Subscriber Questions – Amazon, JHG, CGC and more

**This is an extract from the Market Matters Morning Report from 11 November. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 2

“Hi James, I sent an email through last night but there was no reply today . I was after your opinion on Amazon, is it a buy, sell or hold. Am I doing something wrong with my requests which I send in on Sunday nights.” – David M.

Hi David,

Sorry, I missed it last Sunday night.

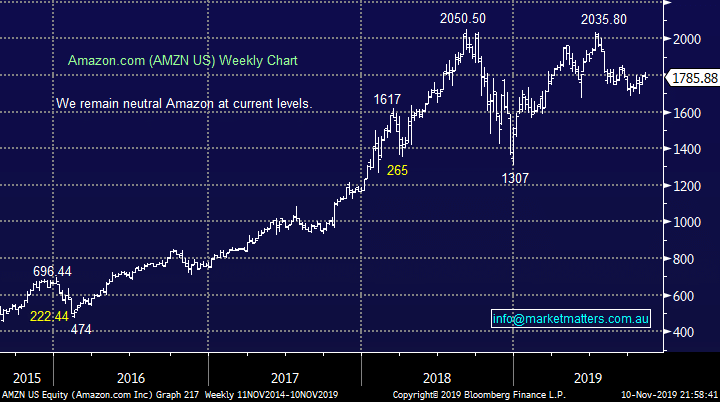

US goliath e-retailer Amazon (AMZN US), its trading at the same level as 16-months ago and we see no reason to try and second guess what comes next. The stocks not cheap which obviously brings with it downside risk but its clearly a successful / quality business with their web services kicking goals, it’s just too hard here from a risk / reward perspective.

MM is neutral Amazon (AMZN US).

Amazon (AMZN US) Chart

Question 3

“Hi, My first question relates to JHG, Janus Henderson. I note on the chart that it has recently jumped above the level of a head and shoulders pattern. I haven't noticed any commentary on this and note that you still have it shown as a hold. I don't yet own the stock and I'm wondering whether to buy some especially on a pullback. Next question relates to Costa Group, CGC, which I don't yet own. you show it as a buy and I'm considering buying up to 3%. any comment on this?” – Fred H.

Hi Fred,

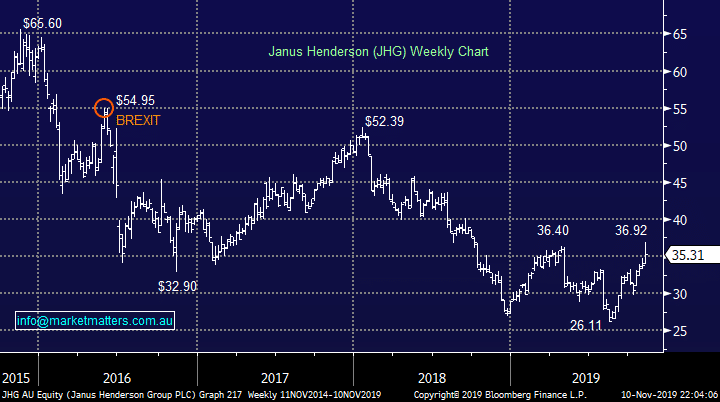

Janus Henderson (JHG) is definitely a topical stock on 2 fronts, which I’ll touch on below but MM went long for our International Portfolio on the 21st of October, which is performing nicely already up ~10%, the move clearly implies we are bullish the stock.

1 – JHG is vulnerable to adverse results from the UK election and / or BREXIT developments but we believe risk / reward is looking good for JHG – technically were bullish JHG while it holds above $33.

2 – We believe the embattled fund manger space is seeing glimmers of optimism after enduring a tough few years, we went long Pendal Group (PDL) last week, again a positive lead for JHG.

Janus Henderson (JHG) Chart

Question 3

“Hi, My first question relates to JHG, Janus Henderson. I note on the chart that it has recently jumped above the level of a head and shoulders pattern. I haven't noticed any commentary on this and note that you still have it shown as a hold. I don't yet own the stock and I'm wondering whether to buy some especially on a pullback. Next question relates to Costa Group, CGC, which I don't yet own. you show it as a buy and I'm considering buying up to 3%. any comment on this?” – Fred H.

Hi Fred,

Janus Henderson (JHG) is definitely a topical stock on 2 fronts, which I’ll touch on below but MM went long for our International Portfolio on the 21st of October, which is performing nicely already up ~10%, the move clearly implies we are bullish the stock.

1 – JHG is vulnerable to adverse results from the UK election and / or BREXIT developments but we believe risk / reward is looking good for JHG – technically were bullish JHG while it holds above $33.

2 – We believe the embattled fund manger space is seeing glimmers of optimism after enduring a tough few years, we went long Pendal Group (PDL) last week, again a positive lead for JHG.

Janus Henderson (JHG) Chart

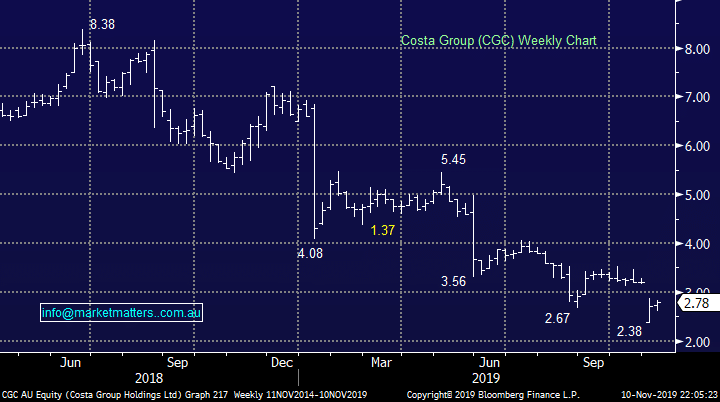

Costa Group (CGC) has been a thorn in our side as downgrades have arrived far too often for our liking by this berry and mushroom producer is looking attractive below $3 in our opinion – we recently reduced our holding from 7.2% to 5% from purely a portfolio management perspective, not because we want to sell CGC under $3.

MM is comfortable with our 5% exposure to CGC but this is clearly a high risk play.

Costa Group (CGC) Chart

Costa Group (CGC) has been a thorn in our side as downgrades have arrived far too often for our liking by this berry and mushroom producer is looking attractive below $3 in our opinion – we recently reduced our holding from 7.2% to 5% from purely a portfolio management perspective, not because we want to sell CGC under $3.

MM is comfortable with our 5% exposure to CGC but this is clearly a high risk play.

Costa Group (CGC) Chart

Question 4

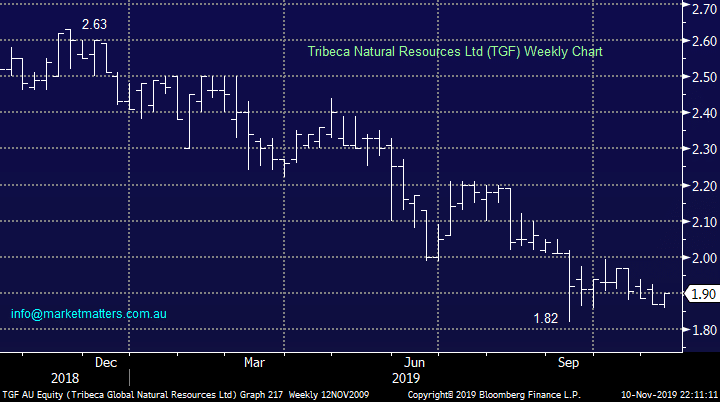

“What do you think of TGF as an energy play” – Mike C.

Hi Mike,

Tribeca Natural Resources Ltd (TGF) is a fund that invest in direct commodities, debt and equity, and their performance has clearly been weak. Shaw was involved in this listing and I had dinner with the guys who were running it. A smart team however I believe there has been some turnover of staff within Tribeca of late.

While we like the commodity space, and TGF now trades at a big discount to their assets, we want to see some performance from their fund first.

MM is neutral TGF.

Tribeca Natural Resources Ltd (TGF) Chart

Question 4

“What do you think of TGF as an energy play” – Mike C.

Hi Mike,

Tribeca Natural Resources Ltd (TGF) is a fund that invest in direct commodities, debt and equity, and their performance has clearly been weak. Shaw was involved in this listing and I had dinner with the guys who were running it. A smart team however I believe there has been some turnover of staff within Tribeca of late.

While we like the commodity space, and TGF now trades at a big discount to their assets, we want to see some performance from their fund first.

MM is neutral TGF.

Tribeca Natural Resources Ltd (TGF) Chart

Question 5

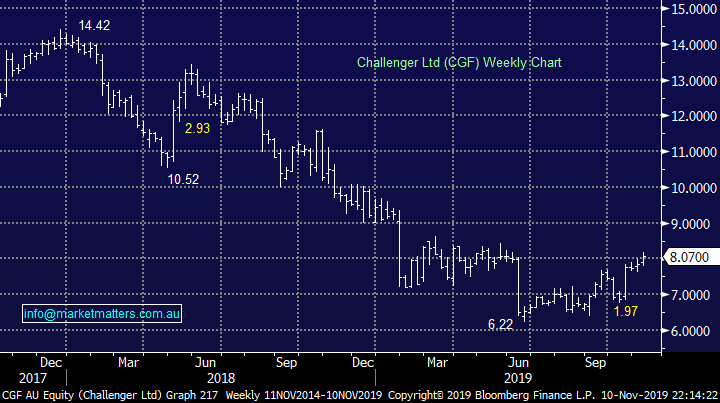

“Hi James and team, I wondering whether you can give your thoughts on CGF and HLS. I’m still holding them from earlier in the year.” Cheers Mike F

Hi Mike,

1 – Challenger (CGF) looks to have bottomed in 2019, a bit frustrating for MM was looking to buy the annuity business around $6, we were too fussy for our own good!

After breaking $8.00, CGF targets the $9 region, however we do not like the fundamentals of the business – margin contraction a real issue

Challenger Group (CGF) Chart

Question 5

“Hi James and team, I wondering whether you can give your thoughts on CGF and HLS. I’m still holding them from earlier in the year.” Cheers Mike F

Hi Mike,

1 – Challenger (CGF) looks to have bottomed in 2019, a bit frustrating for MM was looking to buy the annuity business around $6, we were too fussy for our own good!

After breaking $8.00, CGF targets the $9 region, however we do not like the fundamentals of the business – margin contraction a real issue

Challenger Group (CGF) Chart

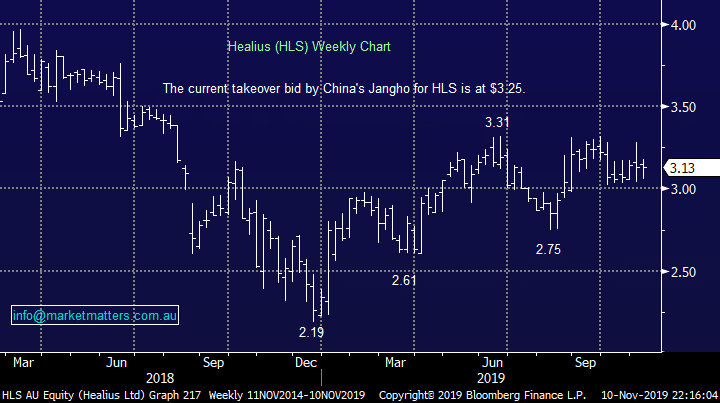

2 – Healius (HLS) continues to trade sideways between $3 and $3.30 with a similar rotational feel to the ASX200 index itself. Obviously HLS is in the takeover sights of Jangho but we don’t see this as a strong enough reason to buy back into the business.

MM is neutral HLS.

Healius (HLS) Chart

2 – Healius (HLS) continues to trade sideways between $3 and $3.30 with a similar rotational feel to the ASX200 index itself. Obviously HLS is in the takeover sights of Jangho but we don’t see this as a strong enough reason to buy back into the business.

MM is neutral HLS.

Healius (HLS) Chart