last week on a number of occasions we saw a usual month’s activity in one day hence MM may become more active accordingly.

ASX200 Index Chart