Shorts target Blue Sky, A2 Milk attracts competition (BLA, A2M)

WHAT MATTERED TODAY

+40 up yesterday and -40 down today as we roll into the four day break over Easter from tomorrow afternoon onwards – the longest stretch of the year the market is closed! Stock options expiry today (rare on a Wednesday) so a busy one on the desk while a number of interesting stock specific rumblings filtered across the ticker – a particularly interesting note on Blue Sky (BLA ) while A2 milk and Fortescue Metals were also in focus. More on those later.

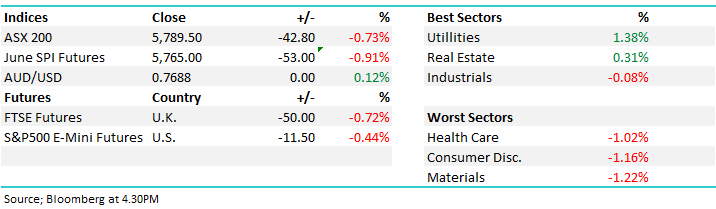

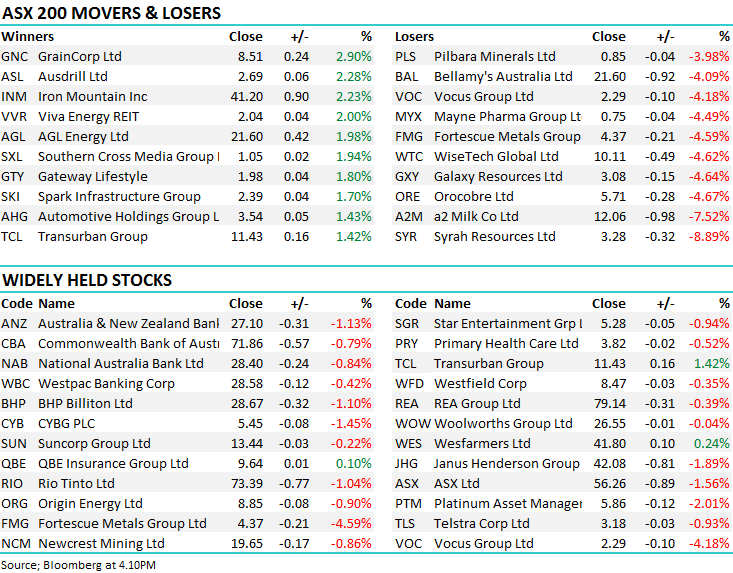

On the market today, resources were the weakest link down around 1.2% while it was the defensive names – Utilities and Real Estate that did best. An overall decline of -42pts or 0.73% on the ASX 200 which closed at 5789.

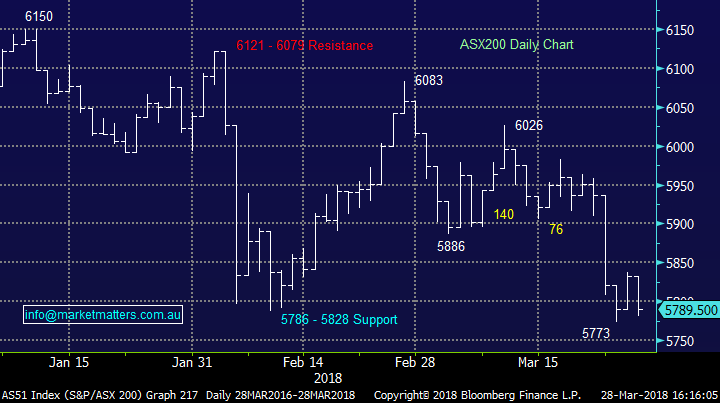

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

A2 Milk $12.06 / -7.52%; came under pressure today as Nestle, the world's biggest food and beverage company, announced plans to ‘rip off’ the A2 concept launching a brand of infant formula that uses the A2 beta-casein protein. They’re even calling the product Atwo – reminds me of the McDowell’s restaurant in the movie, Coming To America! Clearly A2 Milk has a highly attractive business with sublime metrics as shown in the last report, but that makes it ripe for competition, and Nestle is a big Gorilla. A2 clearly have the advantage of the ‘paddock to plate’ quality perception but as Peter McKenna suggested today when I was on Sky Business around lunchtime, Blend 43 is a bad cup of coffee but it’s the world’s best seller!

A2 Milk Chart

Blue Sky Alternative (BLA) $10.40 / -9.01%; This was the target of a ‘big short’ piece from a research house today with Glaucus Research suggesting the stock is actually worth <$2.66 a share, a fraction of its current value – nothing like an inflammatory note to get the mkt excited.

Firstly, the short thesis on BLA is not new with discussion of this floating around the market for some time. The fact that it’s now getting airtime through a reasonably well recognised research firm clearly adds to the strength and thus the market’s reaction. The report highlights a few things that really, we should already know, however here is our take.

This is an extremely complicated company with more than 80 different funds underneath it’s umbrella , a huge variety of assets, and a complex mechanism of collecting fees between them. Simply put, we find this hard to reconcile which I guess is the crux of the research report. To dumb things down though, I’ve always thought of an asset manager simply in the context of rising asset prices and cheap money. If the cost of capital is low and asset prices are rising, then all in good, BUT if the cost of capital rises which coincides with declining asset values, then things can unravel. Over the past few years the drivers of BLA earnings (cheap money and rising asset prices) have been incredibly strong, however it's our belief that we're at a turning point, and for that reason we have no interest in BLA, irrespective of wherther or not todays research piece is accurate or not.

Blue Sky Alternative (BLA) Chart

OUR CALLS

We reduced Suncorp in the Income Portfolio today by 5%, simply to raise capital for new purchases. Refer todays income report – click here

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/03/2018. 5.11PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here