Stocks rally as Santa prepares his sleigh (PRN, SIQ)

WHAT MATTERED TODAY

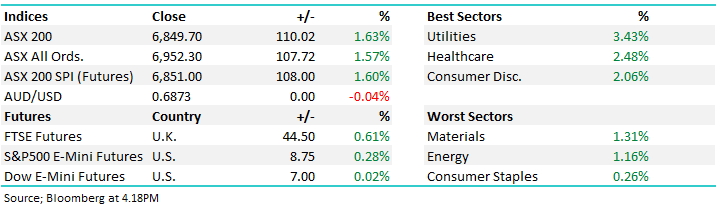

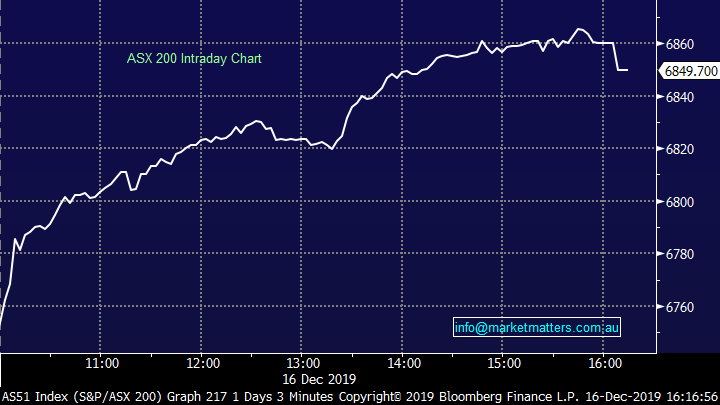

A booming session for the ASX today well and truly outpacing other regional markets while US Futures were also fairly muted during our time zone – it was simply a case of some aggressive catch up with buying across the board. All sectors closed higher today, even the more defensive areas like consumer staples and real-estate managed to cop a bid tone in what’s very typical of a Christmas style rally – i.e. fuelled by a lack of selling more than aggressive buying.

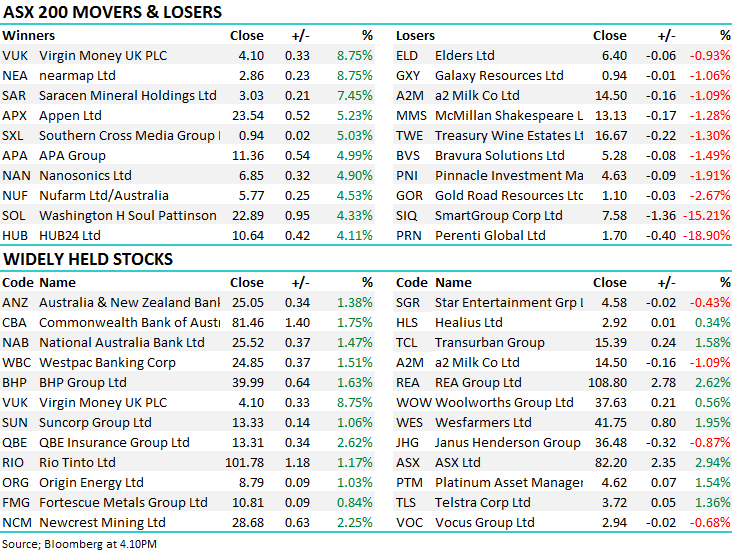

Banks can often be the difference and today they were up strongly, around ~1.70% a pop for the big four bouncing nicely from oversold levels, Westpac now knocking on the door of $25 after hitting a recent low of $23.86, however it wasn’t all beer and skittles, Smart Group (SIG) tanked 15% while the old Ausdrill, now called Perenti (PRN) fell by 19% after losing a contract, more from Harry on those below.

Overall, the ASX 200 added +110pts /1.63% today to close at 6849. Dow Futures are trading marginally higher up 7pts/0.02%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Smart Group (SIQ) –15.21%; the salary packaging stock business took a big hit today after receiving notice from the company’s underwriting partner of changes to the various products terms. The contract with the underwriter is up for renewal in May next year with the new terms coming into effect from July with all authorised representatives impacted – including Smartgroup. SIQ expects a $4m hit to earnings, or around a 5% impost – which doesn’t seem like a lot, but it results in no growth in earnings in FY21 based on consensus expectations.

Smartgroup (SIQ) Chart

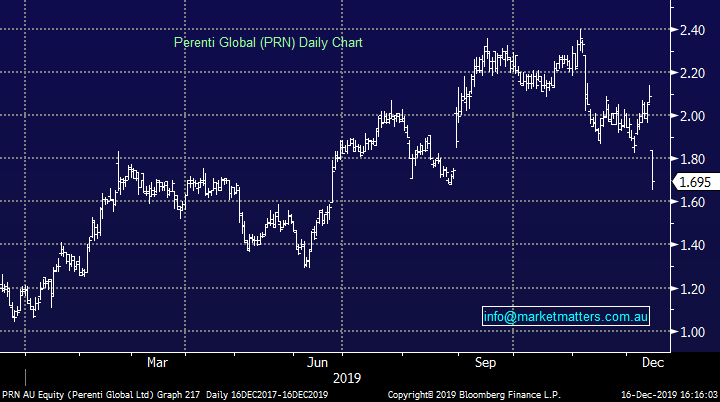

Perenti (PRN) -18.9%; mining services firm Ausdrill has had a tough time trading since changing its name to Perenti with the slide picking up pace today. Shares were off after the company announced an equipment hire contract with Ghana Manganese Company (GMC) had been terminated. The decision by GMC was a result of pressure from the Ghana Government to limit production at the mine. While Perenti remained confident it could recoup some of the lost payments out of the contract and redeploy the capital and equipment to other mines in the area, the company downgraded NPAT guidance around 15% to $115m-$120m for FY20. Not one to catch the falling PRN knife at this stage.

Perenti (PRN) Chart

Broker moves;

- Z Energy Raised to Outperform at Forsyth Barr; PT NZ$4.68

- Z Energy Raised to Neutral at Jarden Securities; PT NZ$4.35

- Bluescope Raised to Overweight at JPMorgan; PT A$17

- Bluescope Raised to Outperform at Macquarie; PT A$16.50

- Pushpay Raised to Outperform at Macquarie; PT NZ$4.61

- Decmil Cut to Hold at Argonaut Securities; PT A$1.10

- QBE Insurance Raised to Buy at Bell Potter; PT A$13.60

OUR CALLS

No changes to the portfolios today.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.