Stocks decline with weakness in healthcare to blame (TYR, ABC)

WHAT MATTERED TODAY

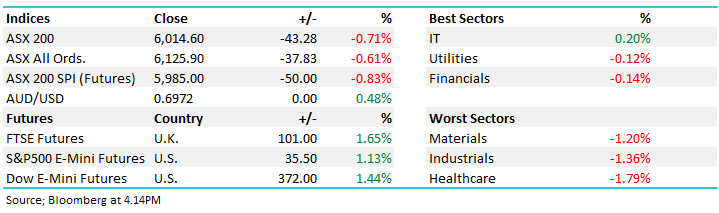

A choppy session today with the market down early, a strong recovery into lunchtime before the sellers took hold and put the boot in late, the ASX closing on its lows. IT stocks the only sector to close in the green today, but only just while a -2.24% fall in CSL weighed on the healthcare space, the weakest link on the day. Chinese stocks were in focus and continued their strong run, a theme we discussed in the weekend note on Sunday – click here – expecting at least another 10% upside. Today the benchmark put on another 5% after rallying strongly yesterday, the move in the past week has clearly been an aggressive one as better data + stimulus puts a rocket under stocks.

Shanghai Composite Chart

Much of the media today was all about the lockdowns in Melbourne, and of course the comments from Pauline Hanson, and by the close the market had given up the gains despite a strong +1.2% bounce in US Futures during our time zone.

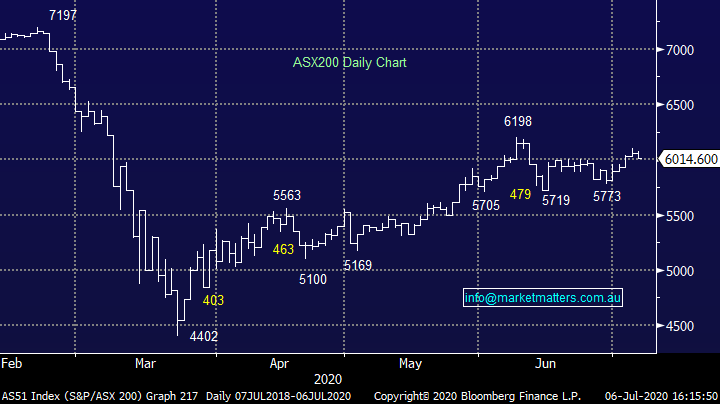

Overall, the ASX 200 fell -43pts / -0.71% today to close at 6014 - Dow Futures are trading up +350pts/ +1.37%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

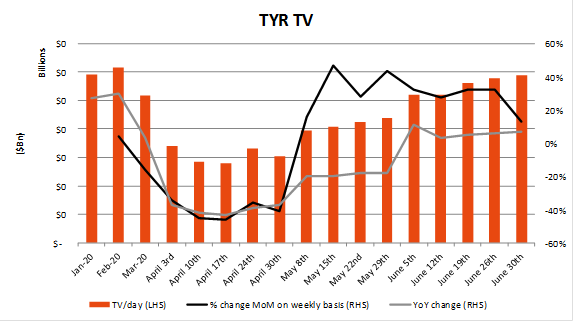

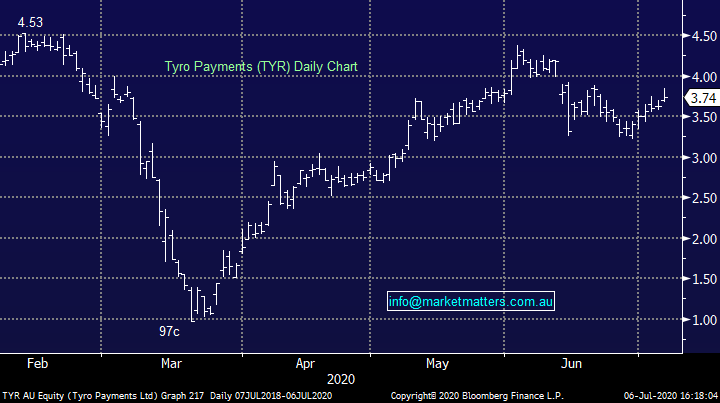

Tyro Payments (TYR) +3.03% : We’ve been tracking the weekly payments data provided by TYR as a proxy for the broader domestic economy – TYR was/is the fastest growing payments terminal provider and likely to be a good indicator of broader offline sales. TYR results are continuing to show a broader economic recovery although week on week volume growth looks to have plateaued and with further restrictions coming into force into Victoria this puts overall discretionary spend as back and comping materially lower year on year.

Key takeout’s

· Weekly Transaction value (TV) to end of June was $58.7m a day. This is up 1.5% on the prior week, a less significant increase in weekly growth;

· TV per day bottomed in Mid-April (week of 17th) at $27.8m and on a MoM basis TV is now comping ~13% higher. TV YoY for June was +7%, versus -46% at the peak of COVID restrictions. Typically, June is a high spending period (skew) and TYR volumes look to be ~25% lower than on a BAU run-rate; and

· On these run-rates and with further restrictions it looks unlikely that TYR volumes will recover to pre-COVID levels by August (as was previously thought). Further, the current $58m+ a day should be $73m+ a day with the previous run-rate of TYR. Considering the stock price is back to pre-COVID levels the stock seems rich.

TYR Transaction Value – Growth slowing

Source: Shaw and Partners

Tyro Payments (TYR) Chart – stock looks rich

Adbri (ABC) -6.81%: As we flagged in the morning report, the old Adelaide Brighten saw plenty of downgrades coming through today with selling pressure continuing to come on the back of losing the lime contract with Alcoa. Four brokers were cutting price targets while UBS moved from a buy to a sell on the back of the news. While the contact was small at only $70m, the lime business has been one of the higher margin parts of the group and the move signals a change in the tide with importers now getting an opportunity to have a crack at the Australian market. So one contract loss is a sign that pricing pressure is to come when Adbri sees other supply deals up for negotiation. Watch for support on the 3rd day down, there may be a trade in it but that’s about all.

Adbri (ABC) Chart

BROKER MOVES:

· Adbri Cut to Sell at CCZ Statton Equities Pty Ltd.; PT A$2

· Pinnacle Investment Reinstated Overweight at Wilsons; PT A$5

· Cleanaway Reinstated Overweight at Morgan Stanley; PT A$2.45

· Reject Shop Raised to Overweight at Morgan Stanley; PT A$10

· Sims Cut to Neutral at Credit Suisse; PT A$7.95

· Domino's Pizza Enterprises Cut to Neutral at JPMorgan; PT A$70

· Adbri Cut to Neutral at JPMorgan; PT A$2.70

· Macquarie Telecom Rated New Buy at Bell Potter; PT A$51.25

OUR CALLS

No changes today

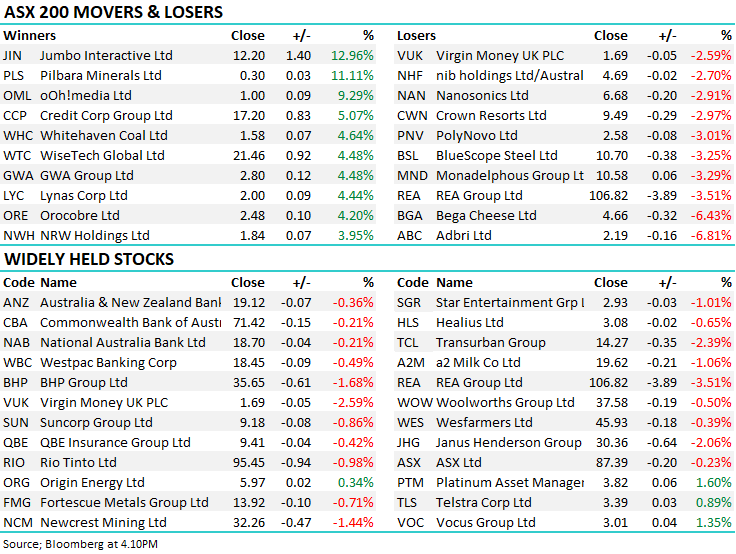

Major Movers Today – JIN rallying off a low base, one now on our radar again.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.