Stockland confirms green shoots in property markets (WTC, SGP, OZL, SGP) **BAC US, JHG US, UNH US**

WHAT MATTERED TODAY

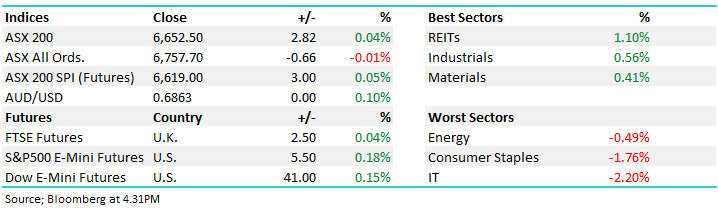

A reasonable way to start the week with the market opening lower before grinding higher through-out the session, the move thanks to positive comments from the Chinese Vice Premier re-confirming positive developments from US / China trade. US Futures traded marginally higher throughout our time zone while Asian markets were generally positive. The Real Estate sector was best of ground thanks to Stockland’s positive (SGP) update, more on that below with positive read throughs for others in the property sector. IT stocks once again the biggest drag with Wisetech (WTC) coming back on briefly before going into another trading halt – Harry covers below.

Overall, the ASX 200 closed marginally higher today up +2pts or +0.04% to 6652, Dow Futures are trading up +41pts/+0.15%.

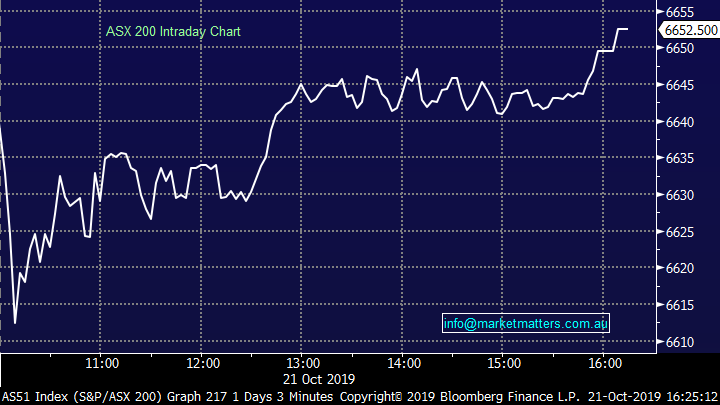

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

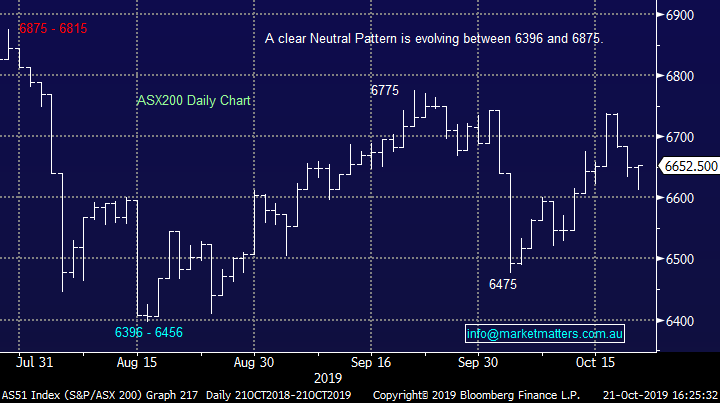

Stockland (SGP) +6.49%: A strong session for the diversified property stock after they gave a more optimistic quarterly trading update. This flowed through to other housing related stocks with strong performances from the likes of Bingo (BIN) +2.19% to $2.33 and CSR +2.18% to $4.21. Stockland is a big diversified player and the trends they see is a good indication of what’s happening, particularly in the residential sector.

For the 3 months to 30 September across their residential book:

- Sales moderately above expectations and they’re we’ll on track to deliver 5k lots in FY20

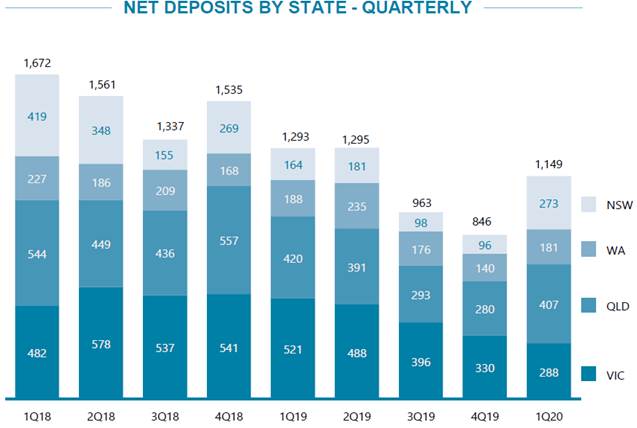

- Enquiries up / deposits taken up, which is detailed in the chart from a geographical perspective - I think this gives a good insight into trends with NSW experiencing a big recovery relative to Q419

The rest of their business is tracking along well, coming off a weak base. Overall, a positive update from SGP and the shares responded accordingly. Another kick in the guts for the property bears! We own SGP in the MM Income Portfolio, while we also own CSR.

Stockland (SGP) Chart

Oz Minerals (OZL) +2.75%; was out this morning with an update regarding the Carrapateena copper-gold mine which is expected to produce their first parcel of saleable copper next month. Oz has pulled in junior miner Cobalt Blue (COB) to assess the technical viability of extracting the battery metal cobalt from the project as well with similarities being drawn to COB’s Broken Hill project. The agreement is for viability confirmation only and won’t extend to optimization so it may be some time before we see cobalt added to the production reports of Oz Minerals. We also saw an upgrade from Bells come through, going from buy to hold with a price target of $10.69 We recently added OZL to the Growth Portfolio for our bullish view on copper/resources.

Oz Minerals (OZL) Chart

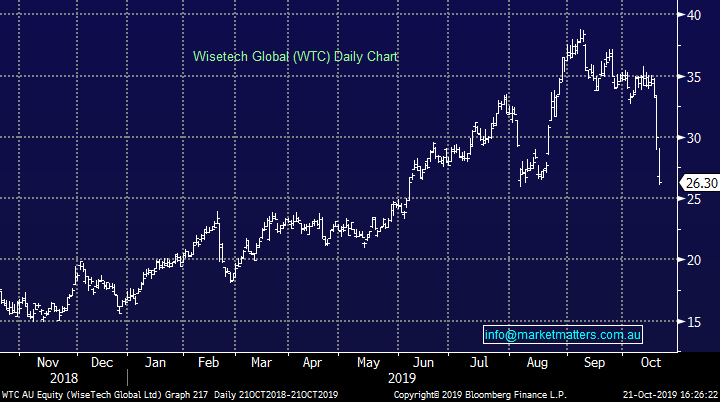

Wisetec (WTC) -12.33%; briefly back online this morning, trading for almost the first hour of the session but long enough to turn over more than their average daily volume. The company was out with a rebuttal to the short thesis on Friday night which denied the main arguments presented by JCAP last week including no overstatement of accounts, confidence in the audit report and the founder’s alignment to shareholders interest. Shares still opened around 10% lower before recovering somewhat early in the session but JCAP was out with a follow up report and WTC was back in a halt before lunch was served.

The new report stood by initial claims and ramped up the aggressive tone calling the company’s response inadequate and further justifying the JCAP view. The report claimed channel checks with clients and competitors proved that Wisetec was having trouble integrating the huge number of acquisitions it had taken on and customers were leaving regularly while some of the larger ones were essentially getting the WTC products for free. The company has given themselves until Wednesday and may need a little more than 4 pages to refute the claims. We have no interest here.

Wisetec (WTC) Chart

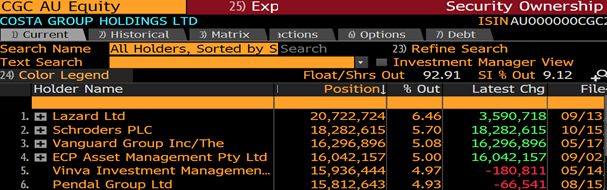

Costa Group (CGC) +0.29%: The fruit and veg supplier has entered a trading halt today pending a trading update – not a good look following two previous downgrades and a warning at their last update that they saw “downside risk” to its May 2019 guidance for net profit between $57 million to $66 million on EBITDA between $140 million to $153 million – a downgrade is a distinct possibility. That said, recent price action has been positive and so has news flow. UBS recently put out a bullish note on CGC with a buy and $5.20 PT plus we’ve seen a regeneration of the major holders, with Lazard increasing to 6.46% and Schroders have come on the register buying 5.7% of the company in recent times

Major holders of CGC and movements

Costa Group (CGC) Chart

BROKER MOVES; Some bottom feeding in Ingham’s (ING) today with Citi turning positive the stock after it traded sub $3.

· Mt Gibson Raised to Hold at ICBC Research

· Ansell Rated New Hold at Jefferies; PT A$26.85

· Domino’s Pizza Enterprises Rated New Underperform at Jefferies

· Inghams Raised to Buy at Citi; PT A$3.40

· Qantas Cut to Neutral at Credit Suisse; PT A$6.40

· OZ Minerals Raised to Buy at Bell Potter; PT A$10.69

· ARB Raised to Buy at Baillieu Ltd; PT A$18.90

OUR CALLS

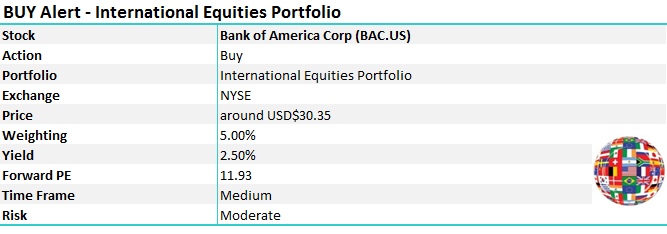

**International Portfolio 3 x NEW BUY Alerts**

We are adding 3 new international equity positions to the MM International Equities Portfolio that were covered in the weekend note as we look to build out our international holdings.

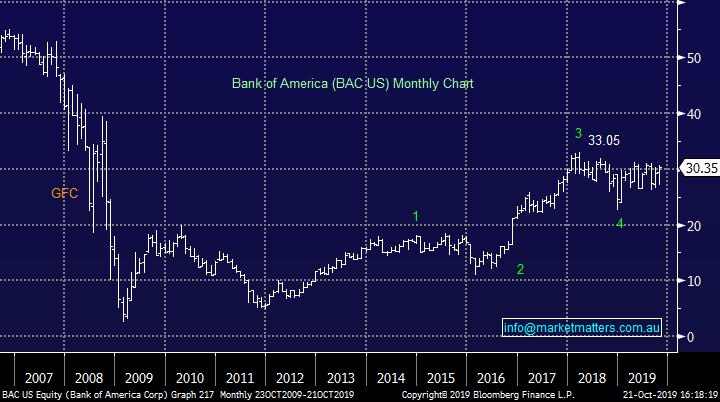

Large US bank looking poised for a breakout above long term resistance.

Bank of America (BAC.US) Chart

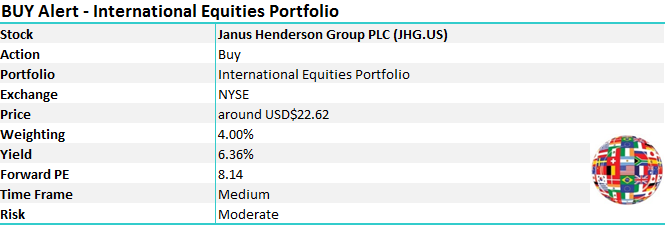

Cheap international fund manager that can also be purchased on the ASX under code JHG.

Janus Henderson Group (JHG.US)

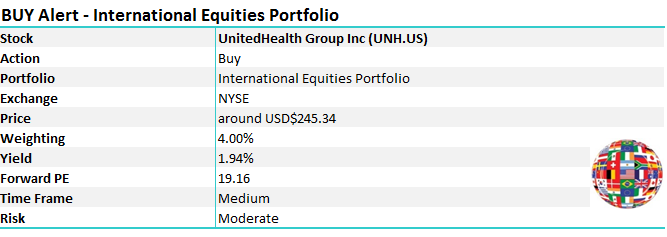

Integrated US based health services provider that looks poised to re-test all-time highs.

United Health Group (UNH.US) Chart

**Growth Portfolio**

We added NRW Holdings (NWH) & Service Stream (SSM) to the portfolio today.

**Income Portfolio**

We sold Tabcorp (TAH) and added the ActiveX Ardea Bond Fund which is a listed bond fund that uses an actively managed relative value strategy.

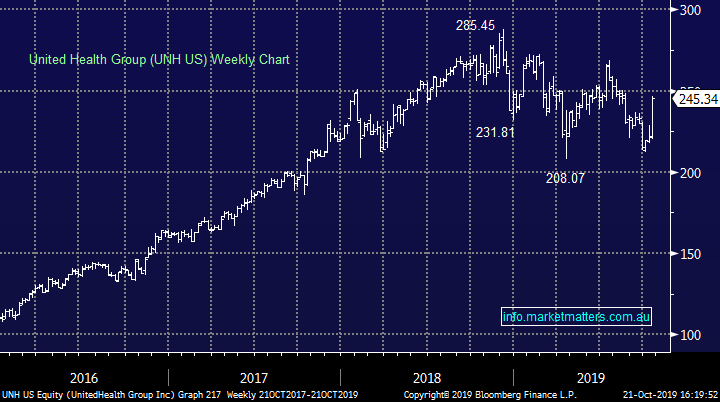

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.