Stocks hit, QBE in the firing line, more competition in BNPL (Z1P, QBE)

WHAT MATTERED TODAY

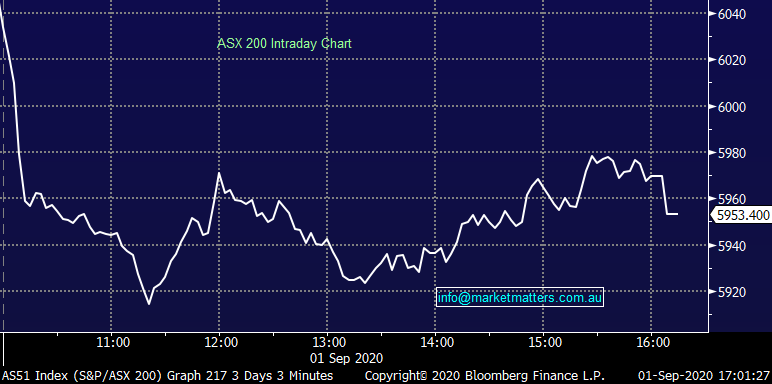

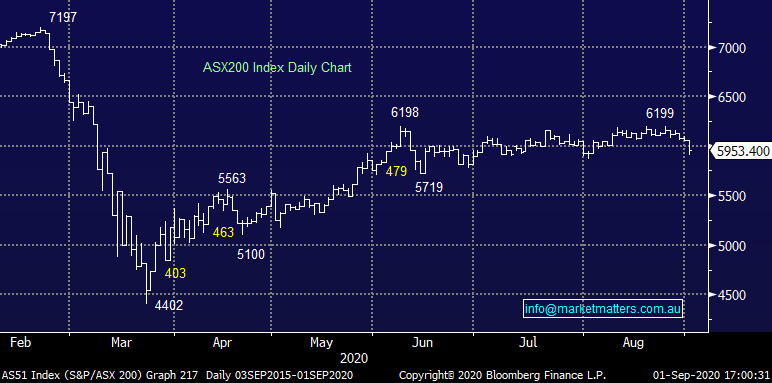

A poor start to September for the ASX with the market giving back 80% of August’s solid gains on day one. Initial weakness came from a sell-off overseas in the sectors that dominate our index - financials / resources / healthcare, however the resilience of US tech failed to support our technology stocks with BNPL companies taking one on the chin after a solid few weeks.

Locally, building approvals data was very strong at 11.30am this morning, up 12% MoM v -2% expected and that helped stocks exposed to that sector (BIN +1.35%) while the RBA kept rates on hold as expected at 2.30pm, they did announce an expansion and extension of its Term Funding Facility ensuring credit continues to flow - as it talked again about the recovery likely to be “uneven and bumpy” with the latest lockdown measures in Victoria meaning that a rebound in Australia’s labour market is likely to be some months off – all pretty much expected and the AUD edged back above the 0.7400 handle following the meeting,

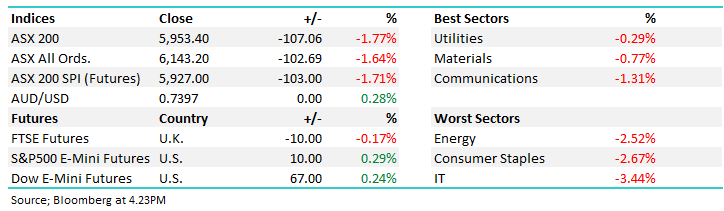

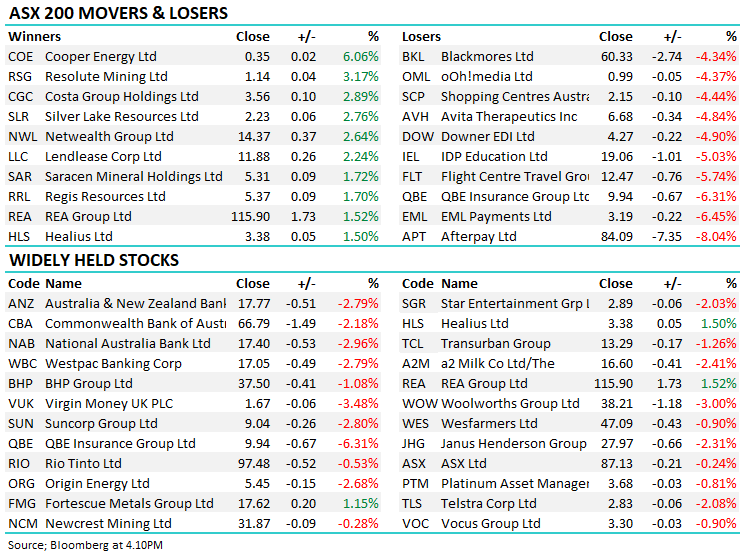

At a sector level today, IT stocks were hardest it, while the defensive utilities did best, however the selling was broad based as the red in the table above implies, just 16% of the ASX 200 finished in the green. Worth also noting though that we did have a large number of stocks trading ex-dividend today which put an added weight on the market.

The sell-off today was very Aussie centric with US Futures holding firm during our session while Asian markets were generally all higher.

Overall, the ASX 200 fell -107pts / -1.77% to close at 5953. Dow Futures are trading up +67pts / +0.24%%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

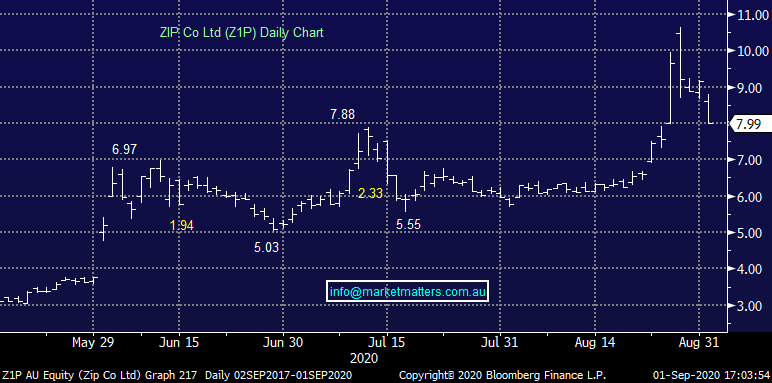

Paypal: News overnight that payments heavyweight PayPal is launching a Pay in 4 Solution, effectively copying current BNPL platforms. The move obviously brings competition back to investors’ minds; however it shouldn’t be a real surprise. Other large payment/credit companies have made similar announcements over the last year and rising competition, particularly in the US is an obvious bi-product of the success Australian companies have had in the space. In Australia, 25% of the population have BNPL accounts however less than 5% of Americans do + the size of the pie is bigger.

Zip also announced today the completion of the Quadpay acquisition. Overall, the sector was sold off reasonably hard on the back of the PayPal news, Afterpay (APT) -8.04%, Zip Co (Z1P) -12.77%, Openpay (OPY) -7.18%, Sezzle (SZL) -14.7%, Splitit (SPT) -7.26%. The sector taking a breather is not a reason to run for the hills – yet! Zip Co (Z1P) likely to be added to the ASX 200 in the rebalance that happens this week

Zip Co (Z1P) Chart

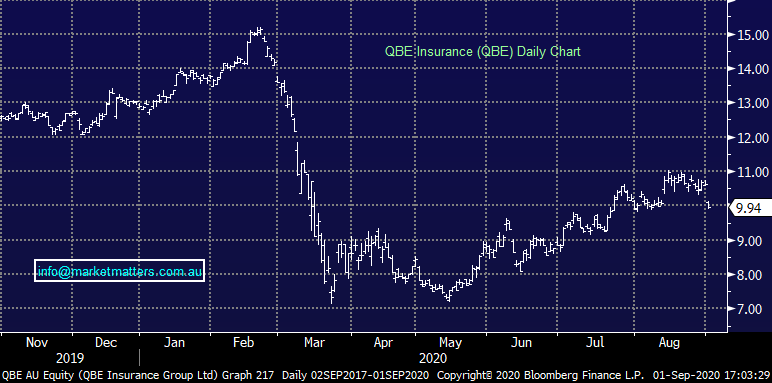

QBE Insurance (QBE) -6.31%: Hit today after the CEO was stood down by the Chair following inappropriate / unethical communications with a female employee – not good. CEO Pat Reagan was known as a hard nose granular sort of operator that had started to turn the QBE ship around, however todays update was poor on a number of fronts. Simply no need to be there in our view. As an aside, subscribers that are familiar with our Insurance Analyst at Shaw, Brett Le Mesurier may find his summation of today’s news interesting.

From Brett Le Mesurier…Good night, sweet prince …one of his finest diatribes on the insurer to date…

As Hamlet lay dying poisoned by treachery, his friend Horatio uttered the words “good night, sweet prince”. It is cruel to refer to the departure of QBE’s most recent CEO with such a Shakespearean quote. Hamlet’s motivation, character, thoughts, and actions have kept scholars engaged for centuries. Such ongoing interest will not extend to QBE’s latest act.

Hamlet was consumed with identifying and exposing those responsible for the death of his father, against an international threat lurking in the background. The consequences of his quest were tragic. QBE’s quest has been to provide hope for shareholders that the forces responsible for its poor international performance would be tamed. The outcome of that quest appears to be tragic for many shareholders thus far. The prince of Brilliant Basics will not be there to complete the task.

He leaves with the combined operating ratio (COR) at an astoundingly high 109.5%, an insurance loss of US$584M, an insurance margin of minus 10.6%, a net earned premium (NEP) decline of 3% in 1H20 and raised over US$1B in capital after taking investment risk which has proved to be excessive. This has occurred as premium rates have escalated.

It’s this premium rate escalation that delivered hope but it’s that same escalation that delivered the poor returns. The link that shareholders have ignored is that premiums respond to claims. This means that claims increase before premiums and when claims stop increasing so do premiums.

The new CEO may not only understand this connection but effectively communicate it to ensure that the market’s expectations reflect the most likely outcome rather than an overly zealous interpretation of the value of such rate increases. Profit expectations could be lowered, and claims reserves may increase. QBE has recently been reporting adverse claims development.

Today’s market release from QBE referred to an “investigation concerning workplace communications that the Board concluded did not meet the standards set out in the Group Code of Ethics and Conduct”. A review of that code suggests that the offense may have been a breach of the following paragraph. While the company has provided insufficient details to be sure of this, the last part of the excerpt is probably relevant. “Go bid the soldiers shoot” (Hamlet Act 5, Scene 2). Source: Shaw and Partners

BTW, he has a SELL & $8.00 price target

QBE Insurance (QBE) Chart

Starpharma (SPL) +12.21%: positive news for SPL today saying it has applied its DEP drug delivery technology to create a long-acting, water soluble version of remdesivir. The benefits are apparently strong hence the pop in SP today…

BROKER MOVES

· Cooper Energy Raised to Buy at Bell Potter

· Gr Engineering Raised to Buy at Moelis & Company; PT A$1.28

· AGL Energy Raised to Neutral at Macquarie; PT A$14.98

· Insurance Australia Raised to Outperform at Macquarie

· Panoramic Resources Rated New Buy at Foster Stockbroking

· Fleetwood Cut to Hold at Moelis & Company; PT A$2.09

· Temple & Webster Raised to Buy at Canaccord; PT A$10

OUR CALLS

No changes today

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.