Subscriber Questions – Bonds, TLS & NWH

**This is an extract from the Market Matters Morning Report from 14 December. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 2

"Hi, Great note – always of great value. When you say portfolios should be structured in favour of cyclical value as opposed to growth / bond proxies. What stocks are we looking to restructure into that are classed as cyclical value?" - Regards Brett

Hi Brett, A good question given we’ve been harping on about this in recent notes. Firstly, most stocks like falling interest rates - lower interest rates mean stock valuations will generally be higher given a ‘risk free’ rate is applied in valuation models. The sectors that really enjoy falling rates are high P/E growth stocks and defensive ‘bond like’ stocks that carry high levels of debt that underpin defensive predictable cash flows. Rising rates are a headwind but even stable rates remove the obvious tailwind.

Cheaper cyclical stocks on the other hand like resources, mining services, building companies, packaging etc. and their associated service providers have a positive correlation to interest rates. These sectors are more influenced by economic activity and the markets expectation of economic activity can be shown through interest rates. Remember, markets price 6-12 months ahead so if rates at least stop falling now, it implies investor expectations around future growth are improving. Cyclical’s are cheaper at this point in the cycle and MM is positive the sectors above.

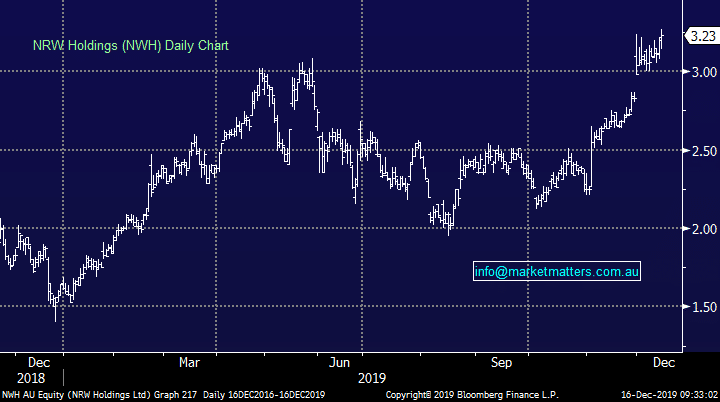

We believe bond yields are ‘looking for a low’ which is bullish for cheaper cyclicals

Australian 3-year Bonds v Official RBA Cash Rate Chart

Question 3

"Just read your Sunday Report (required weekend reading over a late breakfast). As an income investor who held on too long to Telstra Shares through the NBN period high and has since been hoping for the TLS share price to appreciate so I can 'get rid', I read your comments on fading the bond yield bear market with interest. Do we still consider TLS as a bond proxy share? If not, I read your comments as likely bad news for TLS moving in to 2020 - do I read you correctly? Keep up the good work MM!" - Karl B

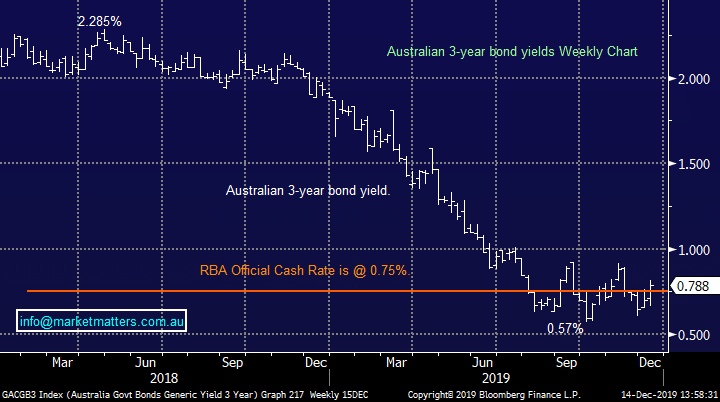

Thanks as always for the thumbs up Karl. In short, no, we don’t view Telstra as the bond proxy it once was given they are now paying less out as dividends and reinvesting more into the technology opportunity in front of them. The underlying dividend yield for TLS is currently 2.72% however they are also paying a special dividend thanks to NBN payments which bumps up the current yield to 4.35% fully franked. The 16cps dividend which creates the 4.35% yield based off current prices is what investors should expect out to at least 2022.

At their last update in November, TLS guided to a lower capex number than the market was expecting and that led to a pop in the share price and upgrades across the analyst community – a clear positive however it shows how sensitive the fate of Telstra is to their cost base. Clearly, they either need to grow at the top line and / or strip more costs out of the business to improve earnings, something we think is very achievable as they part with older legacy systems and improve integration across the business.

MM is positive TLS expecting a slow grind towards $4.50

Telstra (TLS) Chart

Question 3

"Just read your Sunday Report (required weekend reading over a late breakfast). As an income investor who held on too long to Telstra Shares through the NBN period high and has since been hoping for the TLS share price to appreciate so I can 'get rid', I read your comments on fading the bond yield bear market with interest. Do we still consider TLS as a bond proxy share? If not, I read your comments as likely bad news for TLS moving in to 2020 - do I read you correctly? Keep up the good work MM!" - Karl B

Thanks as always for the thumbs up Karl. In short, no, we don’t view Telstra as the bond proxy it once was given they are now paying less out as dividends and reinvesting more into the technology opportunity in front of them. The underlying dividend yield for TLS is currently 2.72% however they are also paying a special dividend thanks to NBN payments which bumps up the current yield to 4.35% fully franked. The 16cps dividend which creates the 4.35% yield based off current prices is what investors should expect out to at least 2022.

At their last update in November, TLS guided to a lower capex number than the market was expecting and that led to a pop in the share price and upgrades across the analyst community – a clear positive however it shows how sensitive the fate of Telstra is to their cost base. Clearly, they either need to grow at the top line and / or strip more costs out of the business to improve earnings, something we think is very achievable as they part with older legacy systems and improve integration across the business.

MM is positive TLS expecting a slow grind towards $4.50

Telstra (TLS) Chart

Question 4

"Hi Guys, Could I get an update on your intentions with the NWH SPP? It looks good to me, and I remember in late November your position was to participate in the institutional offer." - Thanks, Richard

"I was wondering if you plan to take up the Share Purchase Plan for NRW Holdings Ltd? Do you still think there is further upside for NRW?" - Laurence

Hi Richard & Laurence,

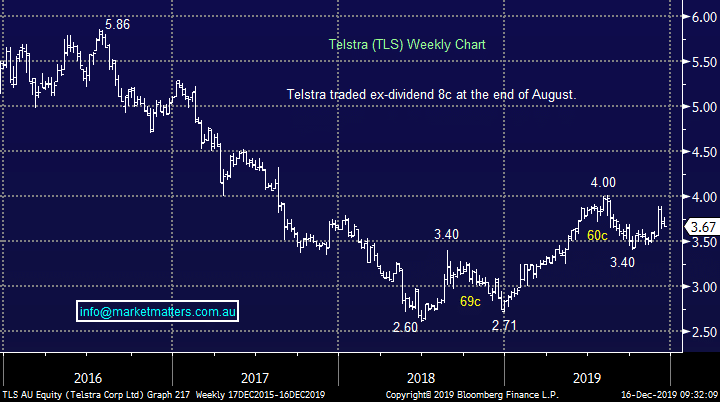

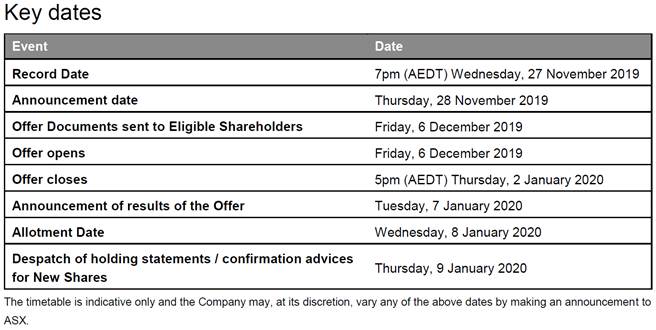

MM intends to participate in the share purchase plan (SPP) – the current share price is $3.23 versus the SPP offer price of $2.85 which represents a ~12% discount to current market prices. As a refresher, holders of the stock at the record date of 27th November can buy up to $15,000 worth of shares at $2.85 as part of the company’s capital raising to buy BGC contracting - a good acquisition. We may get scaled back here given they are capping the SPP component of the raise to $10m

The timetable is below, with the offer closing on the 2nd January.

Question 4

"Hi Guys, Could I get an update on your intentions with the NWH SPP? It looks good to me, and I remember in late November your position was to participate in the institutional offer." - Thanks, Richard

"I was wondering if you plan to take up the Share Purchase Plan for NRW Holdings Ltd? Do you still think there is further upside for NRW?" - Laurence

Hi Richard & Laurence,

MM intends to participate in the share purchase plan (SPP) – the current share price is $3.23 versus the SPP offer price of $2.85 which represents a ~12% discount to current market prices. As a refresher, holders of the stock at the record date of 27th November can buy up to $15,000 worth of shares at $2.85 as part of the company’s capital raising to buy BGC contracting - a good acquisition. We may get scaled back here given they are capping the SPP component of the raise to $10m

The timetable is below, with the offer closing on the 2nd January.

NWH trades on an estimated P/E of 14.3x with strong earnings growth forecast for the coming years.

MM remains bullish NWH

NRW Holdings (NWH) Chart

NWH trades on an estimated P/E of 14.3x with strong earnings growth forecast for the coming years.

MM remains bullish NWH

NRW Holdings (NWH) Chart