S&P criticize NBN, TLS goes lower?

Stock

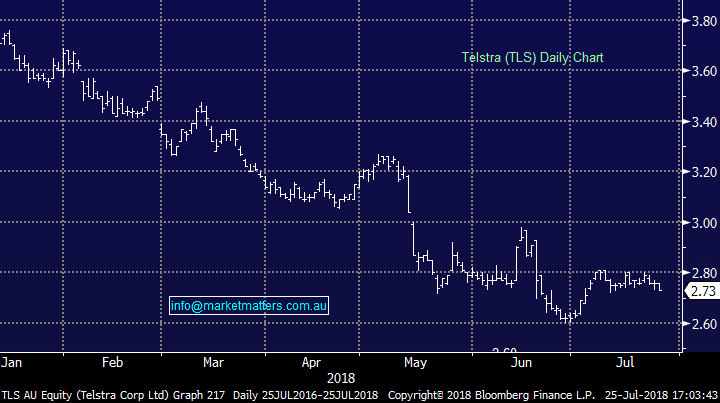

Telstra (TLS) $2.73 as at 25/07/2018Event

Telstra eased today following an S&P Global Ratings report that attacked the NBNs long term viability, forecasting a significant write down of its assets as the regulatory framework that protects it unwinds. In theory, this should be a positive for big telcos such as Telstra, as competition opens up it will provide an opportunity for companies will robust communications infrastructure in place – however S&P argue otherwise. A write down would likely trigger further government spending in an effort to get NBN to compete with the telcos one way or another, and competition is inevitably bad for other businesses. Realistically, however, the NBN model appears to be broken, and short of a complete redesign, it is unlikely to achieve the 75% market penetration of home broadband it has forecast. Telstra now has the opportunity to build a 5G network to compete with NBNs infrastructure and gain a majority share of the predicted 25% of households that will only have fixed wireless or mobile only broadband in the 2020s – in our view, Telstra currently has upgradable infrastructure to offer this service on the widest scale. Optionality is starting to present itself. Telstra (TLS) Chart