Stocks consolidate recent gains – Wisetech in the crosshairs again (WTC, WBC, NST)

WHAT MATTERED TODAY

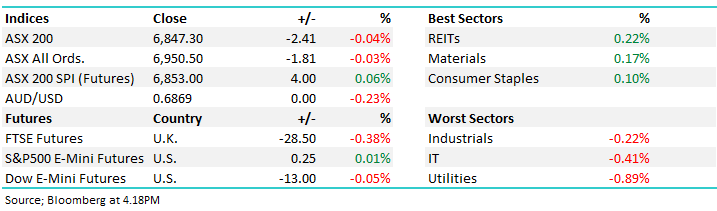

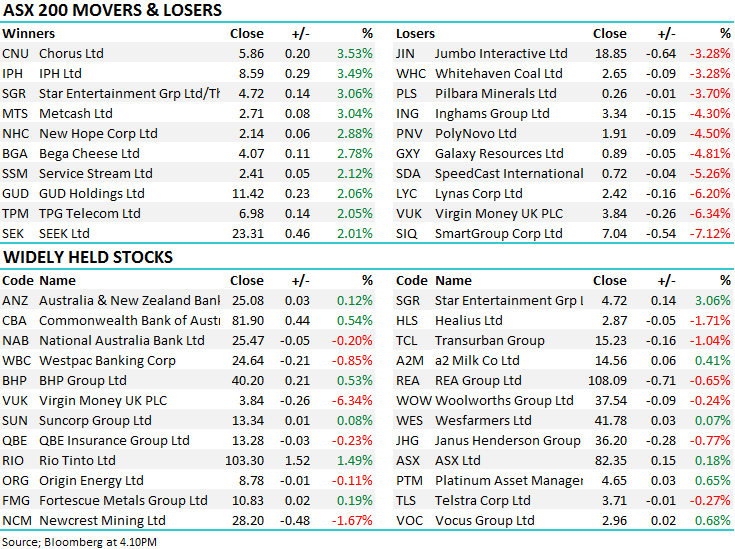

The market consolidated yesterday’s gains today with the index trading in a relatively tight range for the session – chopping around within +/-30pts of the high and low before closing flat. Not a bad effort really given the negative update from Westpac (covered below) this morning, the +110pt move we saw yesterday and growing commentary around how the actual implementation of the phase 1 trade deal between China and the US would work In any case, stocks were marginally up or marginally down, Utilities the weakest link although they were best on ground yesterday while the real-estate sector showed some form today.

Asian markets were higher heading to their highest close since mid-2018 – most markets up more than 1.2% on the session while US Futures were trading marginally down.

Overall, the ASX 200 fell -2pts /-0.04% today to close at 6847. Dow Futures are trading marginally higher up 7pts/0.02%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

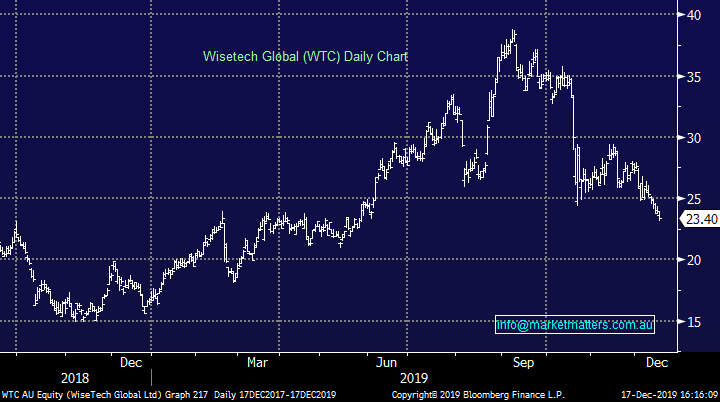

Wisetech (WTC) -2.42%: More questions being asked about WTC today, this time from Bucephalus Research Partnership which is a research firm that delves into the accountancy practices of companies – fund managers use them as an outsourced research function and today they’ve weighed into the WTC debate following the recent attack by J Capital. In short, they don’t agree with all of J Caps assertions however they do cast a further shadow over the way WTC accounts for things. The focus remains on the definition being used for organic growth along with their capitalisation policies. Those running an IT based business would know that there are a number of ways to handle the costs of software development – MM is no different, so we’ve had some experience here. By capitalising costs, it essentially makes the shorter term look better than if costs were expensed in the period they were incurred. CSL is an example of a business that uses an expensed approach to their R & D spend.

In short, the firm concluded that if WTC followed similar policies to other software companies, it would be losing money. They go further by saying that while the balance sheet looks healthy now, most of the cash will have been consumed within 18 months and they believe that to avoid insolvency it needs to keep issuing stock. It simply all seems hard here at the moment

Wisetech (WTC) Chart

Westpac (WBC) –0.85%; just when it started to look like the storm had passed, the bank was hit with another issue today similar to what happened with CBA after their Austrac run in. APRA has forced Westpac to hold an additional $500m operational risk capital while it reviews the bank’s governance, accountability and culture and examines the steps taken to strengthen risk governance in recent years. The investigation will ensure Westpac is on the right path and will ultimately ensure these issues aren’t an ongoing concern for the market – but the $500m additional capital will hit the CET1 ratio by 16bps in the meantime. Not a major issue, but still a negative all the same.

Westpac (WBC) Chart

Northern Star (NST) unch; remained in a trading halt for a second day today while launching a $A800m placement to fund the $US800m purchase of the Newmont stake in WA’s Super Pit mine. The deal follows Saracen (SAR), who bought the other stake of Barrick Gold last month. Norther Star paid a small amount more for their portion as it gives them controlling stake. Northern Star intends to continue the current operating plan and expects the mine to add up to 140kOz of production in FY20. Northern Star have acquired well in recent years and this deal looks to have added another quality gold asset to the mix. The cap raising will sap demand from the broader gold sector.

Norther Star (NST) Chart

Broker moves;

· Xero Rated New Neutral at Credit Suisse; PT A$80

· Perenti Global Cut to Hold at Moelis & Company; PT A$1.82

· Perenti Global Cut to Hold at Argonaut Securities; PT A$1.95

· SmartGroup Cut to Neutral at Macquarie; PT A$7.66

· SmartGroup Cut to Neutral at Credit Suisse; PT A$8.25

· IOOF Holdings Cut to Underweight at JPMorgan; PT A$6.75

· Sandfire Reinstated Neutral at Goldman; PT A$5.40

· Pro Medicus Raised to Buy at Bell Potter; PT A$29.20

OUR CALLS

No changes to the portfolios today.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.