Stocks rebound after yesterday’s sell off (Z1P, SCP, BWP) – International buy alerts **V.US, 700.HK, 2318.HK, COPX.US, IEM, BNKS**

WHAT MATTERED TODAY

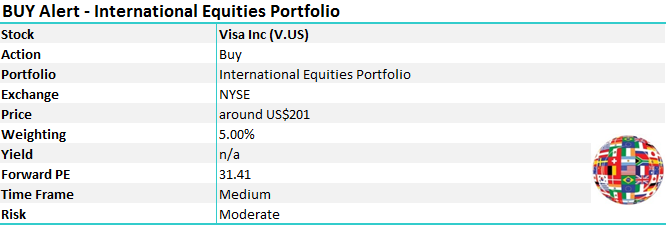

An interesting session across the board today with stocks bouncing back a quarter of yesterday’s aggressive sell-off. While the focus was still on the coronavirus when turning on the news (once Barnarby Joyce was defeated in a leadership tilt for the Nats) there’s more focus starting to skew towards reporting season. A few out with numbers today, Shopping Centres Australasia (SCP) beat, BWP Trust (BWP) came inline, while Cimic (CIM) also reported numbers although no new news given the recent downgrade other than a new CEO appointed. Janus Henderson (JHG) reports tonight which we’ll be watching closely, the stocks has been well bid recently.

The RBA kept rates on hold today as expected, although from the rally in the AUD and slight sell off in the mkt post the release perhaps a few were thinking a cut was on the cards given the growth impact of the virus to our major customer. The Aussie eventually settling at 67.18c

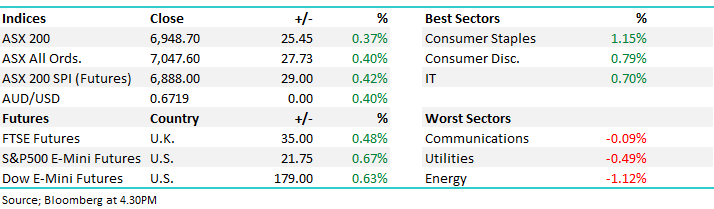

Overall, the ASX 200 added +25pts / +0.37% today to close at 6948. Dow Futures are trading higher by +179pts/+0.63%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Big Moves: Buy Now Pay Later (BNPL) stocks did well today led by Zip Co (Z1P) which put on an impressive ~12%, the stock looks bullish here after a period of consolidation, while Afterpay Touch (APT) traded to new all-time highs just shy of $40. The minnow in the sector OpenPay (OPY) announced a deal with Woolworths to use its software but nots its BNPL services, the stock added +3.33% to close at $1.24.

Z1P Co (Z1P) chart - looks bullish

Shopping Centres Australasia (SCP) +3.85%; outperformed today on the back of a solid first half and an unexpected upgrade to Funds from operations (FFO) guidance for the year. SCP, which own and operate a number of neighbourhood shopping centres anchored by supermarkets, saw NPAT for the half more than double on 1H19 to $90.2m allowing a first half distribution of 7.5c. FFO guidance was bumped up to 16.9c, from 16.7c, and while this is only a small upgrade, it comes when the market has been talking down the ability of retail landlords to grow earnings. SCP still expect to pay a full year distribution of 15.1cpu. Although they are doing well in a tough environment, it’s hard to get excited by the stock.

Shopping Centres Australasia (SCP) Chart

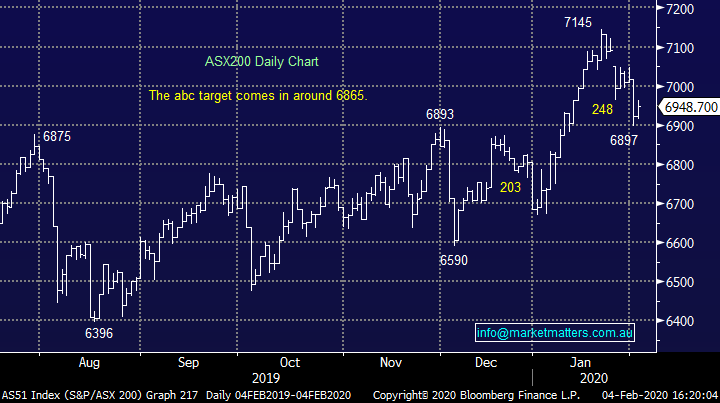

BWP Trust (BWP) +0.49%; the landlord to a number of Bunning’s sites traded marginally higher today on their first half report which was more or less in line with expectations. With 97% of the portfolio leased and WALE of over 4 years with leases linked to CPI, BWP continues the trend of consistent earnings with marginal growth year on year. BWP maintained that distributions are expected to rise by 1% on last year, in line with market expectations.

BWP Trust (BWP) Chart

Broker moves; OSH in the cross hairs. Change of CEO, uncertainty in PNG, an Oil price on the slide – not a lot to like about OSH at this point.

Morgan Stanley tweaked their banking calls.

· JB Hi-Fi Raised to Neutral at UBS; PT A$37.80

· Harvey Norman Raised to Buy at UBS; PT A$4.50

· Oil Search Cut to Neutral at Macquarie; PT A$6.80

· Oil Search Cut to Negative at Evans & Partners Pty Ltd; PT A$7

· Oil Search Cut to Sell at Shaw and Partners; PT A$6.70

· Service Stream Rated New Outperform at Macquarie; PT A$3.19

· HT&E Raised to Neutral at Macquarie; PT A$1.65

· IGO Raised to Hold at Morningstar

· oOh!media Raised to Buy at Morningstar

· National Storage REIT Raised to Hold at Morningstar

· nib Raised to Equal-Weight at Morgan Stanley; PT A$5.45

· ResMed Rated New Underperform at CLSA

· ANZ Bank Raised to Neutral at Credit Suisse; PT A$26

· FlexiGroup Raised to Add at Morgans Financial Limited

· Northern Star Cut to Neutral at JPMorgan; PT A$13

· Newcrest Raised to Neutral at JPMorgan; PT A$30

· CBA Cut to Underperform at Credit Suisse; PT A$77.60

· Wesfarmers Raised to Equal-Weight at Morgan Stanley; PT A$40

· Westpac Cut to Underweight at Morgan Stanley

· ANZ Bank Raised to Overweight at Morgan Stanley; PT A$26.60

OUR CALLS

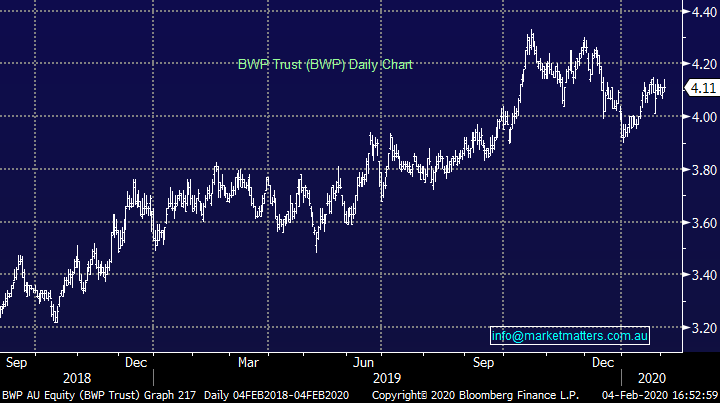

A number of changes across our International Portfolio’s today as outlined below.

MM International Equites Portfolio

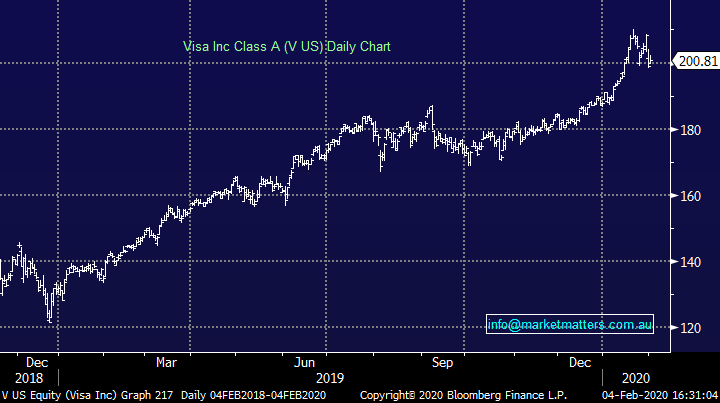

We’re taking a new position in Visa in the international equities’ portfolio with a 5% weighing.

Visa (V US) Chart

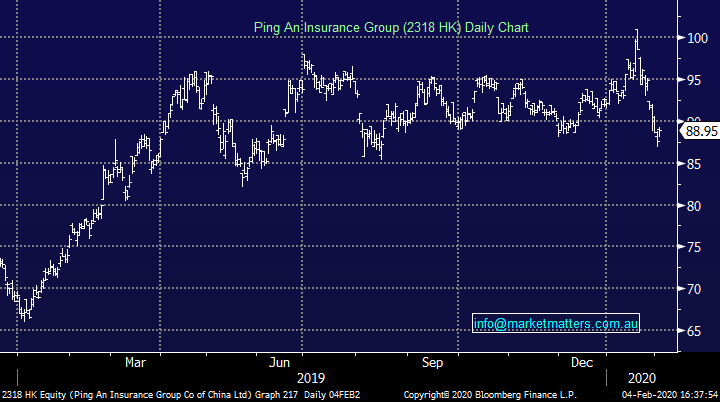

We’re also adding to existing positions in Hong Kong based Tencent (700.HK) and Ping An (2318.HK)

Tencent (700.HK) Chart

Ping An Insurance (2318 HK) Chart

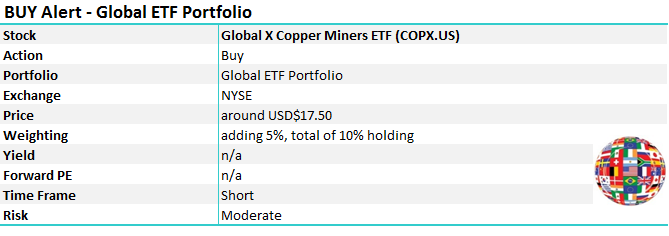

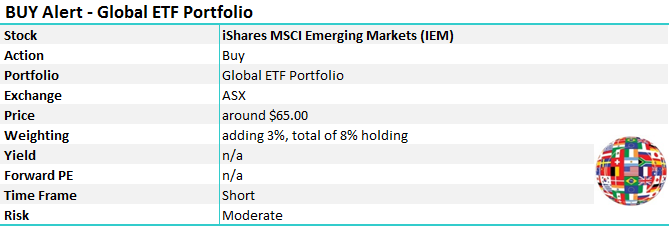

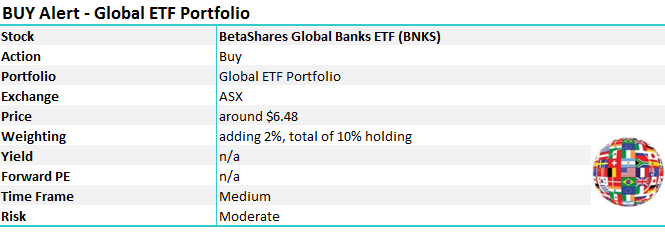

MM Global Macro ETF Portfolio:

We are adding to a number of existing positions in this portfolio as outlined below.

Listed in the US, we are increasing our weighting to the Global X Copper ETF, taking it to 10%.

Global X Copper (COPX US) Chart

We are adding to our existing position in the emerging markets ETF listed in Australia, increasing to an 8% weighting.

Emerging Markets (IEM) Chart

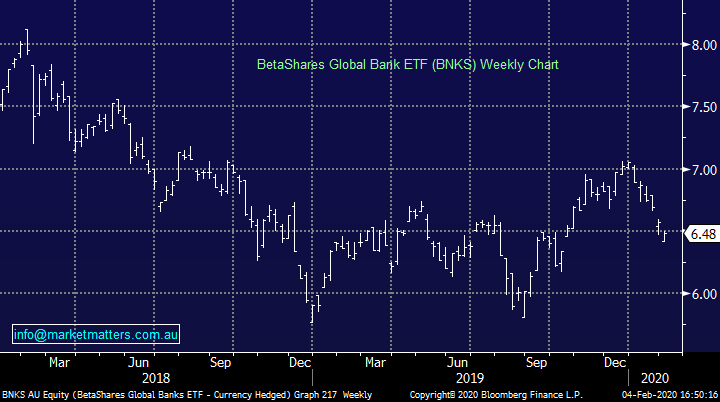

And upweighting our exposure to global banks. Via the Betashares Global Banks ETF listed in Australia

Betashares Global Bank ETF (BNKS) Chart

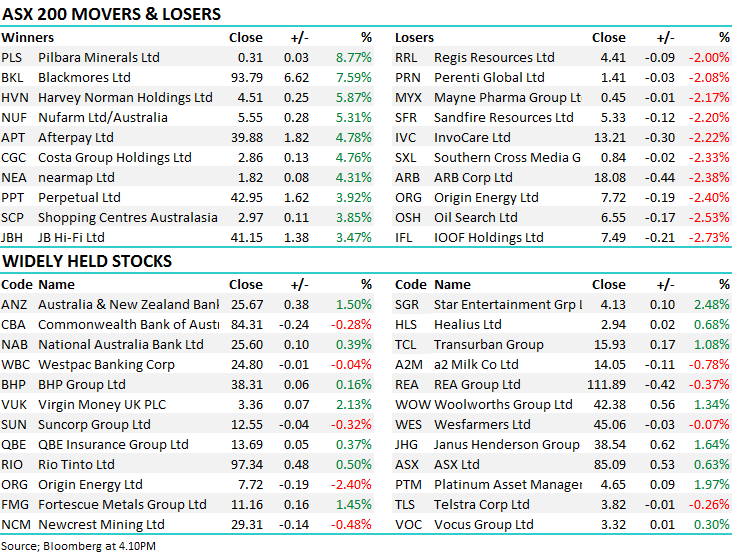

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.