Strong employment data weighs on market (SSM, VRL)

WHAT MATTERED TODAY

Another session where stocks were in a holding pattern today with the news flow dominated by the impeachment of President Trump, only the third time in Americans 243-year history that a sitting President has been impeached. Today’s outcome was never in any doubt given the Democratic numbers in the house; however the Senate is a different story and they really have no hope of getting this through the Senate. US Futures didn’t react to the news, they were fairly muted all session and while this will make headlines, it’s unlikely to have any real impact on markets.

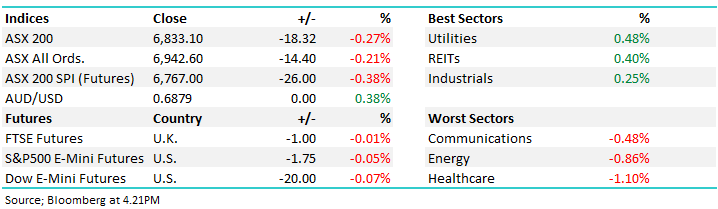

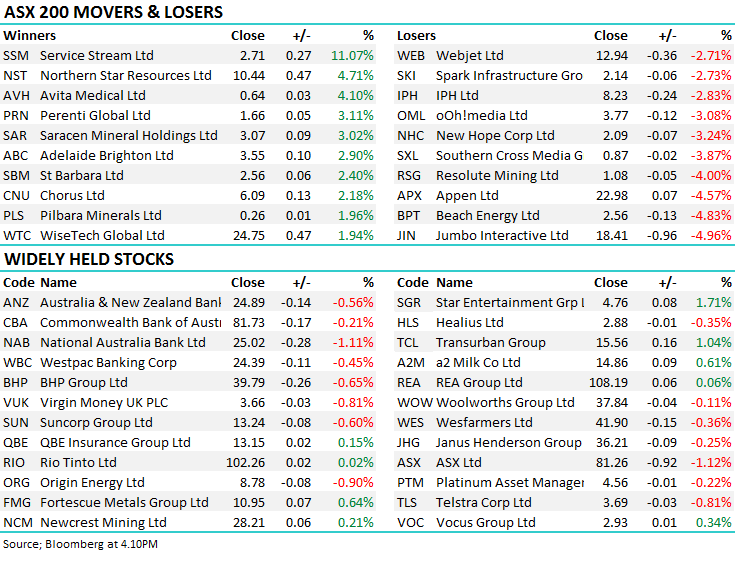

Local employment data was out this morning and was better than expected, more on that below while Service Stream (SSM) had a good announcement and the stock rallied as a consequence. At a sector level, most interest was targeted towards the utilities while the healthcare sector lagged. Asian markets tracked lower.

Overall, the ASX 200 lost -18pts /-0.27% today to close at 6833. Dow Futures are trading marginally lower by -20pts/-0.07%.

ASX 200 Chart

ASX 200 Chart

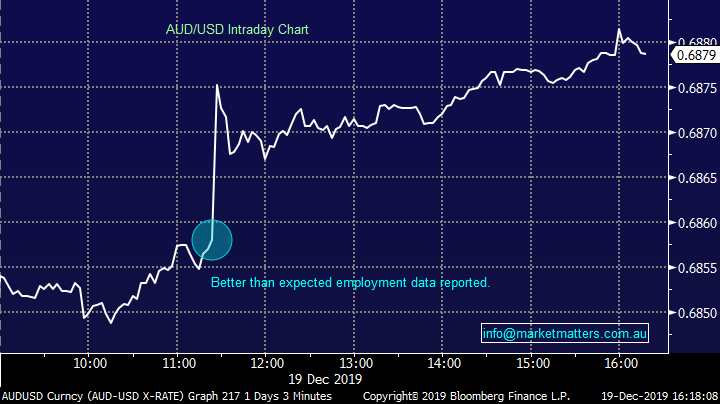

CATCHING MY EYE

Employment Data: Australian Employment Rose +39,900 in November versus and estimated gain of +15,000. The stronger than expected hiring pushed the unemployment rate down to 5.2% from the 5.3% expected. Full-time jobs rose 4,200, Part-time jobs climbed 35,700 and the participation rate was as per expected at 66%. The AUD rallied on the news trading from 68.50c to 68.72 post release, the strength in the currency putting some pressure on stocks. Markets are currently pricing in a 60% chance of a February rate cut.

Australian Dollar/ USD Chart

Service Stream (SSM) +11.07%: The essential network services business has a fully owned subsidiary called Comdain Infrastructure which has a 30% interest in a joint venture (with John Holland, Lend Lease & WSP Australia). That consortium was today awarded a 10 year asset management agreement covering the design, construction, maintenance and facility management of all treatment and network assets in the southern region with the contract expected to deliver $200m revenue to the group, of which, $60m is attributed to SSM. Clearly a good win and the move in SP today is pleasing + it snaps the recent downtrend in the stock. We own SSM in the Growth Portfolio and remain bullish

Service Stream (SSM) Chart

Village Roadshow (VRL) +21.56%: shares gapped higher today on news it had received a takeover proposal from private equity firm PEP. The conditional full cash bid at $3.90 a share represented a 22% premium to yesterday’s close, while PEP was also open to a combination of cash and scrip. Any deal here is certainly in its infancy with a number of loops to jump through yet. PEP have been granted due diligence to run the ruler through the film producer / distributor and theme park owner ahead of a potential pitch to shareholders. VRL shares were briefly as high as the offer price in May of this year before a strategy day skewered the stock. While VRL does not own Dreamworld were a tragedy occurred in 2016, theme parks collectively were hit. VRL owned Sea World, Wet and Wild & Movie World amongst others. A successful takeover could be the best thing for shareholders.

Village Roadshow (VRL) Chart

Broker moves;

· QBE Insurance Cut to Hold at Bell Potter; PT A$13.60

· QBE Insurance Cut to Hold at Morgan’s Financial Limited

· Afterpay Ltd Rated New Outperform at Macquarie; PT A$38

· Integral Diagnostics Rated New Buy at Citi; PT A$4.30

· Spark Infra Rated New Neutral at UBS; PT A$2.05

· AusNet Rated New Buy at UBS; PT A$1.85

· GTN Ltd Raised to Buy at Canaccord; PT A$1

· Codan Cut to Hold at Canaccord; PT A$7.21

· Regis Healthcare Rated New Hold at Jefferies; PT A$2.70

· Estia Health Rated New Hold at Jefferies; PT A$2.45

· Japara Rated New Underperform at Jefferies

· Rio Tinto Cut to Hold at HSBC; PT A$106

· Atlas Arteria Rated New Outperform at RBC; PT A$8.25

· Alkane Reinstated Speculative Buy at Hartleys Ltd

· Northern Star Raised to Buy at Argonaut Securities; PT A$11

· Strike Energy Rated New Outperform at Credit Suisse

OUR CALLS

No changes to the portfolios today.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.