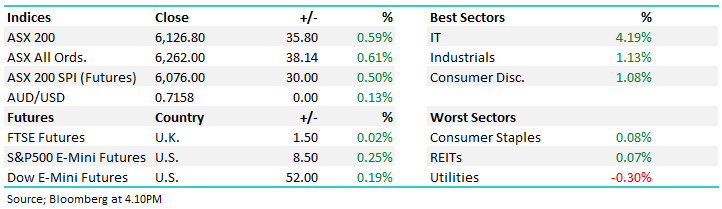

Stocks end a good week higher (NAB, NCM, MSB, BBN)

WHAT MATTERED TODAY

A reasonable session to end the week with the market higher despite weaker than expected data coming from China – then again, weak data = stimulus = stocks go higher! Overall, it was really nice to get back into looking at company earnings rather the Coronavirus stats this week. While the virus is still very much in play its far more interesting to think about corporate earnings – and this week we had a large whack of them with more to come over the next two weeks. While there were clear hits and misses over the week, overall results were positive against low expectations.

As a sector level today, IT the standout with a few of our stocks in that space doing well – XRO, Z1P and the like, while Afterpay put on more than 6%.

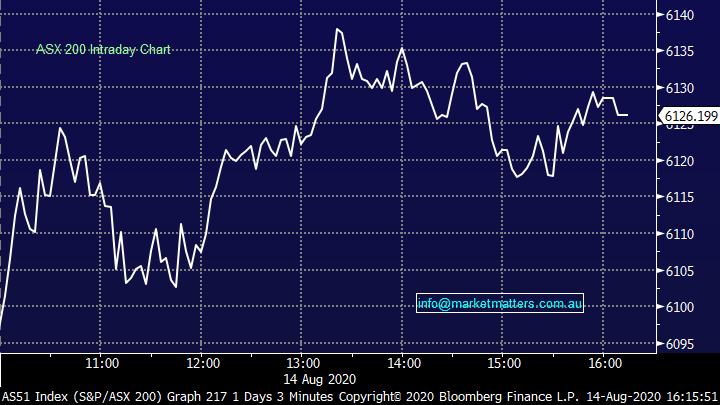

As mentioned above, Chinese data was weaker today, a bunch of metrics below expectations however stocks looked through it, and move higher from the 11.30 low,

China data today

Source: Bloomberg

Asian markets edged higher today while US Futures were in the green during our time zone.

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

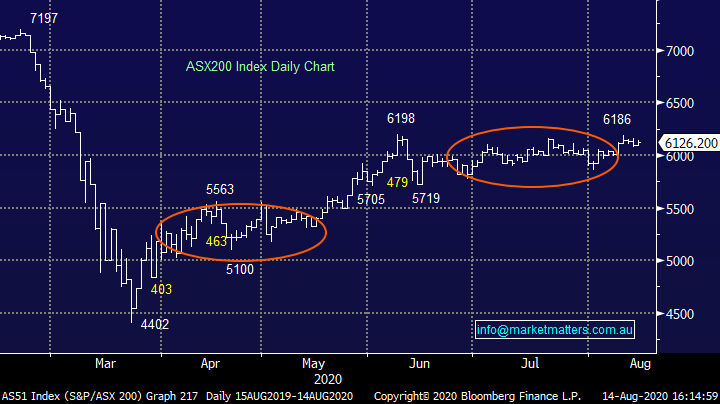

Overall, the ASX 200 closed up +35pts or +0.58% to 6126 today. US Futures are higher, with Dow Futures up +82pts/0.30%.

ASX 200 Chart

ASX 200 Chart

CATHCING MY EYE

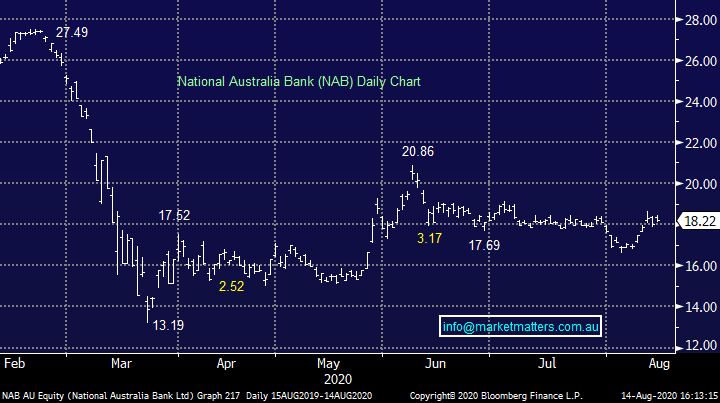

National Bank (NAB) +1.17%: Out with a quarterly trading update today showing cash earnings of $1.55B for 3Q20 which puts them on track to meet current earnings expectations for the full year. The treasury & markets division was a standout, more than recovering from their miserable 1H20 performance which enabled NAB to report 10% income growth in 3Q20 compared to the quarterly average of 1H20. Their net interest margin is unchanged from 1H20 to 3Q20 as a result of the improved treasury performance which offsets the impact of lower interest rates and competition. Expenses are 2% higher in 3Q20 compared to the quarterly average of 1H20 with COVID impact to blame. They were supposed to be unchanged. They confirmed that 12% of home loans are subject to deferral and 16% of business loans. All up, an inline update.

National Bank (NAB) Chart

Newcrest (NCM)-0.90%: I said this morning that the result was a beat, and on first read through it was with both profit and dividends coming in ahead of the street. The balance sheet was strengthened during the year and the company is “rich” with 3-5 tier 1 growth opportunities. Their underlying NPAT was $750M vs consensus of $703m + other metrics were strong, however the stock closed down - Why? Operational issues at Lihir continue with grades disappointing. Frustrating to say the least when it did look like Lihir was on the improve. NCM screens ‘cheap’ when looking at gold stocks globally and todays update on Lihir refocussed attention on why that is. Anyway, we’ll see how it plays out from here but we we’re not that enthused by todays news.

Newcrest Mining (NCM) Chart

Mesoblast (MSB) +39.05%: we wrote about the FDA issues in Tuesday’s report and now the biotech looks to have put the issue behind them. A vote by an advisory committee went in favour of Mesoblast’s RYONCIL drug 9 to 1. Though the vote is non-binding, the FDA will now consider the recommendation and make a final determination by 30 September.

Mesoblast (MSB) Chart

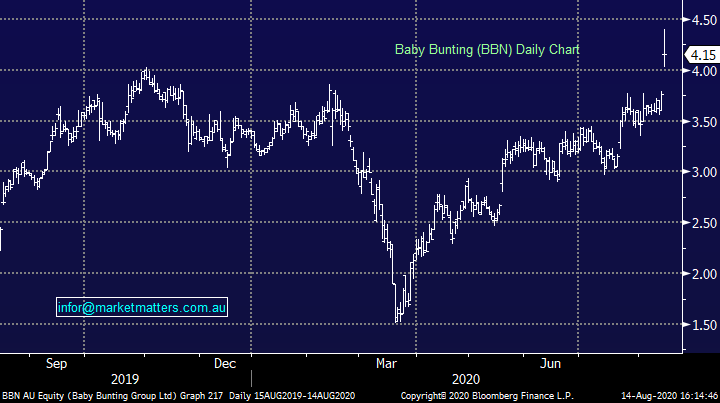

Baby Bunting (BBN) +10.37%: top line growth of 14% and Profit growth of 34% were both better than expectations for Baby Bunting’s full year result out today. NPAT of $19.3m was a little ahead of expectations, driven by a 91% lift in Click & Collect orders into the second half of the year. As with many other retailers, the online presence had to be accelerated as the pandemic hit and BBN was able to capitalized on the shift. Despite the fall in travel related products, BBN saw sales growth of 11.8% for the full year, and +15.3% in the second half alone. The momentum has continued into the new financial year with LFL sales up 20% for the first six weeks, though the company didn’t give guidance for the full year.

Baby Bunting (BBN) Chart

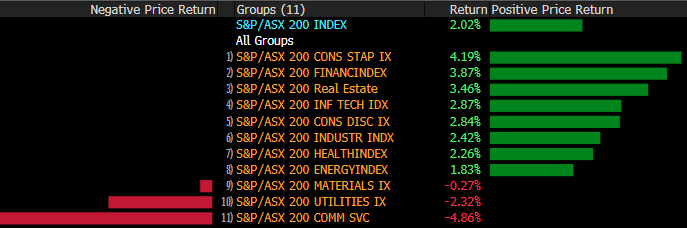

Sectors this week

Source: Bloomberg

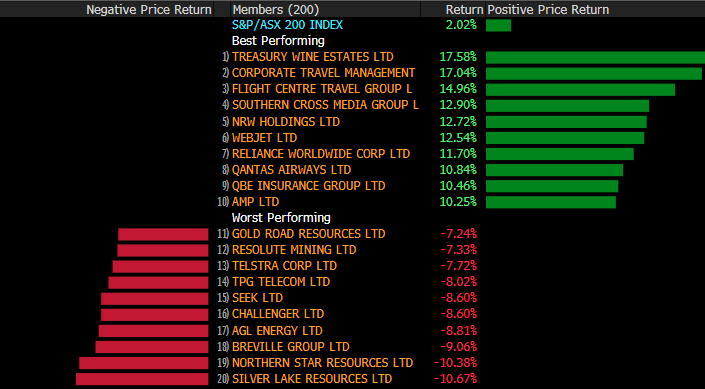

Stocks this week

Source: Bloomberg

OUR CALLS

No changes today

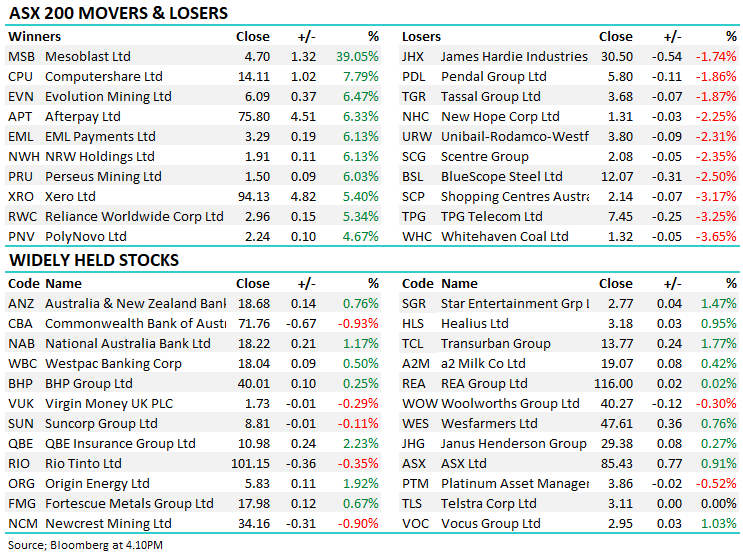

Major Movers Today

Have a great night

James, Harry and the Market Matters team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.