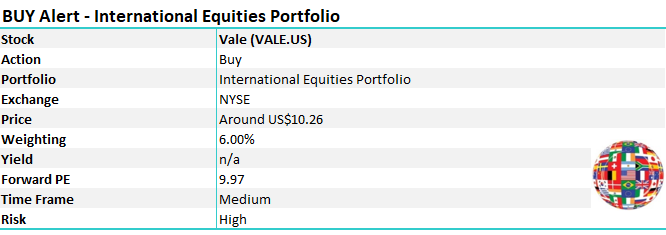

Stocks brush off recession talk (OPY, WZR, BLD) **International Equities Portfolio Alert – Buy VALE US**

WHAT MATTERED TODAY

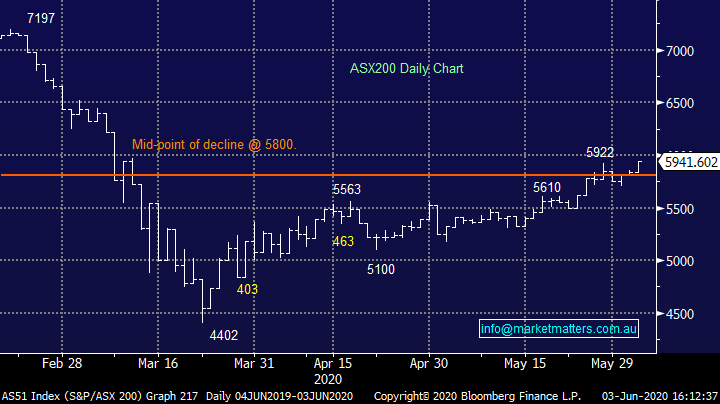

Bang, another quick +100pts for the local market today as banks re-entered the fray, a few must have been following the MM Income Note out at lunchtime!! The market opened higher this morning however really found its groove after lunch with the strong move towards the banking stocks providing most of the support at the index level.

GDP data was out at 11.30am and it was better than feared, the economy contracting by 0.3% in the March QTR which confirms Australia will have its first recession since 1991 given the contraction we’ll see in the June quarter, however these are all known knowns for the market - March hit by bushfires and the start of COVID-19 while June will bear the brunt of the shutdowns. That said, the economic outcomes we’re achieving are clearly better than first thought, clearly better than Government modelling suggested and clearly better than the assumptions used to underpin the raft of stimulus that was rolled out which is why the market is rallying so hard.

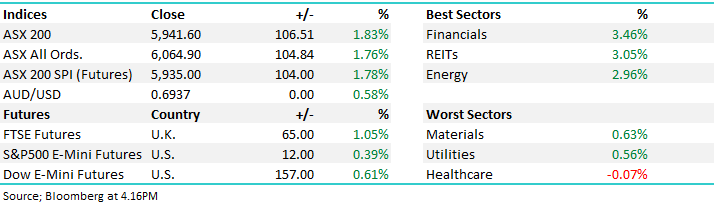

Economic Data Today

Source: Bloomberg

Overall, the ASX 200 added +106pts / +1.83% today to close at 5941 - Dow Futures are trading up +157pts/+0.61%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

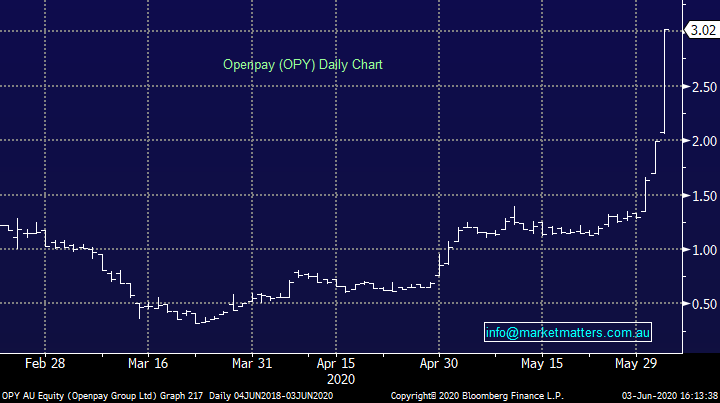

Money stocks: We talked about Z1P yesterday and they’ve put on another 20%+ today as the news of their expansion in the US worked through the market, however a lesser known name – Openpay (OPY), another BNPL company has outpaced the move rallying +51% today. Clearly we’re see some decent money flow into the cheapest exposure listed locally with OPY’s market cap still sitting around $200m. Astonishingly, its rallied from near 30c to close today at $3.02 - a huge move in anyone’s language but it’s still cheap.

Openpay (OPY) Chart

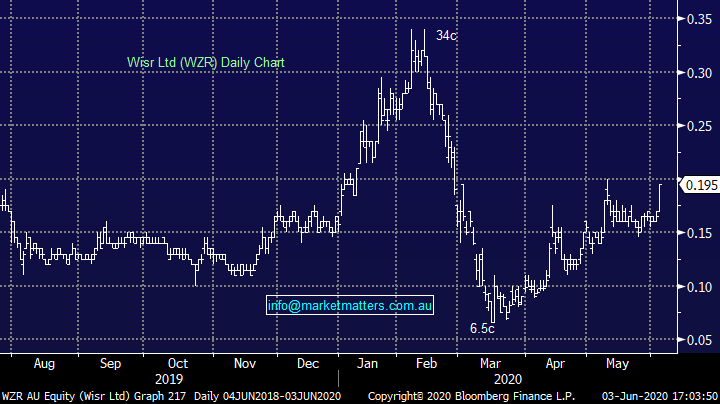

While not a BNPL stock, Wisr (WZR) is an interesting finance business (neo bank) that’s copped some buying today as money flows into the space. It closed up +18% today at 19.5c. We like it as a speccy.

Wisr (WZR) Chart

Boral (BLD) +1.7%: as we flagged yesterday, Seven Group (SVW) submitted a substantial holder notice last night on their holding in Boral, taking up 10% of the shares on issue and it seems they have been in the market since March, holding just shy of the 5% substantial limit before the last push on Friday. The move is a positive one for Boral with plenty of cross over between the businesses, it could mean they have a substantial ally in the construction market. The government stimulus is pretty focussed on this area. Boral has now more than doubled from the lows, and while we like the exposure to a recovery in construction, we have concerns over BLD’s balance sheet.

Boral (BLD) Chart

BROKER MOVES:

· Arena REIT Raised to Overweight at Morgan Stanley; PT A$2.68

· JB Hi-Fi Raised to Outperform at Macquarie; PT A$41

· SkyCity Entertainment Cut to Hold at Morningstar

· Orora Cut to Hold at Morningstar

· Aurizon Cut to Sell at Morningstar

· Bingo Industries Cut to Hold at Morningstar

· Newcrest Raised to Buy at UBS

· Evolution Cut to Sell at UBS

· Northern Star Cut to Sell at UBS

· Westpac Cut to Hold at Bell Potter; PT A$18.30

· Aurelia Raised to Buy at Hartleys Ltd; PT 60 Australian cents

· QBE Insurance Cut to Hold at Bell Potter; PT A$9.70

OUR CALLS

International Equities Portfolio

We are buying Iron Ore miner Vale into current weakness as they grabble with COVID-19 + face continueing issues with dams. This has the stocks trading at a steep discount to other global Iron Ore markets.

Vale US (Chart)

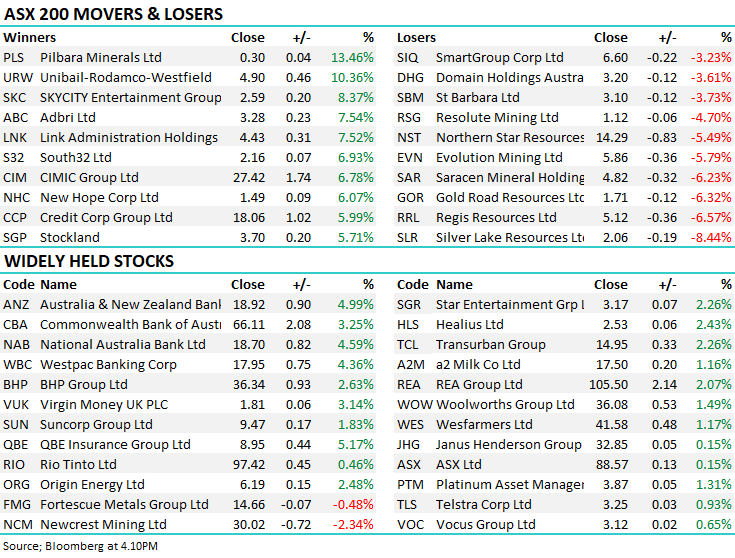

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.