Sims suffers commodity pain

Stock

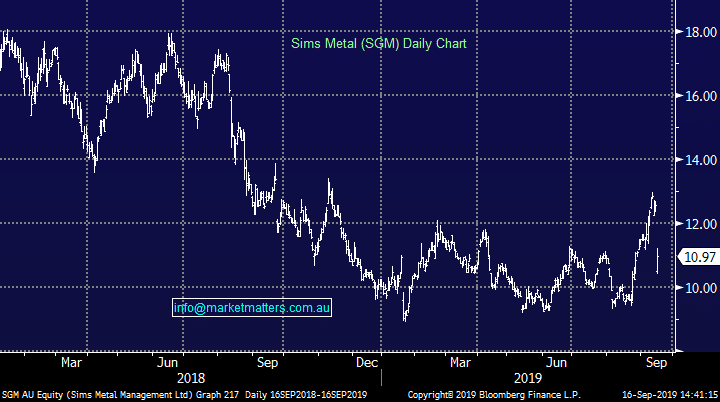

Sims Metals (SGM) $10.87 as at 16/09/2019

Event

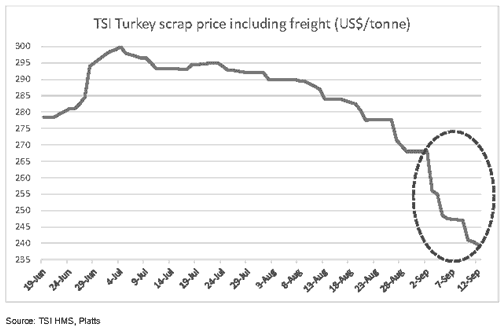

Scrap metals trader Sims has seen its profits slump in the first half on falling commodity prices, enough to warn the market just a few months into the year.

The company said that the trade escalation continued “to reduce the demand for steel and aluminium” to the point where scrap purchases and outlook from steel mills had eroded. Sims also noted that the spot prices had fallen to a level where it would not be economical for some suppliers while others “may choose to sit on inventory until the price recovers.” On the other side of the ledger, Sims has also been hit by rising freight costs which has not been possible to pass onto customers.

These issues have forced Sims to update the market for their half year result saying they are “expecting the outcome (profit) to be materially lower than the prior corresponding half year,” while holding fire on the full year, leaving the door open to a recovery in the price in the remaining 9 months of the year. The market was expecting an 8% increase in profits to $174.9m over the full year, while they managed $76.5m in the first half of FY18. A materially lower first half would leave a big margin to make up in the second half.

Sims Metals (SGM) Chart

These issues have forced Sims to update the market for their half year result saying they are “expecting the outcome (profit) to be materially lower than the prior corresponding half year,” while holding fire on the full year, leaving the door open to a recovery in the price in the remaining 9 months of the year. The market was expecting an 8% increase in profits to $174.9m over the full year, while they managed $76.5m in the first half of FY18. A materially lower first half would leave a big margin to make up in the second half.

Sims Metals (SGM) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook