Stocks edge lower but aged care providers defy the RC & rally (BEN, JHC, EHE, JBH)

WHAT MATTERED TODAY

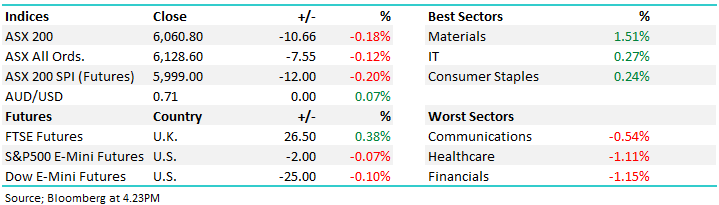

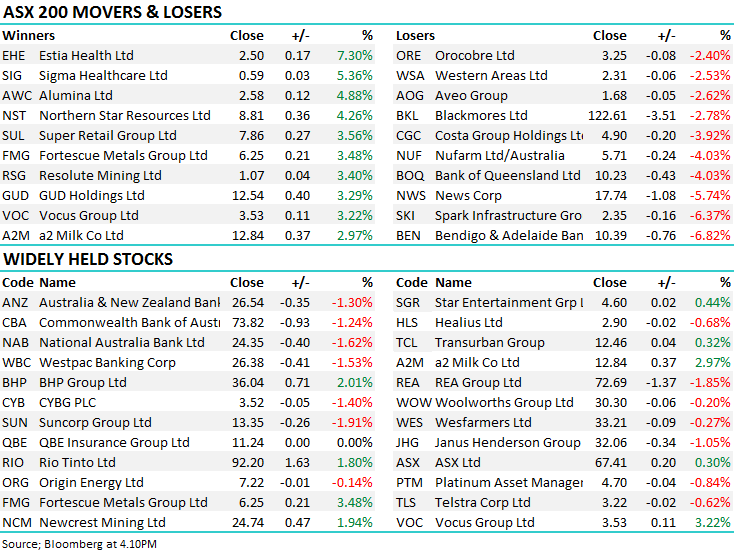

A fairly lacklustre open to the trade this morning with the market trying to take the high road before succumbing to selling, mainly focussed in the banks following last week’s strong run up. That said, buyers bought the weakness from around lunchtime onwards and the market recovered into the close. At its worst the ASX 200 was down ~40points but closed down just 10 as we saw some decent volume start to flow back into the big 4. On the reporting front, Bendigo released a weak set of numbers, with revenue down and costs meaningfully higher – really soft underbelly there, while JB Hi-Fi (ASX:JBH) was reasonable (given the tough retail environment).

Chinese markets re-opened today after a week long holiday for Chinese New Year celebrations, and unsurprisingly the iron ore traders were busy, with the price breaching the limit up level early on. That continued to give the broader mining space support with Alumina (ASX:AWC) putting on +4.88% while Fortescue (ASX:FMG) added another 3.48% to close at $6.25

Overall, the ASX 200 closed down -10points or -0.18% to 6060. Dow Futures are currently trading down -28pts.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Reporting; BEN and JBH in focus today and Harry has covered them off below – we have no interest in either name at this stage. Amcor (ASX:AMC) was decent and worth more of a look – they beat strongly on the profit line and the stock rallied as a result. In the property space, GPT delivered full year results which were in line with expectations – Funds from Operations were +3.7% on pcp to $574.6m while FY19 guidance is FFO/share growth of +4% (implying ~33.1¢¢) and DPS growth of 4% (implying 26.5¢). The stock up smalls as a consequence.

A quieter day tomorrow however in addition to below we also have Macquarie (ASX:MQG) out with an operational briefing…Mkt is now looking for full year profit growth of ~18% which is a big number after a volatile December quarter!

Source; Bloomberg

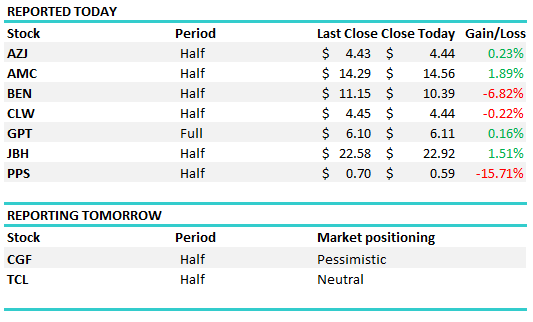

Aged Care; Despite being on the midst of their own Royal Commission, aged care providers rallied today – and pretty aggressively at that – following the Government’s pledge of $662m to the sector. Although some of the spend will go towards alternatives to nursing homes such as in-home care, the bulk will be allocated to providers in an effort to increase support for Australia’s aging population – Japara (ASX: JHC) was up 5.2% & Estia (ASX: EHE) +7.3%. The Commission began in January, but only just began hearing submissions from those impacted by poor conduct today…

Japara Healthcare (ASX:JHC) Chart

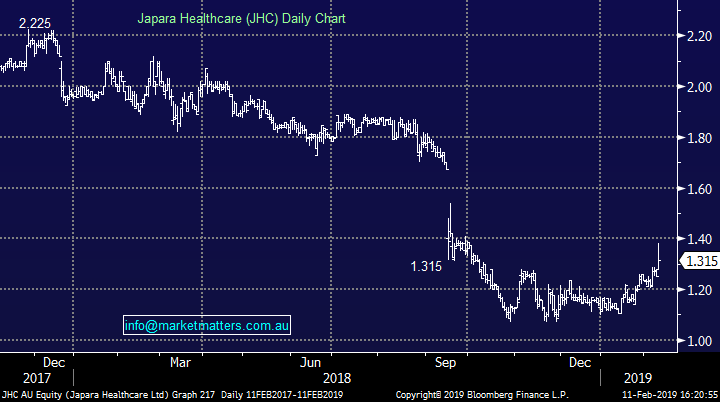

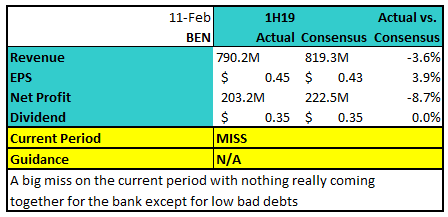

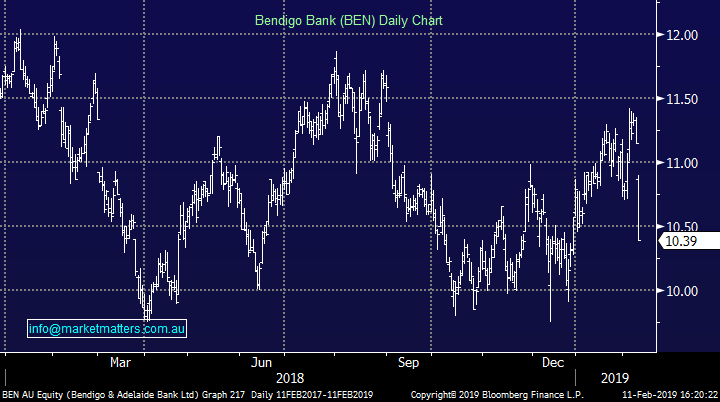

Bendigo (ASX: BEN) -6.82%; The regional bank has slumped today, taking other financial stocks with it on a soft first half result. Bendigo has missed on expectations, as costs rise and income falls – BEN missing expectations by ~2% at the profit line. Bendigo was hoping to see loan growth in the face of the Royal Commission but in the end saw the loan book shrink over the half and revenues fall by around 1%. Mortgages might have grown, but a measly 2.7% growth there was more than offset by the slump in commercial lending.

Net Interest Margin (NIM), the difference between what the bank pays for funding vs the rate it loans out to you and I, fell 3bps between the 2nd half of 2018 and this 1H19 – not a trend you see often with a shrinking loan book. To add to the woes of the result, costs continue to skyrocket, up 8% from the 6 months prior as the bank struggles to grow. The only positive of the update was a continued slide in bad debts, yet this wasn’t enough to cover the impact of rising costs on falling revenue. We prefer the major banks here over the regionals.

Bendigo (ASX: BEN) Chart

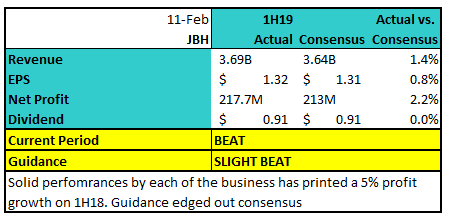

JB Hi Fi (ASX: JBH) +1.51%; the first of the big retail names to report and the one with the biggest short interest (~16%), JB Hi Fi’s result was better than expected, and even the outlook was not the car crash that the market had feared. The big surprise in the result was the performance of the Good Guys, the business that has been a big drag on JBH results for the past few years. The GG’s printed sales growth of 1.5% while margins actually expanded, although off a low base. The NZ operations also saw some improvement, although JBH NZ is a small portion of the group’s profit.

Outlook was mixed, however few in the market are positive Australian retail, so it looks a better than expected outlook. January has seen some slowing sales yet guidance for the full year was at worst in line with expectations. JB is looking at full year profit of $237-$245m vs consensus of $239.6M at the lower end. Overall, the group profit rose over 5% on the first half of FY18, the dividend grew 6%, guidance was slightly better and the stock has rallied over 1.5% today as a result.

JB HiFi (ASX: JBH) Chart

Broker Moves; Village Roadshow (ASX:VRL) is a stock with momentum behind it and now we have Citi upgrading to a buy. The stock has run from ~$1.80 to close today $3.23…

· Freedom Foods Rated New Buy at UBS; PT A$6.70

· Sandfire Rated New Overweight at Morgan Stanley; PT A$8.65

· CBA Downgraded to Hold at Morningstar

· OZ Minerals Upgraded to Hold at Morningstar

· Stockland Downgraded to Hold at Morningstar

· Rio Tinto Downgraded to Hold at Investec; PT 44.78 Pounds

· Wesfarmers Downgraded to Hold at Shaw and Partners; PT A$34.20

· Village Roadshow Upgraded to Buy at Citi; PT A$3.65

OUR CALLS

No amendments today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.