Should you buy these Australian stocks that earn US dollars?

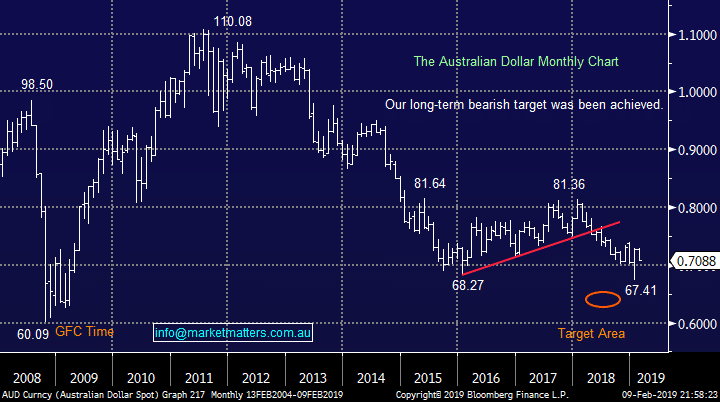

The $A has hit our mid / high 60c targeted area and we believe that we will see 80c in 2019 / 2020. – MM remains very wary of the crowded US earners trade medium / longer-term.

Our view is based on a few pieces of the puzzle starting with the extreme pessimism towards the $A but also including potential interest rate reversion touched on above plus the very influential iron ore price.

The Australian Dollar ($A) Chart

The $A is extremely cheap when compared to today’s iron ore price although we did have a similar scenario unfold in early 2017 when the iron ore strength dissipated fairly quickly.

However iron ore stocks have embraced the bulk commodities strong rally, I ponder who will be correct this time? If the Iron Ore price stays up for longer, which is now the view of our Resource Analyst ‘Rocky’, then the AUD will rally.

The reality is that if our bullish outlook for the $A proves correct it will result from a combination of 2, or 3, of the above points.

Over recent months we have seen some almost unprecedented damage inflicted on heavily owned positions / stocks e.g. the high growth play.

As we’ve alluded to above we are bullish the $A over the next year, a very contrarian view. However this may potentially confuse some subscribers with regards to 2 of our holdings, and one of member of our shopping list hence some clarification:

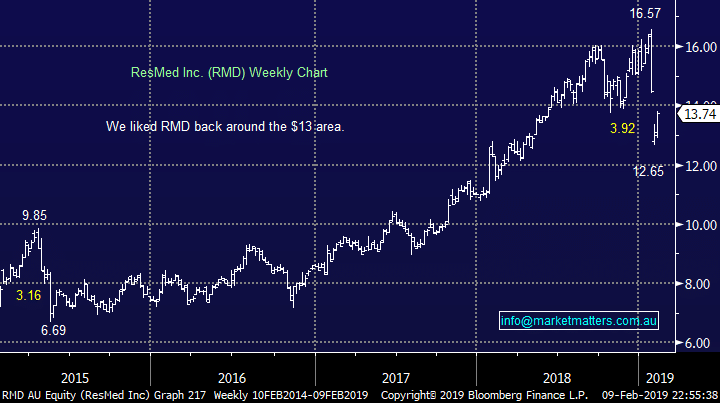

1 – ResMed (RMD) – We recently bought RMD following the stocks spike lower following its latest report. We feel this is a quality business that was unduly sold off on an average but not diabolical report – simply too many people were long. Obviously we will continually re-evaluate but we feel comfortable at least over the coming few months.

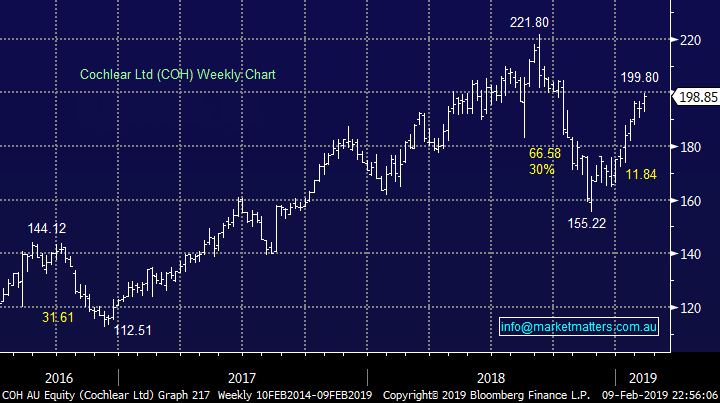

2 – Cochlear (COH) – COH reports this week which may change the picture in a few keystrokes but the almost 30% recovery from its late 2018 sell-off does offer a degree of confidence in our holding, but assuming there are no surprises when they report we will considering taking our $$ into strength above $200.

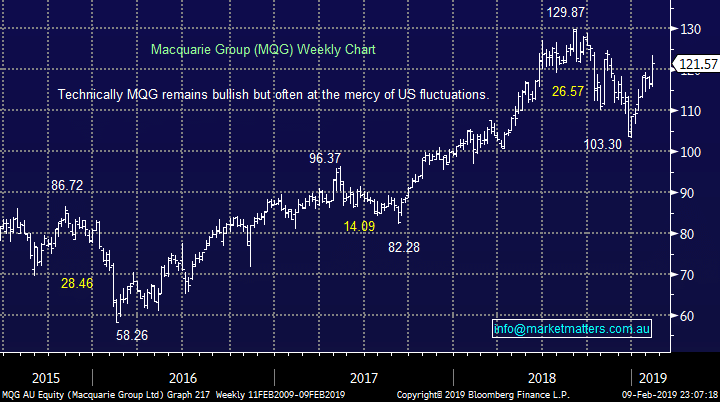

3 – Macquarie Group (MQG) – MQG also reports this week and its currently on our shopping list ~$115. Again the report may change the picture very quickly but at this point we are bullish targeting ~$135 hence a 4-5% pullback would offer solid risk / reward opportunity.

In a nutshell we can see MM not owning any of these positions into the next financial year which is in line with our view that 2019 /2020 will be a period to be fluid with your investments between stocks, sectors and occasionally cash.

ResMed (ASX: RMD) Chart

The $A is extremely cheap when compared to today’s iron ore price although we did have a similar scenario unfold in early 2017 when the iron ore strength dissipated fairly quickly.

However iron ore stocks have embraced the bulk commodities strong rally, I ponder who will be correct this time? If the Iron Ore price stays up for longer, which is now the view of our Resource Analyst ‘Rocky’, then the AUD will rally.

The reality is that if our bullish outlook for the $A proves correct it will result from a combination of 2, or 3, of the above points.

Over recent months we have seen some almost unprecedented damage inflicted on heavily owned positions / stocks e.g. the high growth play.

As we’ve alluded to above we are bullish the $A over the next year, a very contrarian view. However this may potentially confuse some subscribers with regards to 2 of our holdings, and one of member of our shopping list hence some clarification:

1 – ResMed (RMD) – We recently bought RMD following the stocks spike lower following its latest report. We feel this is a quality business that was unduly sold off on an average but not diabolical report – simply too many people were long. Obviously we will continually re-evaluate but we feel comfortable at least over the coming few months.

2 – Cochlear (COH) – COH reports this week which may change the picture in a few keystrokes but the almost 30% recovery from its late 2018 sell-off does offer a degree of confidence in our holding, but assuming there are no surprises when they report we will considering taking our $$ into strength above $200.

3 – Macquarie Group (MQG) – MQG also reports this week and its currently on our shopping list ~$115. Again the report may change the picture very quickly but at this point we are bullish targeting ~$135 hence a 4-5% pullback would offer solid risk / reward opportunity.

In a nutshell we can see MM not owning any of these positions into the next financial year which is in line with our view that 2019 /2020 will be a period to be fluid with your investments between stocks, sectors and occasionally cash.

ResMed (ASX: RMD) Chart

Cochlear (ASX: COH) Chart

Cochlear (ASX: COH) Chart

Macquarie Group (ASX: MGQ) Chart

Macquarie Group (ASX: MGQ) Chart