Strong day as company results impress (BHP, KGN, MND, EHE, SEK)

WHAT MATTERED TODAY

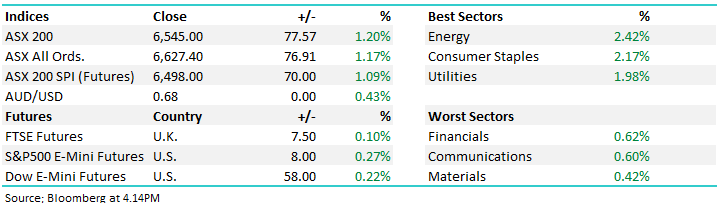

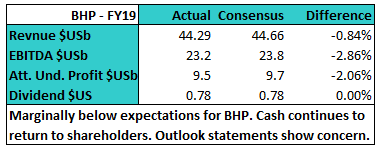

A strong rebound for local stocks today with broad based buying across all sectors despite a slightly weaker than expected result from BHP. Energy the standout sector while Gold continued to lag highlighting the growth v risk theme that has been ebbing and flowing of late. Company results were strong overall today, although some took time to digest during early trade. Kogan (KGN) and Seek (SEK) a case in point here with the FY19 numbers a slight miss but FY20 growth was firmly in focus and they both impressed there. Estia Health (EHE), a business that has had a tough 12 months rallied +8% today, a good result for the MM Income Portfolio while Bluescope (BSL) snapped back from yesterday’s sell-off to close up +7.69%.

Overall, the ASX 200 added +77pts today or 1.20% to 6545. Dow Futures are now trading up +58pts /+0.15%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

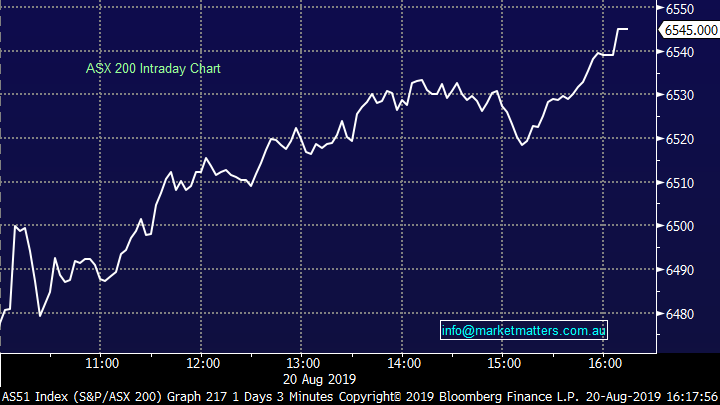

Stocks today: The table below looks at the share price performance of those companies that reported today. A positive outcome overall with another big day of reporting tomorrow. Of note we have BXB, CAR, CWN, DMP – which rallied +6% today ahead of the result, EHL which was also strong ahead of their numbers tomorrow adding +7.41% and SGP which added +3.14% ahead of full year earnings tomorrow.

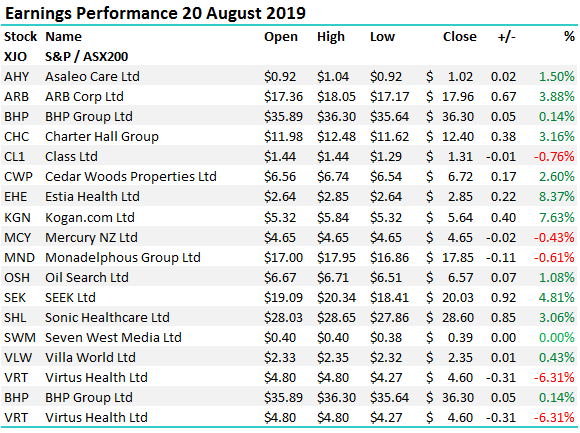

BHP Billiton (BHP) +0.14%: While BHP reported the best profit result in 5 years the FY19 numbers were a slight miss to bullish market expectations – somewhere around 2% shy of market expectation in terms of their underlying earnings from ongoing operations. Not a bad result – record dividends certainly suggests things are going OK - but neither should the result be seen as great. Despite the 4 year uptick BHP is still well short of the heady profitability of both the pre-GFC (US$10-15bn) period and China growth phase (US$10-24bn). . Improved operational cash flow combined with the windfall gains from the shale oil divestment (1H19) underwrote RECORD shareholder returns in FY19, BHP delivered both a record final ordinary dividend and FY dividend – ironically eclipsing the previous high water mark under the now abandoned “progressive dividend policy”. Combined with the merry Christmas buy back (17 December) shareholders have enjoyed ~US$15bn of spoils over the past year. A good, but not great number from the big Australian today.

BHP Billiton (BHP) Chart

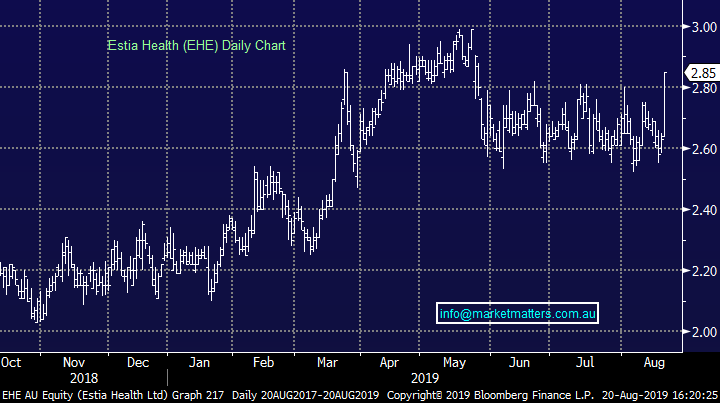

Estia Healthcare (EHE) +8.37%: No doubt a difficult year for the aged care sector however the EHE result today shows they’re doing a good job to in a tough environment. Revenue increased 7.1% on last year while EBITDA was up 4.3% on FY18 with the company investing the $93.8m expanding and upgrading their facilities. They maintained their dividend at 15.8cps for the period putting EHE in an attractive yield of 5.8% fully franked. They provided guidance for EBITDA of $86-$90m for FY20 with the market currently sitting at $89m. Capex will increase in FY20 and be in the range of $120m-$150m. We continue to like EHE for yield.

Estia health (EHE) chart

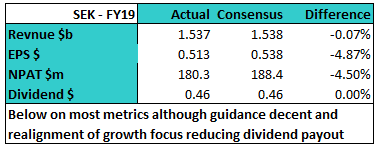

Seek (SEK) +4.81%: A volatile session for SEK today following their full year earnings release this morning – the stock trading down as low at $18.41 only to recover strongly as they provided more commentary on the numbers. On most metrics the result was a miss for FY19 however the miss was explained by reinvestment for future growth which was supported by more upbeat guidance for FY20 - the company expecting revenue to increase by 15 to 18% (mkt was at +14% revenue growth) with EBITDA expected to increase by 8-11% (mkt was at +9.8%). It’s all about growth for SEK and today they reduced their dividend guidance for FY20 to reinvest further into the business which should drive the improved revenue line in FY20. A business growing sales at 16.5% trading on 32x is hardly cheap but they have a v ’good track record of delivering.

Seek (SEK) Chart

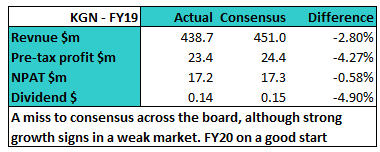

Kogan (KGN) +7.63%; The online retailer missed across the board, although only marginally at the profit line. Kogan still managed 22% profit growth for the year on just 6.4% revenue growth showing margins went a long way to saving the result – a big turnaround in costs seen in the second half. The site saw more than 15% growth in active users over FY19 and these trends looked to have continued. The first month of FY20 has shown gross profit growth of 32% yoy. Consensus is looking for Net profit growth of around 23% in FY20. Much of the upside in Kogan lies in their ability to execute the recently launched Kogan Marketplace structure which allows other retailers to list products on the Kogan site. This booked just $7.1m gross sales in FY19 but had already seen $5m of sales for the month of July.

Kogan.com (KGN) Chart

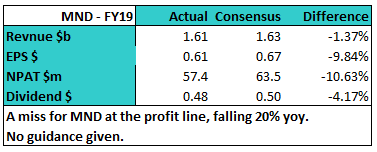

Monadelphous (MND) -0.61%; The resources construction and maintenance contractor has slipped today with the FY19 result coming in below expectations. Profit of $57.4m was 10% below expectations, and 20% below FY18 in what has been a tougher year for MND. While the top line figure was marginally below expectations, higher than expected depreciation number and higher interest expenses contributed to the profit line miss. The maintenance & industrial services division enjoyed a decent year, seeing revenue grow nearly 20%, however this was more than offset by a 35% fall in revenue across the engineering & construction division to see revenue for the group decline by around 7% in FY19.

While no guidance was provided, the company did talk up FY20 with significant increases in CAPEX spend and maintenance requirements expected to lead to increased revenue for MND. They did also point to an increase in competition with margins continuing to decline. The market consensus is looking for 13% revenue growth, and a huge 40% profit growth in FY20. From a technical perspective, today’s rally from the lows is positive.

Monadelphous (MND) Chart

Broker moves;

- Rhipe Downgraded to Hold at Bell Potter; PT A$3

- Netwealth Upgraded to Buy at Ord Minnett; PT A$8.95

- Netwealth Upgraded to Neutral at UBS; PT A$7.25

- Westpac Downgraded to Hold at Bell Potter; PT A$29.50

- NIB Downgraded to Sell at UBS; PT A$6.40

- NIB Upgraded to Neutral at JPMorgan; PT A$6.97

- GWA Group Downgraded to Sell at Citi; PT A$3.13

- Beach Energy Upgraded to Buy at Citi; PT A$2.33

- Beach Energy Downgraded to Hold at Morningstar

- Bluescope Upgraded to Neutral at Macquarie; PT A$10.80

- Altium Upgraded to Neutral at Macquarie; PT A$35.50

OUR CALLS

No changes today

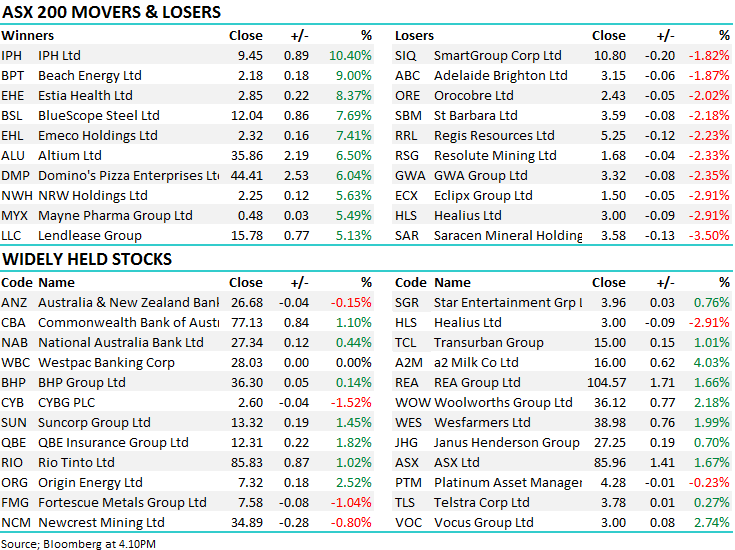

Major Movers Today

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.