Shorts are for the beach…(ACX, ANZ, RFG)

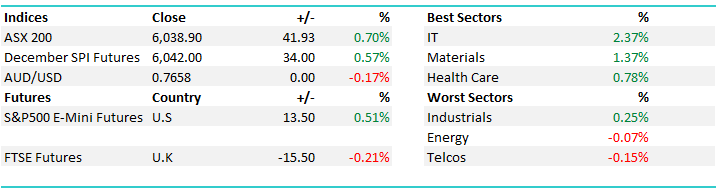

WHAT MATTERED TODAY

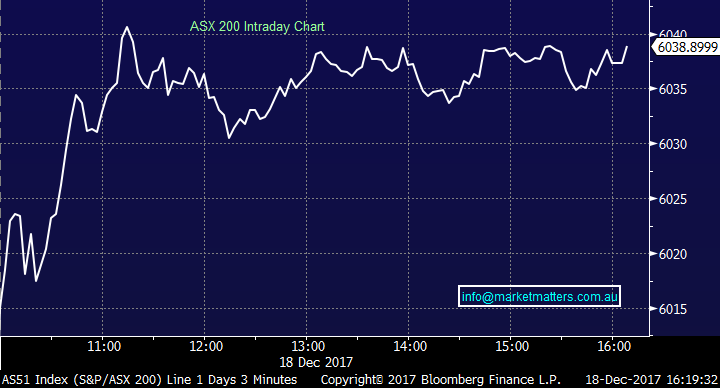

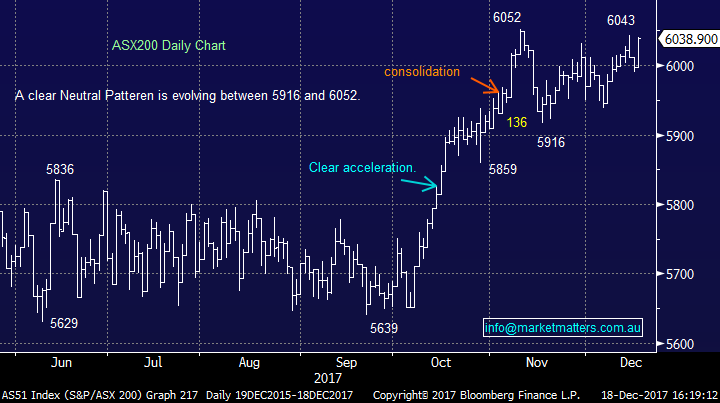

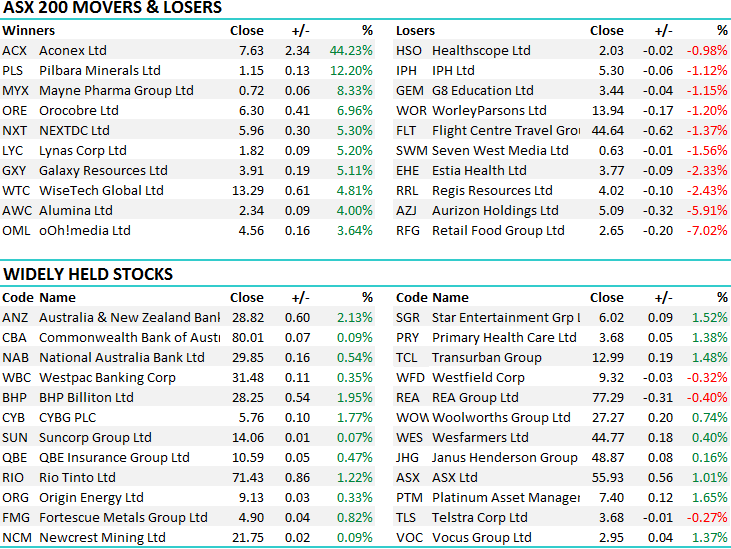

A bullish open to trade this morning with the market responding well to developments in the US after the Republicans released their final version of their tax text on Friday which now looks like it has become a certainty rather than a strong possibility - a deal should be done by Wednesday. The corporate Tax rate is most likely to be set at 21% while the interesting aspect of the bill – primarily around the international earnings repatriation tax rate which is primed to be lowered to 15.5% for cash and 8% for more illiquid assets. Theoretically, this should be supportive of the $US however given the plans have been well discussed / covered / expected, it may be a case of buy the rumor and sell the fact – a lower US currency is obviously supportive of resources + lower taxes are good for growth which is also supportive of growth assets – a theme that is good for the miners. Anyway, as I wrote in the AM report, the ASX200 remains in its seasonally strongest period of the year however we’re yet to see the mkt really kick up. Today was good (+41pts) considering that the mkt had rallied just +27pts in the first half of the month – however typically, we get most buying in the last 2 weeks over and above the first two!

Assuming we simply see an average December to see out 2017 then the ASX200 should reach 6125 in the coming 2-weeks i.e. a gain of +2.5% in December. Our “Gut Feel” at MM is still the ASX200 will say goodbye to 2017 around the 6150 level i.e. this would be an impressive +8.6% gain for the year.

The IT sector (tks ACX) was the standout today adding +2.37% while the Telcos bucked the positive trend down -0.15%. An overall range today of +/- 32 points, a high of 6043, a low of 6011 and a close of 6011, off -10pts or -0.17%

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

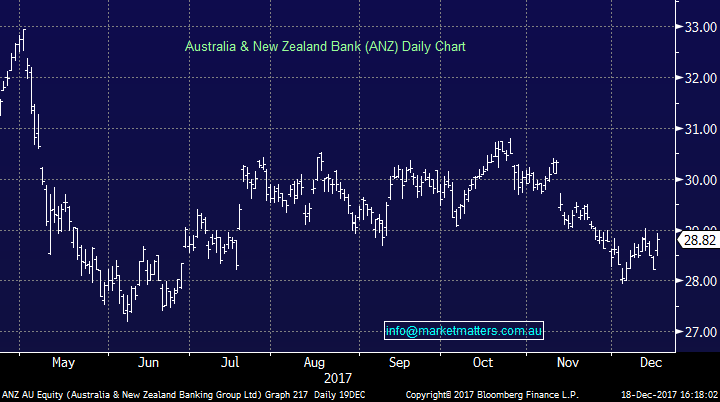

TOP MOVERS

1. Aconex (ACX) $7.63 / 44.23% - The old adage that short sellers simply target weak businesses, relax, give it some time and wait to count their money is often the misconception promoted by the media, and today those said shorts felt some pain with a bid for Aconex by the giant US based tech giant Oracle. A big +47% premium to their last traded price and the $1.6bn deal has the backing of the original founders…. "As co-founders of Aconex, both Rob Phillpot and I remain committed to the business and are excited about the opportunity to advance our collective vision on a larger scale, and the benefits this combination will deliver to our customers."

The deal is being done under a scheme of arrangement with Oracle putting in a $7.80 per share bid – which is BIG. Aconex is the 9th biggest short on the ASX with 20.5m shares held short in the project management software business – or about 10% of free float.

Aconex Daily Chart

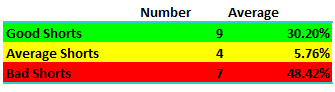

To give some context around the success or otherwise of shorts, the below table outlines the shorts that have done well (RED), the shorts that have down nothing (YELLOW), and the shorts that have been successful over the past 12 months (GREEN).

The interesting takeout here is that the Good Shorts were not as Bad (which is good) than the Bad Shorts, and if we put equal money in the outcomes above, we’d be down for the year. It’s clearly not all beer and skittles for the short sellers – and some will need their wounds tendered to this evening.

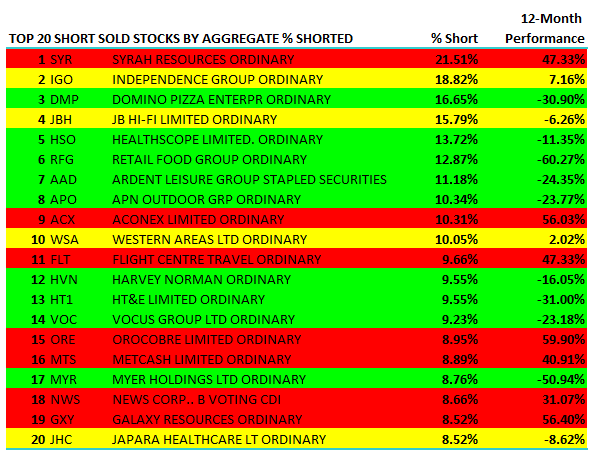

2. ANZ (ANZ) $28.82 / 2.13% - has today announced it will commence a $1.5bn on market buyback as part of its capital management plan. We think ANZ have the ability to do a $7bn-8bn buy back or 8% of shares on issue over the next few years given they’re shedding capital intensive businesses.

ANZ Daily Chart

3. Retail Food Group (RFG) $2.65 / -7.92% - has now lost ~40% since the Fairfax media article was published outlining discontent amongst Franchisee’s – and was smacked again by 8% today – the stocks now trades on 6x FY18 earnings and clearly the mkt thinks this one is on the way out – or can’t come back strongly from the current issues. Value starting to emerge here however a brave person to step up now – maybe soon!!!

RFG Daily Chart

OUR CALLS

No changes to the portfolio’s today…

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/12/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here