Stocks sold off ahead of UK election (WBC, LYC)

WHAT MATTERED TODAY

No sign of a Christmas rally today as stocks opened pretty well in early trade only to succumb to strength in the local currency which put pressure on stocks. Westpac’s (WBC) AGM didn’t help sentiment with the bank splashed over most papers + no doubt it will get a good run tonight in the news – Harry covers the AGM below.

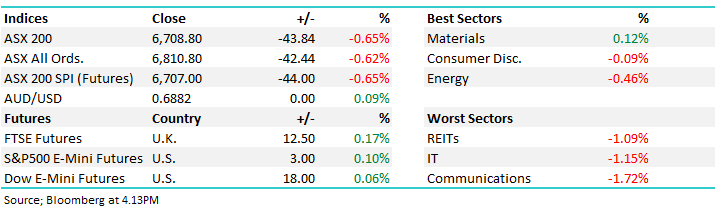

The UK election tonight saw volatility priced a touch higher today – investors buying some protection for an unlikely labour win while we also have the ECB decision on rates. At a sector level today, financials usurpingly weak while the materials were again a place or relative strength to be the only sector closing in the green for the session. Telstra’s 2% decline weighed on the communication sector. Overseas markets were mostly higher today, Asian markets up between +0.30% & +1.26% while US Futures were a touch higher during our time zone.

Overall, the ASX 200 lost -43pts /-0.65% today to close at 6708. Dow Futures are trading marginally higher up by +18pts/+0.06%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

UK Election: Is on tonight and will be the clear driver of markets, of the 5 stocks we talked about in the AM note today (click here) Pendal (PDL) finished down 0.12%, , Iress (IRE) fell -1.13%, Janus Henderson (JHG) -1.28%, Xero (XRO) -1.54% to & Sims Group (SGM) closd +0.27% higher.

The Pound v the Dollar traded higher into the vote.

British Pound v US Dollar Chart

Westpac (WBC) –1.23%; bank shares in general sold off today against the backdrop of a weaker market. Westpac fronted shareholders at their AGM today, spending the bulk of the meeting apologising to investors, stakeholders and anyone impacted by their shortcomings. Interim CEO Peter King was keen to acknowledge that these issues were no longer occurring within the bank although admitted there was some way to go before the bank would be completely comfortable with their processes.

Despite the backlash seen at the event, it appears departing Chairman and the interim CEO managed to woo large institutional investors over such that the remuneration report is accepted and the board is not spilled. A few board members were still up for re-election and all look to have kept their jobs for now. Ex ANZ CFO Peter Marriott who held a position in the risk committee – and notably did not confirm when asked if he had read the Hayne report in full – had a close call but ultimately snuck through with a 58% vote.

The bank also pointed out that earnings were likely to remain under pressure through FY20 with low rates, minimal loan growth and further remediation work required. A lot of this is built into the share prices of the banks, and for that reason we like WBC around currently levels,.

Westpac (WBC) Chart

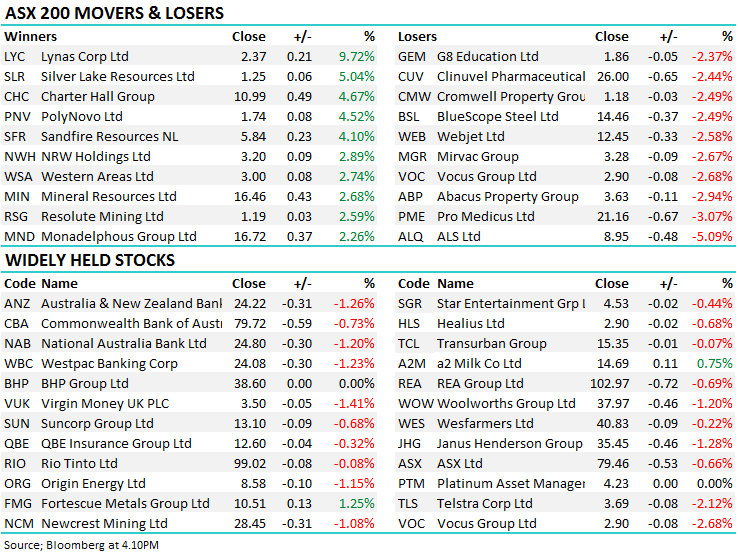

Lynas (LYC) +9.72%; stormed ahead today on reports they are in the running for a contract with the US Army who are looking for a partner in a rare earths processing facility in the states. Lynas recently announced a processing facility will be built in Kalgoorlie WA near to their Mt Weld mine, however today they are rumoured to be pitching a pilot plant to the US military who are looking to open a facility following threats China will stop exporting. The minerals are a key component in electronics and Lynas is one of a few producers outside of China.

Lynas (LYC) Chart

Broker moves;

· Peak Resources Rated New Speculative Buy at Foster Stockbroking

· Rio Tinto Cut to Neutral at Citi; PT A$100

· Rio Tinto ADRs Cut to Neutral at Citi

· Evolution Raised to Equal-Weight at Morgan Stanley

· Iluka Cut to Equal-Weight at Morgan Stanley

· Iluka Cut to Sell at Citi

· Whitehaven Cut to Neutral at Citi; PT A$2.90

· Harvey Norman Rated New Buy at Jefferies; PT A$4.80

· JB Hi- Fi Rated New Hold at Jefferies; PT A$38

· Seven West Rated New Hold at Jefferies; PT 38 Australian cents

· Nine Entertainment Rated New Buy at Jefferies; PT A$2.07

· GWA Group Reinstated Neutral at Goldman; PT A$3.45

· ALS Cut to Sell at Goldman; PT A$8

· Bingo Industries Cut to Hold at CCZ Statton Equities Pty Ltd.

OUR CALLS

No changes to the portfolios today.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.