Stocks cautiously higher to start the week (APT, CTX, NUF, BOQ, WBC)

WHAT MATTERED TODAY

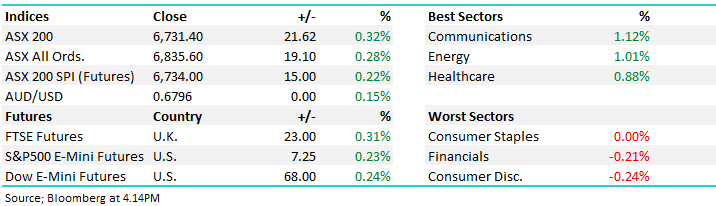

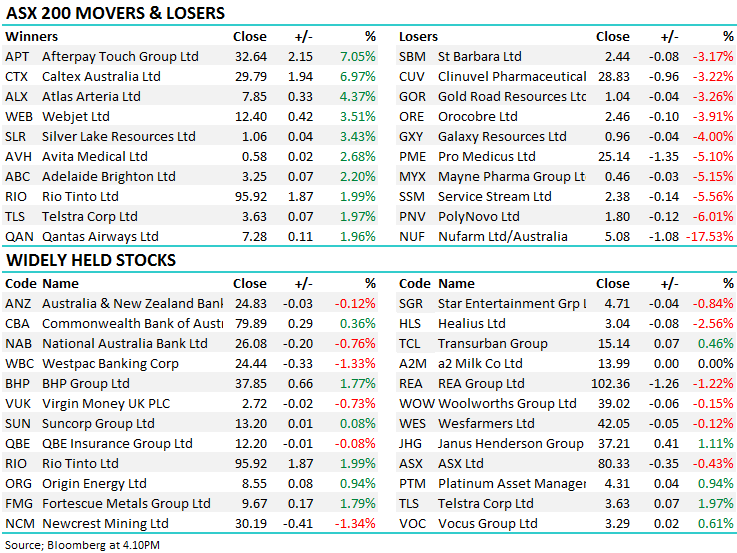

The market was strong on open this morning although the optimism faded from around 11am onwards, stocks declined from early highs to finish up but not convincingly so. Asian markets were strong during out time zone, particularly in Hong Kong with the index up ~1.50% nearing our close with the elections playing a part here while US Futures were trading marginally better, up around 0.2%.

At a sector level today, gains were led by the Telco stocks as Telstra (TLS) put on more than 2% - the stock looks interesting after 6 months of consolidation /decline. Elsewhere, the banks were lower as a sector, although CBA finished in the green, Westpac the worst performer off -1.33% as they start to address the AUSTRAC suit.

It was a busy day for stock specific news. We cover off news from Afterpay (APT), Caltex (CTX), Nufarm (NUF), Bank of Queensland (BOQ) and Westpac (WBC) below.

Overall, the ASX 200 gained 21pts /0.32% today to close at 6731. Dow Futures are trading up 68pts/+0.24%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

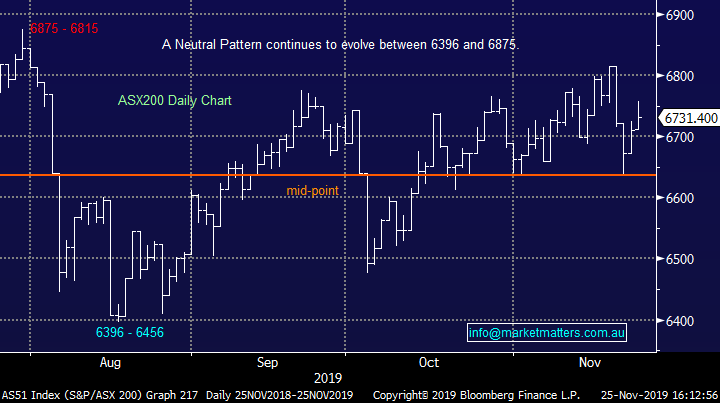

Caltex (CTX) +6.97%; continued its climb higher, now almost 50% higher than the panic low set in June when guidance for the half was posted. Today the fuel refiner and retailer updated guidance for the Convenience Retail side of $190-$210m for the calendar year, with the second half far outperforming the first largely thanks to fuel margin improvement despite soft volumes. Refiner margins have rebounded significantly as the year has progressed, with October at $US12.01/bbl vs the 2nd quarter which averaged just $US7.45/bbl.

Along with the solid progress from the fuel business, Caltex announced plans IPO up to 49% of the groups property portfolio of 250 convenience freehold sites. First estimates of value suggest the sale could free up around $1b in cash for Caltex, with the new trust to receive around $80-$100m in rental payments in the first year. Caltex will remain the majority shareholder whilst also receiving a decent capital injection for “capital management opportunities” – sounds like the shareholders will be rewarded.

Caltex (CTX) Chart

Westpac (WBC) –1.33%; Shares were lower again today as they released an action plan on how they are / plan to deal with the AUSTRAC issues. While there are a lot of unknowns at this point in the investigation the clouds are often darkest at the outset – much like the storm about to roll through Sydney. Westpac has now lost around $6.5bn in terms of market capitalisation since this issue was raised, and that seems an overreaction at this point.

Westpac (WBC) Chart

Bank of Queensland (BOQ) unch; in a halt today as the regional bank followed Westpac down the capital raise tunnel, issuing around 32m shares to raise $275m in an effort to lift the CET1 ratio by ~85bps. The company is in the middle of the book build for the institutional component with the price to be set between $7.69 and $7.78 – at least a 10% discount to the last traded with a retail component to follow. Upon completion the bank will see its CET1 ratio lift to ~9.85% before sliding back to the top end of the target range of 9%-9.5% implying costs will remain elevated in the half as the bank invests in technology and lays off staff. More detail to come when the insto book is filled.

Bank of Queensland (BOQ) Chart

Afterpay (APT) +7.05%; the independent auditor that AUSTRAC appointed to Afterpay earlier in the year released the final report today which was the catalyst for the share price rally despite identifying a number of breaches. The auditor was looking in to flaws in the systems & processes of Afterpay in regards to its AML compliance. The auditor did find a number of compliance issues prior to an upgrade in May 2018 but was broadly happy with the company’s procedure and noted the continuing efforts to improve. The report has been submitted to the regulator for final approval, and while they do have the option of pursuing Afterpay for the historical breaches, it is unlikely to tear the BNPL business model apart as some feared.

Afterpay (APT) Chart

Nufarm (NUF) -17.53%; the crop protection business saw its shares slugged today after the company flagged a number of issues impacting the first half to the point where the company was not able to give guidance for the six months to January 2020. The problem was the company recognizing a number of sales rebate claims from German customers from FY19 which will drag EBITDA but around $9m, or ~2% of FY19 EBITDA. Nufarm have also needed to implement a review of procedures in handling these claims because a number slipped through the cracks which may also mean increasing costs.

Secondly, the company flagged difficult trading conditions, particularly in North America where falling demand and high inventories will halve the regions EBITDA contribution compared to the first half of 19. This alone is enough to shave ~16% off the first half figure while the announcement talks to soft demand across other regions as well. As a result of the issues, Nufarm says “it has become increasingly difficult to forecast the half year results” but expects it “to be significantly lower than the prior year.” Throughout all of this, the company is trying to offload their South American arm with the $1.2b deal due to be completed in a matter of weeks. With performance continuing to slide, it looks like the company could use the capital. We remain cautious

Nufarm (NUF) Chart

Broker moves;

- Metcash Cut to Neutral at UBS; PT A$2.80

- Metcash Raised to Neutral at Citi; PT A$2.80

- Wesfarmers Rated New Hold at Jefferies; PT A$40

- Chorus Raised to Hold at Morningstar

- ResMed Rated New Sector Weight at KeyBanc

- Pacific Smiles Cut to Hold at Bell Potter; PT A$1.95

- Reliance Worldwide Rated New Buy at CCZ Statton Equities Pty Ltd.

OUR CALLS

No trades today

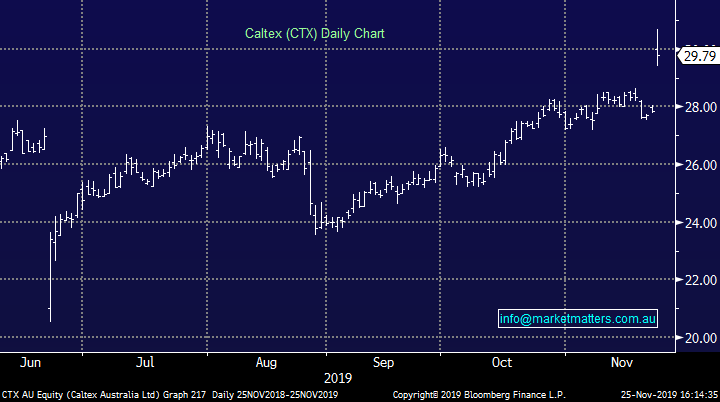

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.